358 Asbury Ct Senoia, GA 30276

Estimated Value: $346,000 - $396,000

3

Beds

2

Baths

1,796

Sq Ft

$207/Sq Ft

Est. Value

About This Home

This home is located at 358 Asbury Ct, Senoia, GA 30276 and is currently estimated at $371,107, approximately $206 per square foot. 358 Asbury Ct is a home located in Coweta County with nearby schools including Eastside Elementary School, East Coweta Middle School, and East Coweta High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 23, 2021

Sold by

Mccloud Bruce Allen

Bought by

Frye Sandra L

Current Estimated Value

Purchase Details

Closed on

Mar 22, 2019

Sold by

Marmel Properties Llc

Bought by

Roberts Richard William and Frye Sandra L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$212,800

Interest Rate

4.3%

Mortgage Type

New Conventional

Purchase Details

Closed on

Mar 25, 2011

Sold by

2005Qs12 Rali

Bought by

Marmel Properties Llc

Purchase Details

Closed on

Nov 2, 2010

Sold by

Arnold Wendy R

Bought by

2005Qs12 Rali

Purchase Details

Closed on

Feb 17, 1999

Sold by

Mark Wood Properties Ltd

Bought by

Arnold Wendy R

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$114,584

Interest Rate

6.79%

Mortgage Type

New Conventional

Purchase Details

Closed on

Aug 19, 1998

Sold by

Martinwood Propertie

Bought by

Mark Wood Properties

Purchase Details

Closed on

Nov 30, 1986

Bought by

Martinwood Propertie

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Frye Sandra L | -- | -- | |

| Mccloud Bruce Allen | -- | -- | |

| Roberts Richard William | $224,000 | -- | |

| Marmel Properties Llc | $115,000 | -- | |

| 2005Qs12 Rali | $101,250 | -- | |

| Rali 2005Qs12 Deutsche Bank Trust Compan | $101,300 | -- | |

| Arnold Wendy R | $112,700 | -- | |

| Mark Wood Properties | $14,000 | -- | |

| Martinwood Propertie | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Roberts Richard William | $212,800 | |

| Previous Owner | Arnold Wendy R | $114,584 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,876 | $136,702 | $26,000 | $110,702 |

| 2024 | $3,669 | $131,990 | $26,000 | $105,990 |

| 2023 | $3,669 | $124,884 | $22,000 | $102,884 |

| 2022 | $3,253 | $111,312 | $22,000 | $89,312 |

| 2021 | $1,355 | $91,693 | $20,000 | $71,693 |

| 2020 | $1,323 | $89,600 | $19,542 | $70,058 |

| 2019 | $3,094 | $86,606 | $14,000 | $72,606 |

| 2018 | $3,110 | $86,606 | $14,000 | $72,606 |

| 2017 | $2,690 | $74,544 | $14,000 | $60,544 |

| 2016 | $2,506 | $69,544 | $9,000 | $60,544 |

| 2015 | $2,213 | $62,369 | $9,000 | $53,369 |

| 2014 | $2,034 | $57,436 | $9,000 | $48,436 |

Source: Public Records

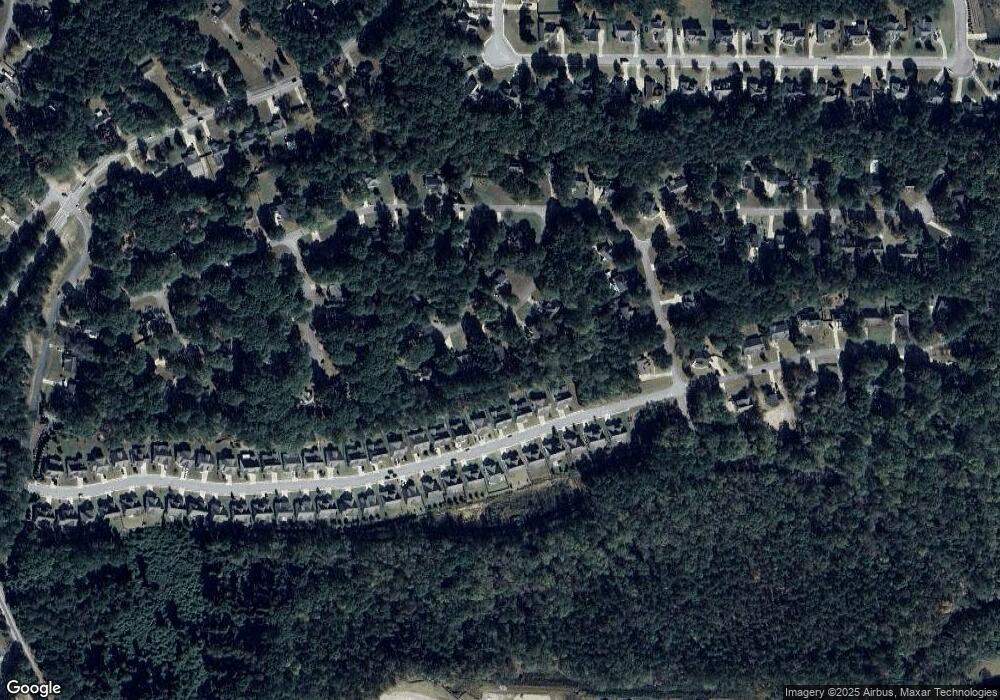

Map

Nearby Homes

- 290 South Ridge

- 245 South Ridge

- 631 Rockaway Rd

- 140 Southridge

- 42 Piedmont Dr

- 367 Northridge Dr

- 170 Redhaven Dr

- 215 Redhaven Dr

- 0 Coweta St Unit 10555038

- 65 Redhaven Dr

- 390 Redhaven Dr

- 150 Redhaven Dr

- 140 Redhaven Dr

- 130 Redhaven Dr

- 416 Rockaway Rd

- 40 Greylock Creek Dr

- 50 Greylock Creek Dr

- 45 Crest Haven Ct

- 55 Crest Haven Ct

- 355 Werner Way

- 358 Asbury Ct Unit 52

- 340 Asbury Ct

- 376 Asbury Ct

- 320 Southridge

- 373 Asbury Ct

- 320 South Ridge Unit LOT 23

- 320 South Ridge

- 340 Southridge

- 310 South Ridge Unit LOT 22

- 322 Asbury Ct

- 337 Asbury Ct

- 300 Southridge

- 300 Southridge Unit 21

- 394 Ashbury

- 350 South Ridge Unit 25

- 350 South Ridge Unit 24

- 394 Asbury Ct

- 290 Southridge

- 389 Asbury Ct

- 391 Asbury Ct