359 Elderberry St La Verne, CA 91750

South La Verne NeighborhoodEstimated Value: $706,600 - $911,000

4

Beds

3

Baths

1,767

Sq Ft

$465/Sq Ft

Est. Value

About This Home

This home is located at 359 Elderberry St, La Verne, CA 91750 and is currently estimated at $821,150, approximately $464 per square foot. 359 Elderberry St is a home located in Los Angeles County with nearby schools including Grace Miller Elementary School, Lone Hill Middle School, and San Dimas High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 11, 2015

Sold by

Cecala Mercedes

Bought by

Cecala Mercedes and The Mercedes Cecala Trust

Current Estimated Value

Purchase Details

Closed on

Jan 22, 2008

Sold by

Cecala Casey J

Bought by

Cecala Mercedes

Purchase Details

Closed on

Dec 20, 2001

Sold by

Piedad Mercedes

Bought by

Cecala Casey J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$125,600

Interest Rate

7.13%

Purchase Details

Closed on

Jan 16, 1997

Sold by

Cecala Casey Joseph

Bought by

Piedad Mercedes

Purchase Details

Closed on

Jan 24, 1996

Sold by

Piedad Mercedes

Bought by

Cecala Casey Joseph

Purchase Details

Closed on

Dec 9, 1993

Sold by

Piedad Tony Parra

Bought by

Piedad Mercedes

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Cecala Mercedes | -- | None Available | |

| Cecala Mercedes | -- | Accommodation | |

| Cecala Casey J | -- | Southland Title Corporation | |

| Piedad Mercedes | -- | Commonwealth Land | |

| Cecala Casey Joseph | -- | -- | |

| Piedad Mercedes | -- | -- | |

| Piedad Mercedes | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Cecala Casey J | $125,600 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,309 | $260,561 | $65,132 | $195,429 |

| 2024 | $3,309 | $255,453 | $63,855 | $191,598 |

| 2023 | $3,238 | $250,445 | $62,603 | $187,842 |

| 2022 | $3,184 | $245,535 | $61,376 | $184,159 |

| 2021 | $3,117 | $240,722 | $60,173 | $180,549 |

| 2019 | $3,053 | $233,584 | $58,389 | $175,195 |

| 2018 | $2,864 | $229,005 | $57,245 | $171,760 |

| 2016 | $2,747 | $220,115 | $55,023 | $165,092 |

| 2015 | $2,704 | $216,810 | $54,197 | $162,613 |

| 2014 | $2,685 | $212,564 | $53,136 | $159,428 |

Source: Public Records

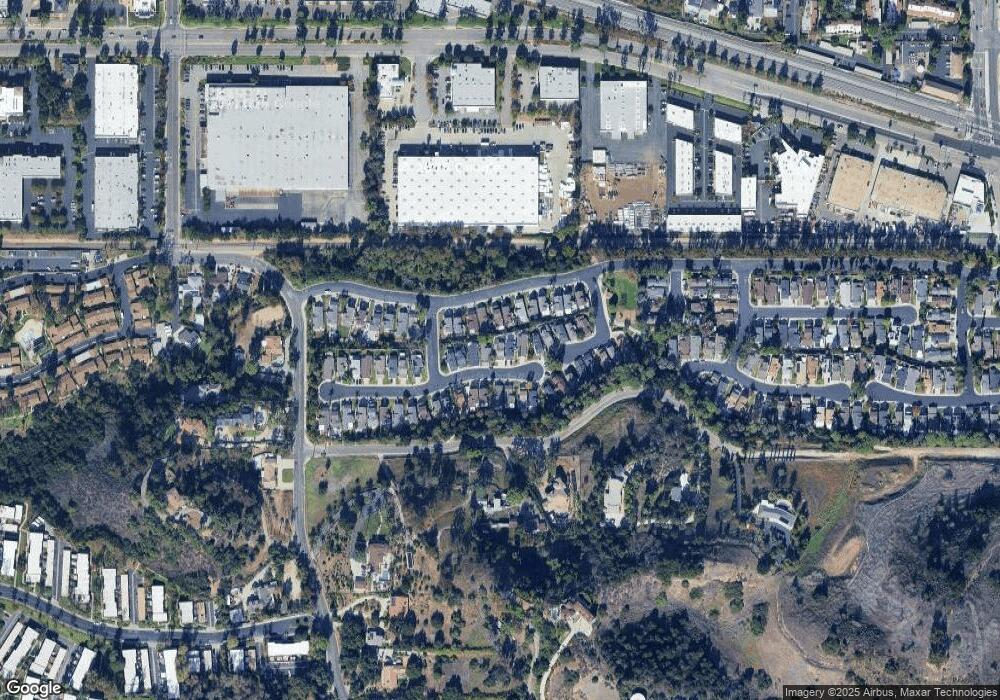

Map

Nearby Homes

- 402 E De Anza Heights Dr

- 507 Juniper St

- 518 Willow Place

- 751 Harwood Ct

- 748 S Walnut Ave

- 680 Redwood Ln

- 785 Teakwood Ln

- 0 E De Anza Heights Dr

- 649 Cottonwood Ln

- 275 S San Dimas Canyon Rd

- 770 S Tonopah Ct

- 765 Smokewood Ln

- 743 Smokewood Ln

- 808 Arbor Cir

- 514 San Pablo Ct

- 730 Briarwood Ln

- 1770 Van Dusen Rd

- 135 W Nubia St

- 2206 Stratford Way

- 404 W Via Vaquero

- 373 Elderberry St

- 349 Elderberry St

- 381 Elderberry St

- 341 Elderberry St

- 342 Sun Rose St

- 330 Sun Rose St

- 348 Sun Rose St

- 322 Sun Rose St

- 333 Elderberry St

- 395 Elderberry St

- 356 Elderberry St

- 352 Sun Rose St

- 344 Elderberry St

- 310 Sun Rose St

- 401 Lupine Place

- 374 Elderberry St

- 334 Elderberry St

- 321 Elderberry St

- 360 Sun Rose St

- 308 Sun Rose St