3610 Cama Ln Castro Valley, CA 94552

Castro Valley East NeighborhoodEstimated Value: $1,014,000 - $1,124,000

3

Beds

3

Baths

1,541

Sq Ft

$700/Sq Ft

Est. Value

About This Home

This home is located at 3610 Cama Ln, Castro Valley, CA 94552 and is currently estimated at $1,078,584, approximately $699 per square foot. 3610 Cama Ln is a home located in Alameda County with nearby schools including Independent Elementary School, Creekside Middle School, and Canyon Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 1, 2009

Sold by

Faroqi Mohammad and Faroqi Hadia

Bought by

Azamey David Sayed

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$217,000

Outstanding Balance

$137,178

Interest Rate

4.78%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$941,407

Purchase Details

Closed on

Jan 4, 2005

Sold by

Tsang Walter Sing Chuen

Bought by

Tsang Suk Yin

Purchase Details

Closed on

May 20, 1998

Sold by

Mirzazadeh Morteza and Maghsoodnia Maryam

Bought by

Faroqi Mohammad and Faroqi Hadia

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$152,000

Interest Rate

7.07%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Azamey David Sayed | $310,000 | Placer Title Company | |

| Tsang Suk Yin | -- | Chicago Title Co | |

| Faroqi Mohammad | $190,000 | First American Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Azamey David Sayed | $217,000 | |

| Previous Owner | Faroqi Mohammad | $152,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $7,012 | $534,382 | $160,314 | $374,068 |

| 2024 | $7,012 | $523,907 | $157,172 | $366,735 |

| 2023 | $6,893 | $513,637 | $154,091 | $359,546 |

| 2022 | $6,755 | $503,568 | $151,070 | $352,498 |

| 2021 | $6,581 | $493,695 | $148,108 | $345,587 |

| 2020 | $6,430 | $488,637 | $146,591 | $342,046 |

| 2019 | $6,545 | $479,058 | $143,717 | $335,341 |

| 2018 | $6,361 | $469,667 | $140,900 | $328,767 |

| 2017 | $6,194 | $460,458 | $138,137 | $322,321 |

| 2016 | $5,894 | $451,431 | $135,429 | $316,002 |

| 2015 | $5,510 | $444,655 | $133,396 | $311,259 |

| 2014 | $5,439 | $435,948 | $130,784 | $305,164 |

Source: Public Records

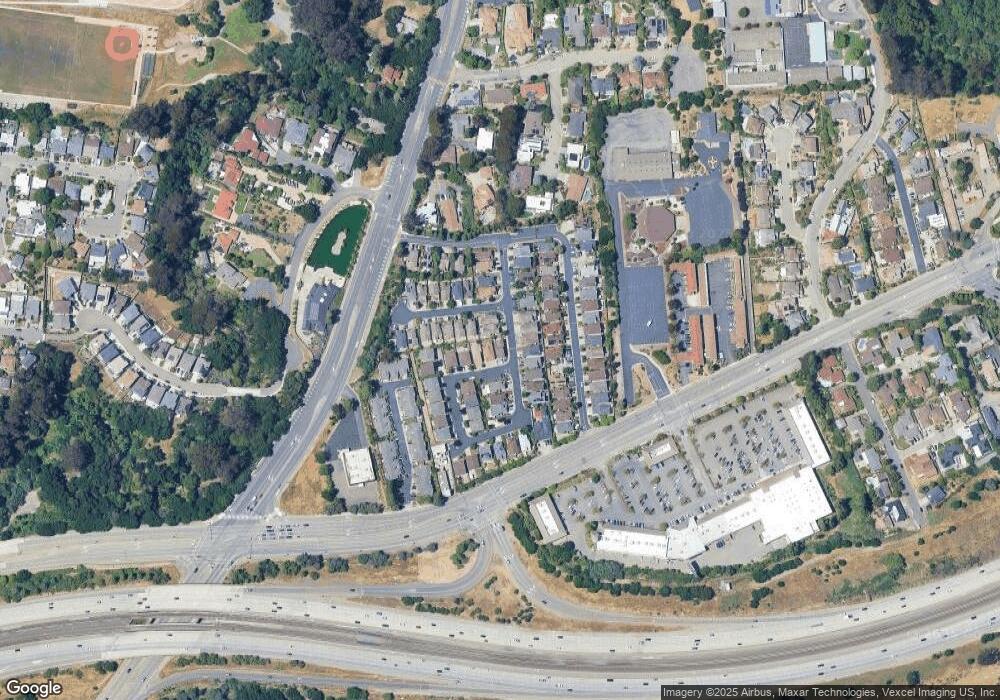

Map

Nearby Homes

- 3594 Cama Ln

- 0 Jensen Rd Unit 41089385

- 21798 Independent School Rd

- 4597 Edwards Ln

- 4937 Crow Canyon Rd

- 3285 Monika Ln

- 3264 Monika Ln

- 3238 Monika Ln

- 4525 Edwards Ln

- 3241 Monika Ln

- 22679 Valley View Dr

- 22561 Mossy Rock Dr

- 19430 Center St

- 5389 San Simeon Place

- 22490 Bayview Ave

- 3998 Castro Valley Blvd Unit SPC 27

- 22633 Mossy Rock Dr

- 4314 Shamrock Way

- 3086 Greenview Dr

- 5288 Crown Ct

- 21242 Timco Way

- 3578 Cama Ln

- 21293 Timco Way

- 21267 Timco Way

- 21216 Timco Way

- 21319 Timco Way

- 21241 Timco Way

- 21320 Timco Way

- 3562 Cama Ln

- 21215 Timco Way

- 21345 Timco Way

- 21296 Highland Dr

- 3573 Timco Ct

- 21371 Timco Way

- 21346 Timco Way

- 3546 Cama Ln

- 21189 Timco Way

- 21465 Justco Ln

- 3557 Timco Ct

- 21521 Justco Ln