360 Auburn Way Unit 8 San Jose, CA 95129

Loma Linda NeighborhoodEstimated Value: $632,000 - $864,000

2

Beds

2

Baths

1,099

Sq Ft

$643/Sq Ft

Est. Value

About This Home

This home is located at 360 Auburn Way Unit 8, San Jose, CA 95129 and is currently estimated at $706,971, approximately $643 per square foot. 360 Auburn Way Unit 8 is a home located in Santa Clara County with nearby schools including Manuel De Vargas Elementary School, Warren E. Hyde Middle School, and Cupertino High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 29, 2023

Sold by

Wyrick Laura

Bought by

Wyrick Living Trust and Wyrick

Current Estimated Value

Purchase Details

Closed on

Apr 18, 2005

Sold by

Sandoval Juan Carlos and Preciado Claudia E

Bought by

Wyrick Laura

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$312,000

Interest Rate

6.62%

Mortgage Type

Stand Alone First

Purchase Details

Closed on

Oct 20, 2003

Sold by

Sandoval Juan Carlos

Bought by

Sandoval Juan Carlos and Preciado Claudia E

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$256,000

Interest Rate

4.44%

Mortgage Type

Balloon

Purchase Details

Closed on

Oct 15, 2001

Sold by

Cardenas Hector Hans and Cardenas Mary Ann

Bought by

Sandoval Juan C

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$256,500

Interest Rate

6.84%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Wyrick Living Trust | -- | None Listed On Document | |

| Wyrick Laura | $390,000 | First American Title Company | |

| Sandoval Juan Carlos | -- | Stewart Title Of California | |

| Sandoval Juan C | $270,000 | Commonwealth Land Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Wyrick Laura | $312,000 | |

| Previous Owner | Sandoval Juan Carlos | $256,000 | |

| Previous Owner | Sandoval Juan C | $256,500 | |

| Closed | Wyrick Laura | $78,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $6,822 | $543,257 | $271,525 | $271,732 |

| 2024 | $6,822 | $532,605 | $266,201 | $266,404 |

| 2023 | $6,745 | $522,163 | $260,982 | $261,181 |

| 2022 | $6,880 | $511,925 | $255,865 | $256,060 |

| 2021 | $6,796 | $501,889 | $250,849 | $251,040 |

| 2020 | $6,709 | $496,743 | $248,277 | $248,466 |

| 2019 | $6,586 | $487,004 | $243,409 | $243,595 |

| 2018 | $6,412 | $477,456 | $238,637 | $238,819 |

| 2017 | $6,385 | $468,095 | $233,958 | $234,137 |

| 2016 | $6,191 | $458,918 | $229,371 | $229,547 |

| 2015 | $6,149 | $452,025 | $225,926 | $226,099 |

| 2014 | $5,591 | $412,000 | $205,900 | $206,100 |

Source: Public Records

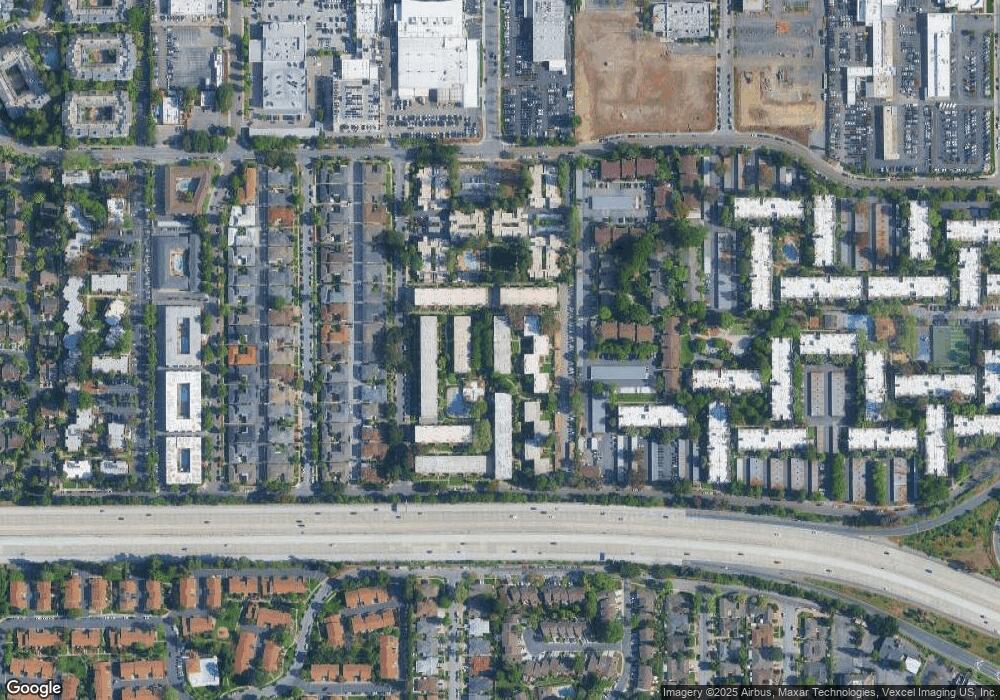

Map

Nearby Homes

- 380 Auburn Way Unit 10

- 380 Auburn Way Unit 6

- 410 Auburn Way Unit 42

- 490 Auburn Way Unit 14

- 494 Greendale Way

- 477 Greendale Way

- 380 Richfield Dr

- 4661 Albany Cir Unit 121

- 4626 Moorpark Ave

- 4792 Raspberry Place

- 4685 Albany Cir Unit 151

- 4815 Capistrano Ave

- 4425 Blackford Ave

- 4733 Lago Vista Cir

- 4691 Albany Cir Unit 116

- 2831 Malabar Ave

- 461 Northlake Dr Unit 22

- 5011 Lapa Dr

- 223 Kiely Blvd Unit A

- 513 Kiely Blvd

- 360 Auburn Way Unit 14

- 360 Auburn Way Unit 15

- 360 Auburn Way Unit 11

- 360 Auburn Way

- 360 Auburn Way Unit 17

- 360 Auburn Way Unit 16

- 360 Auburn Way Unit 15

- 360 Auburn Way Unit 14

- 360 Auburn Way Unit 13

- 360 Auburn Way Unit 12

- 360 Auburn Way Unit 11

- 360 Auburn Way Unit 10

- 360 Auburn Way Unit 9

- 360 Auburn Way Unit 7

- 360 Auburn Way Unit 6

- 360 Auburn Way Unit 5

- 360 Auburn Way Unit 4

- 360 Auburn Way Unit 3

- 360 Auburn Way Unit 2

- 360 Auburn Way Unit 23