3605 36th Way Unit 211-C West Palm Beach, FL 33407

Spencer Lakes NeighborhoodEstimated Value: $247,000 - $307,000

2

Beds

2

Baths

1,236

Sq Ft

$219/Sq Ft

Est. Value

About This Home

This home is located at 3605 36th Way Unit 211-C, West Palm Beach, FL 33407 and is currently estimated at $270,233, approximately $218 per square foot. 3605 36th Way Unit 211-C is a home located in Palm Beach County with nearby schools including Egret Lake Elementary School, Bear Lakes Middle School, and Palm Beach Lakes High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 1, 2021

Sold by

Wade Debra

Bought by

Delrosario Alejandro Nunez and Trissler Erika Rodriguez

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$211,850

Outstanding Balance

$189,702

Interest Rate

2.9%

Mortgage Type

New Conventional

Estimated Equity

$80,531

Purchase Details

Closed on

Jun 26, 2020

Sold by

Cook Carlton R

Bought by

Wade Debra Ann

Purchase Details

Closed on

Aug 30, 2011

Sold by

Federal National Mortgage Association

Bought by

Cook Carlton R

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$54,994

Interest Rate

4.16%

Mortgage Type

FHA

Purchase Details

Closed on

Jan 27, 2011

Sold by

Rosales Carmella

Bought by

Federal National Mortgage Association

Purchase Details

Closed on

Jun 10, 2005

Sold by

Dinnan Blake A and Dinnan Deri L

Bought by

Rosales Carmella

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$168,300

Interest Rate

7.5%

Mortgage Type

Fannie Mae Freddie Mac

Purchase Details

Closed on

Aug 2, 2001

Sold by

Susan B Miller I

Bought by

Greeson Deri L and Dinnan Blake A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$81,357

Interest Rate

7.09%

Mortgage Type

FHA

Purchase Details

Closed on

Mar 2, 1999

Sold by

Bezerra Nilo S and Bezerra Maria L

Bought by

Miller Susan B

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$39,950

Interest Rate

6.84%

Mortgage Type

New Conventional

Purchase Details

Closed on

Dec 16, 1996

Sold by

Timmons Robert M and Timmons Merle L

Bought by

Bezerra Maria L and Bezerra Nilo S

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$42,350

Interest Rate

7.77%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Delrosario Alejandro Nunez | $229,000 | Sage Title & Escrow Svcs Inc | |

| Delrosario Alejandro Nunez | $229,000 | Sage Title & Escrow Services | |

| Wade Debra Ann | $143,750 | Harbour Land Title Llc | |

| Cook Carlton R | $59,000 | Servicelink | |

| Federal National Mortgage Association | $51,600 | None Available | |

| Rosales Carmella | $187,000 | -- | |

| Greeson Deri L | $82,000 | -- | |

| Miller Susan B | $61,500 | -- | |

| Bezerra Maria L | $56,500 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Delrosario Alejandro Nunez | $211,850 | |

| Closed | Delrosario Alejandro Nunez | $211,850 | |

| Previous Owner | Cook Carlton R | $7,500 | |

| Previous Owner | Cook Carlton R | $54,994 | |

| Previous Owner | Rosales Carmella | $168,300 | |

| Previous Owner | Bezerra Maria L | $81,357 | |

| Previous Owner | Bezerra Maria L | $39,950 | |

| Previous Owner | Bezerra Maria L | $42,350 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,083 | $226,312 | -- | -- |

| 2024 | $4,083 | $219,934 | -- | -- |

| 2023 | $3,965 | $213,528 | $0 | $0 |

| 2022 | $3,877 | $207,309 | $0 | $0 |

| 2021 | $3,476 | $142,493 | $0 | $142,493 |

| 2020 | $1,044 | $69,868 | $0 | $0 |

| 2019 | $1,045 | $68,297 | $0 | $0 |

| 2018 | $932 | $67,024 | $0 | $0 |

| 2017 | $893 | $65,645 | $0 | $0 |

| 2016 | $886 | $64,295 | $0 | $0 |

| 2015 | $891 | $63,848 | $0 | $0 |

| 2014 | $895 | $63,341 | $0 | $0 |

Source: Public Records

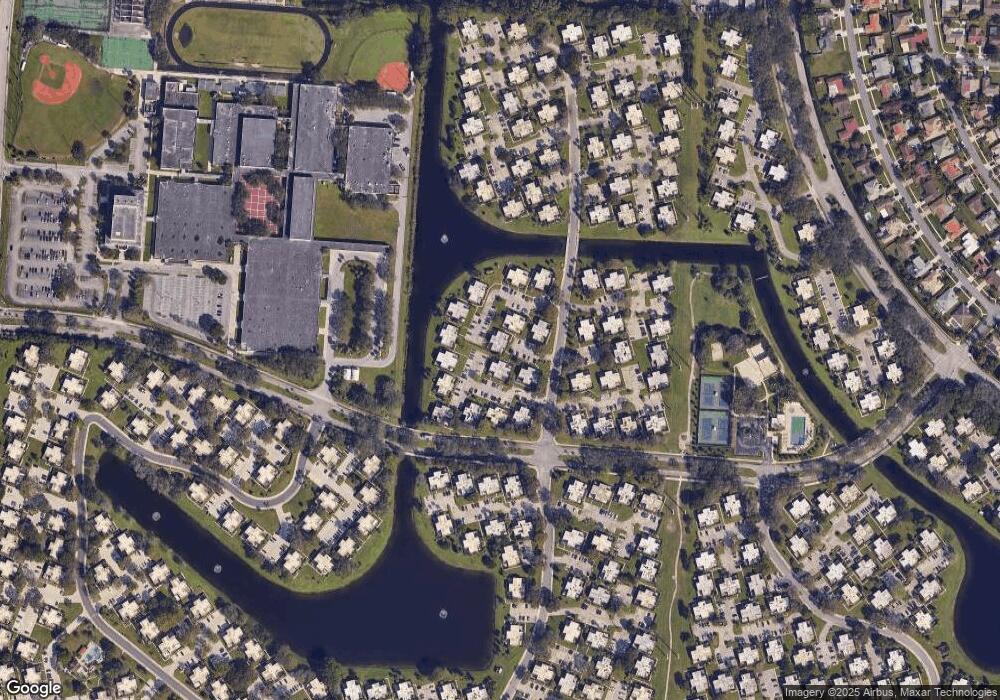

Map

Nearby Homes