36 Glen Ridge Wilton, CT 06897

Estimated Value: $533,000 - $578,000

1

Bed

2

Baths

1,127

Sq Ft

$490/Sq Ft

Est. Value

About This Home

This home is located at 36 Glen Ridge, Wilton, CT 06897 and is currently estimated at $552,185, approximately $489 per square foot. 36 Glen Ridge is a home located in Fairfield County with nearby schools including Miller-Driscoll School, Cider Mill School, and Middlebrook School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 7, 2021

Sold by

Odishaw Elsie

Bought by

Devivo Jamie G

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$332,000

Outstanding Balance

$301,239

Interest Rate

2.9%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$250,946

Purchase Details

Closed on

May 12, 2016

Sold by

Maxwell Peter and Maxwell Courtney

Bought by

Odishaw Elsie

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$220,000

Interest Rate

3.71%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Aug 31, 2009

Sold by

Gilbert Stephen P

Bought by

Maxfield Peter and Maxwell Courtney

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$283,500

Interest Rate

5.17%

Purchase Details

Closed on

Apr 1, 1997

Sold by

Quattrochi Charles and Quattrochi Judith

Bought by

Gilbert Stephen

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Devivo Jamie G | $415,000 | None Available | |

| Odishaw Elsie | $330,000 | -- | |

| Maxfield Peter | $315,000 | -- | |

| Gilbert Stephen | $162,500 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Devivo Jamie G | $332,000 | |

| Previous Owner | Gilbert Stephen | $220,000 | |

| Previous Owner | Gilbert Stephen | $275,500 | |

| Previous Owner | Gilbert Stephen | $283,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $7,761 | $317,940 | $0 | $317,940 |

| 2024 | $7,611 | $317,940 | $0 | $317,940 |

| 2023 | $6,841 | $233,800 | $0 | $233,800 |

| 2022 | $6,600 | $233,800 | $0 | $233,800 |

| 2021 | $6,516 | $233,800 | $0 | $233,800 |

| 2020 | $6,420 | $233,800 | $0 | $233,800 |

| 2019 | $4,895 | $233,800 | $0 | $233,800 |

| 2018 | $5,740 | $203,630 | $0 | $203,630 |

| 2017 | $5,655 | $203,630 | $0 | $203,630 |

| 2016 | $5,567 | $203,630 | $0 | $203,630 |

| 2015 | $5,463 | $203,630 | $0 | $203,630 |

| 2014 | $5,398 | $203,630 | $0 | $203,630 |

Source: Public Records

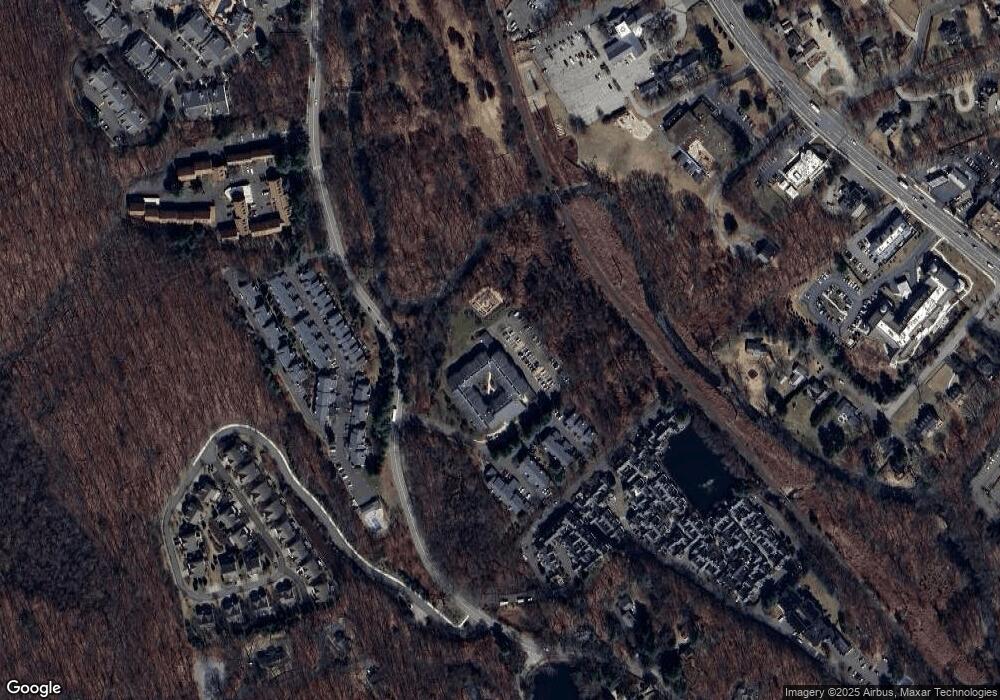

Map

Nearby Homes

- 52 Glen Ridge

- 35 Village Walk

- 36 Wilton Crest Unit 36

- 20 Wilton Crest Unit 20

- 84 Wilton Crest Rd Unit 84

- 15 River Rd Unit STE 210

- 81 Graenest Ridge Rd

- 332 Belden Hill Rd

- 105 Danbury Rd

- 110 Dudley Rd

- 28 Village Ct

- 33 Middlebrook Farm Rd

- 181 Old Boston Rd

- 515 Belden Hill Rd

- 29 Grumman Ave

- 55 Liberty St

- 510 Foxboro Dr

- 123 Old Belden Hill Rd Unit 40

- 330 Ridgefield Rd

- 112 Middlebrook Farm Rd

- 50 Glen Ridge

- 48 Glen Ridge

- 46 Glen Ridge

- 44 Glen Ridge

- 42 Glen Ridge

- 40 Glen Ridge

- 38 Glen Ridge

- 37 Glen Ridge

- 35 Glen Ridge

- 34 Glen Ridge

- 33 Glen Ridge

- 46 Glen Ridge Unit 46

- 34 Glen Ridge Unit 34

- 50 Glen Ridge Unit 50

- 35 Glen Ridge Unit 35

- 36 Glen Ridge Unit 36

- 38 Glen Ridge Unit 38

- 103 Glen Side

- 32 Glen Ridge

- 31 Glen Ridge