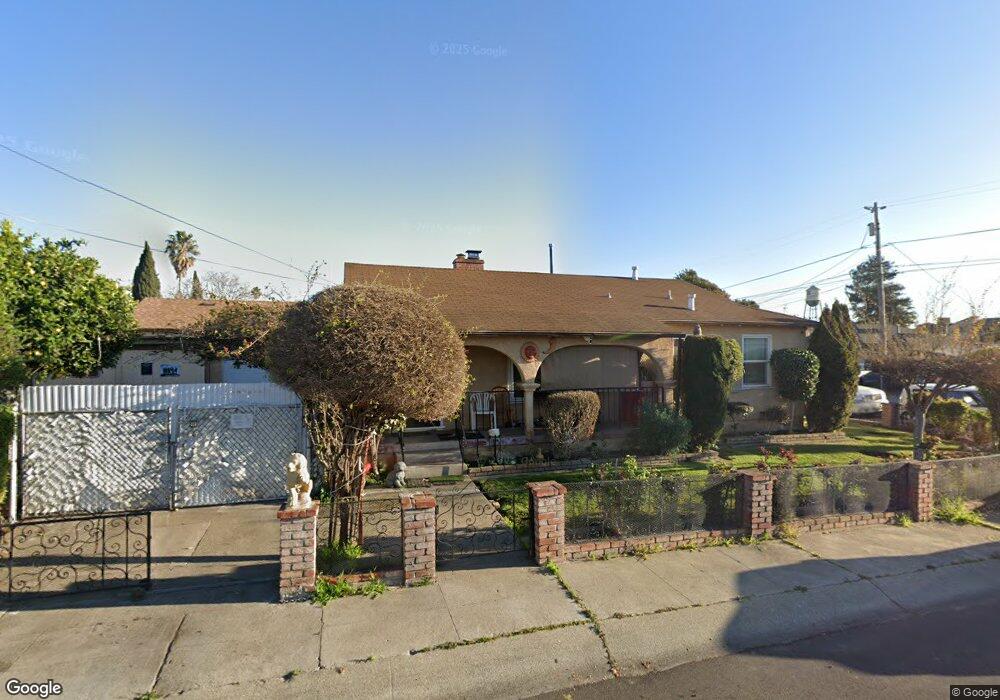

359 Lion St Hayward, CA 94541

Burbank NeighborhoodEstimated Value: $616,000 - $831,000

3

Beds

1

Bath

1,013

Sq Ft

$686/Sq Ft

Est. Value

About This Home

This home is located at 359 Lion St, Hayward, CA 94541 and is currently estimated at $695,407, approximately $686 per square foot. 359 Lion St is a home located in Alameda County with nearby schools including Burbank Elementary School, Winton Middle School, and Hayward High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 30, 2022

Sold by

Herminia Gomez Castillo Revocable Living

Bought by

Castillo Rene

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$102,595

Outstanding Balance

$86,489

Interest Rate

4.26%

Mortgage Type

Balloon

Estimated Equity

$608,918

Purchase Details

Closed on

Aug 22, 2022

Sold by

Ausencia Rodriguez

Bought by

Castillo Rene

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$102,595

Outstanding Balance

$86,489

Interest Rate

4.26%

Mortgage Type

Balloon

Estimated Equity

$608,918

Purchase Details

Closed on

Apr 4, 2008

Sold by

Castillo Herminia G

Bought by

Revoca Castillo Herminia Gomez and Revoca Herminia Gomez Castillo

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Castillo Rene | -- | Chicago Title | |

| Castillo Rene | -- | Chicago Title | |

| Revoca Castillo Herminia Gomez | -- | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Castillo Rene | $102,595 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,124 | $64,235 | $34,324 | $29,911 |

| 2024 | $1,124 | $62,976 | $33,651 | $29,325 |

| 2023 | $1,110 | $61,742 | $32,992 | $28,750 |

| 2022 | $1,010 | $53,531 | $32,345 | $28,186 |

| 2021 | $1,000 | $52,345 | $31,711 | $27,634 |

| 2020 | $991 | $58,736 | $31,386 | $27,350 |

| 2019 | $994 | $57,584 | $30,770 | $26,814 |

| 2018 | $951 | $56,455 | $30,167 | $26,288 |

| 2017 | $935 | $55,349 | $29,576 | $25,773 |

| 2016 | $860 | $54,264 | $28,996 | $25,268 |

| 2015 | $848 | $53,448 | $28,560 | $24,888 |

| 2014 | $818 | $52,402 | $28,001 | $24,401 |

Source: Public Records

Map

Nearby Homes

- 589 Staley Ave

- 22964 Alice St

- 204 Sullivan Way

- 522 B St

- 537 Dean St

- 568 Dean St

- 622 Moss Way

- 22876 Charing St

- 710 City Walk Place Unit 3

- 710 City Walk Place Unit 4

- 22575 Amador St

- 22894 Kingsford Way

- 728 City Walk Place Unit 4

- 742 B St

- 22716 Atherton St Unit 30

- 24023 Edloe Dr

- 257 Poplar Ave

- 22836 Watkins St

- 19895 Mission Blvd

- 24386 Thomas Ave

- 367 Lion St

- 22810 Optimist St

- 375 Lion St

- 22816 Optimist St

- 22809 Myrtle St

- 358 Lion St

- 364 Lion St

- 22815 Myrtle St

- 372 Lion St

- 352 Lion St

- 22822 Optimist St

- 345 Lion St

- 22811 Optimist St

- 22821 Myrtle St

- 346 Lion St

- 22817 Optimist St

- 22763 Myrtle St

- 22828 Optimist St

- 22757 Myrtle St

- 22823 Optimist St

Your Personal Tour Guide

Ask me questions while you tour the home.