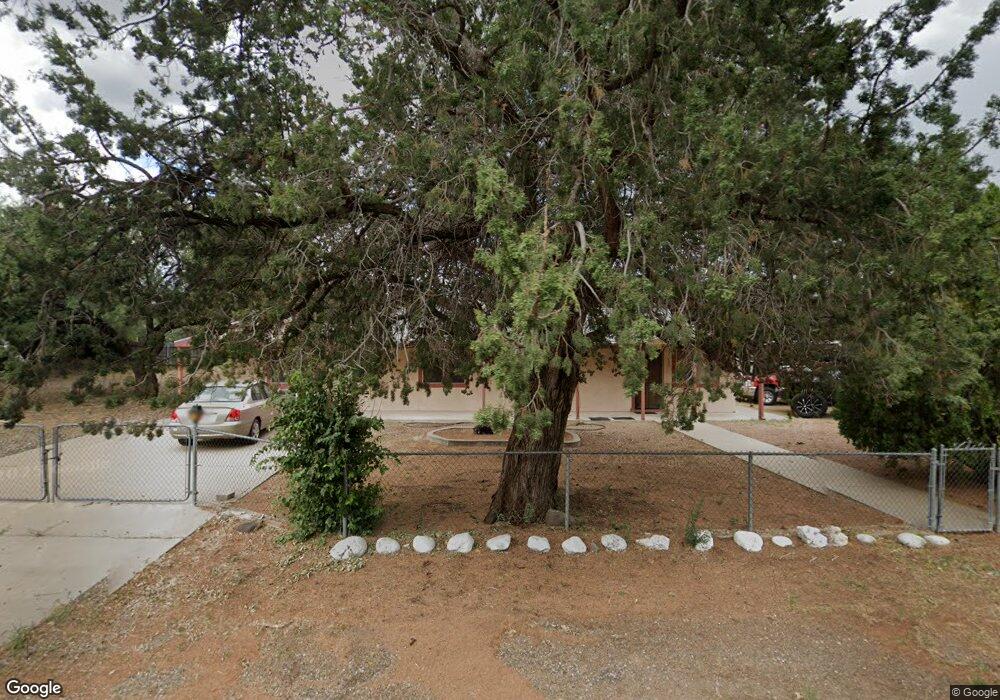

3553 E Mocking Bird Ln Camp Verde, AZ 86322

Estimated Value: $306,285 - $391,000

Studio

--

Bath

1,500

Sq Ft

$234/Sq Ft

Est. Value

About This Home

This home is located at 3553 E Mocking Bird Ln, Camp Verde, AZ 86322 and is currently estimated at $351,571, approximately $234 per square foot. 3553 E Mocking Bird Ln is a home located in Yavapai County with nearby schools including Camp Verde Elementary School, Camp Verde Middle School, and Camp Verde High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 28, 2007

Sold by

Saucedo Edna J

Bought by

Breshears Robert

Current Estimated Value

Purchase Details

Closed on

Dec 14, 2005

Sold by

Dean William E and Dean Rose M

Bought by

Breshears Robert and Saucedo Edna

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$99,200

Interest Rate

7.25%

Mortgage Type

New Conventional

Purchase Details

Closed on

May 1, 2002

Sold by

Sweney Glen M and Sweney Violet M

Bought by

Dean William E and Dean Rose M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$75,600

Interest Rate

6.74%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Breshears Robert | -- | None Available | |

| Breshears Robert | $124,000 | None Available | |

| Dean William E | -- | Chicago Title Insurance Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Breshears Robert | $99,200 | |

| Previous Owner | Dean William E | $75,600 | |

| Closed | Breshears Robert | $24,800 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2026 | $1,107 | $29,357 | -- | -- |

| 2024 | $1,070 | $28,443 | -- | -- |

| 2023 | $1,070 | $23,447 | $2,554 | $20,893 |

| 2022 | $1,009 | $19,243 | $1,797 | $17,446 |

| 2021 | $1,049 | $17,660 | $1,722 | $15,938 |

| 2020 | $1,012 | $0 | $0 | $0 |

| 2019 | $990 | $0 | $0 | $0 |

| 2018 | $1,124 | $0 | $0 | $0 |

| 2017 | $1,071 | $0 | $0 | $0 |

| 2016 | $1,032 | $0 | $0 | $0 |

| 2015 | -- | $0 | $0 | $0 |

| 2014 | -- | $0 | $0 | $0 |

Source: Public Records

Map

Nearby Homes

- 3480 S Verde Lakes Dr

- 3278 E Ripple Rd

- 3226 E Mocking Bird Ln

- 3844 E Sparrow Ln

- 3550 E White Cap Dr Unit 564

- 3422 Dawn Dr Unit 89

- 3261 E Desert Dr

- 3077 Wagner Dr Unit 529

- 3087 S Cedar Way Unit 515

- 2924 S Palo Verde Ln

- 4021 Sparkling Ln Unit 58

- 3767 E Caroline Cir

- 3366 E Mesquite Trail

- 3761 Caroline Cir

- 3125 S Verde Lakes Dr Unit 178

- 3200 Aspen Way

- 4120 E Sparkling Ln Unit 73

- 3735 E Tumbleweed Dr

- 2788 S Twin Leaf Cir

- 4072 E Cripple Creek Dr