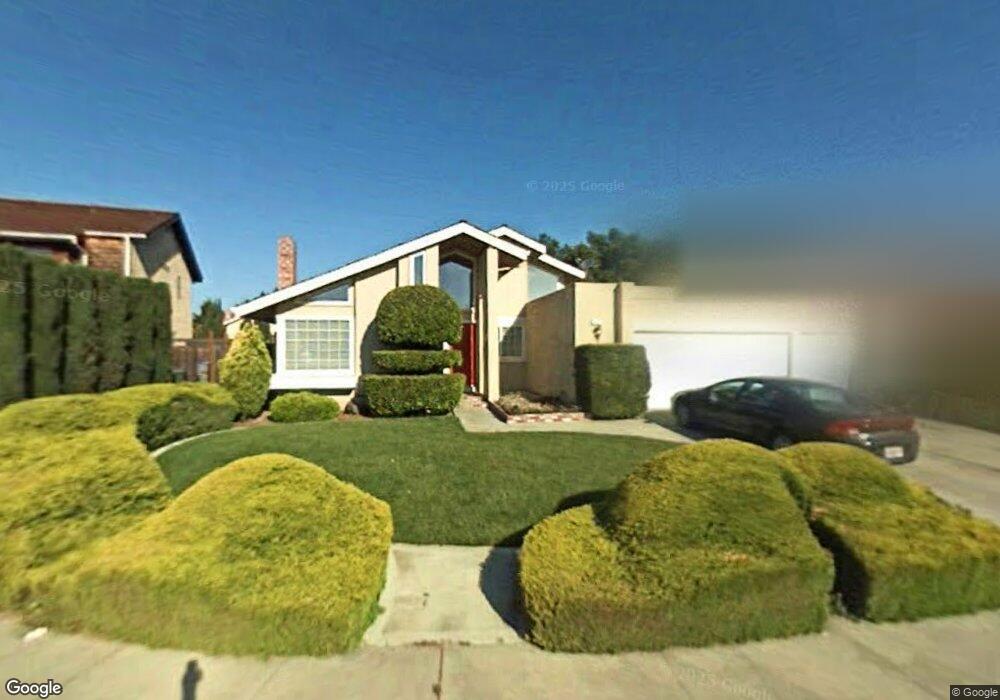

3579 Millet Ct San Jose, CA 95127

East Foothills NeighborhoodEstimated Value: $1,454,213 - $1,578,000

4

Beds

2

Baths

1,841

Sq Ft

$810/Sq Ft

Est. Value

About This Home

This home is located at 3579 Millet Ct, San Jose, CA 95127 and is currently estimated at $1,490,553, approximately $809 per square foot. 3579 Millet Ct is a home located in Santa Clara County with nearby schools including Mt. Pleasant High School, Voices College-Bound Language Academy at Mt. Pleasant, and Rocketship Academy Brilliant Minds.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 13, 2023

Sold by

Cabrales Edgardo J

Bought by

Cabrales Edgardo J and Cabrales Silvia

Current Estimated Value

Purchase Details

Closed on

Oct 23, 2006

Sold by

Cabrales Silvia

Bought by

Cabrales Edgardo J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$79,000

Interest Rate

6.36%

Mortgage Type

Credit Line Revolving

Purchase Details

Closed on

Oct 18, 2006

Sold by

Ziemba Joseph Thomas and Ziemba Madeleine Marie

Bought by

Cabrales Edgardo J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$79,000

Interest Rate

6.36%

Mortgage Type

Credit Line Revolving

Purchase Details

Closed on

Feb 25, 1998

Sold by

Ziemba Susan Eileen

Bought by

Ziemba Joseph Thomas and Ziemba Madeleine Marie

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$208,000

Interest Rate

6.9%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Cabrales Edgardo J | -- | -- | |

| Cabrales Edgardo J | -- | First American Title Company | |

| Cabrales Edgardo J | $790,000 | First American Title Company | |

| Ziemba Joseph Thomas | -- | All Cal Title Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Cabrales Edgardo J | $79,000 | |

| Previous Owner | Cabrales Edgardo J | $632,000 | |

| Previous Owner | Ziemba Joseph Thomas | $208,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $14,655 | $1,058,416 | $740,897 | $317,519 |

| 2024 | $14,655 | $1,037,664 | $726,370 | $311,294 |

| 2023 | $14,054 | $1,017,319 | $712,128 | $305,191 |

| 2022 | $13,956 | $997,372 | $698,165 | $299,207 |

| 2021 | $14,080 | $977,817 | $684,476 | $293,341 |

| 2020 | $13,532 | $967,792 | $677,458 | $290,334 |

| 2019 | $13,215 | $948,817 | $664,175 | $284,642 |

| 2018 | $12,856 | $930,213 | $651,152 | $279,061 |

| 2017 | $12,285 | $880,000 | $620,000 | $260,000 |

| 2016 | $12,244 | $889,400 | $621,800 | $267,600 |

| 2015 | $11,494 | $816,000 | $571,200 | $244,800 |

| 2014 | $9,603 | $697,400 | $488,200 | $209,200 |

Source: Public Records

Map

Nearby Homes

- 1245 Fleming Ave

- 14862 Watters Dr

- 3457 Ramstad Dr

- 801 Fleming Ave

- 950 Macduff Ct

- 3514 Ramstad Dr

- 3472 Kaylene Dr

- 822 Rosemar Ct

- 681 Heirloom Ct

- 3434 Dominick Ct

- 10150 Clayton Rd

- 1310 Park Pleasant Cir

- 3341 Hickerson Dr

- 14440 Victoria Ct

- 3382 Mount Wilson Dr

- 14990 Garcal Dr

- 3305 Hickerson Dr

- 3253 Arthur Ave

- 14545 Jerilyn Dr

- 366 Cureton Place