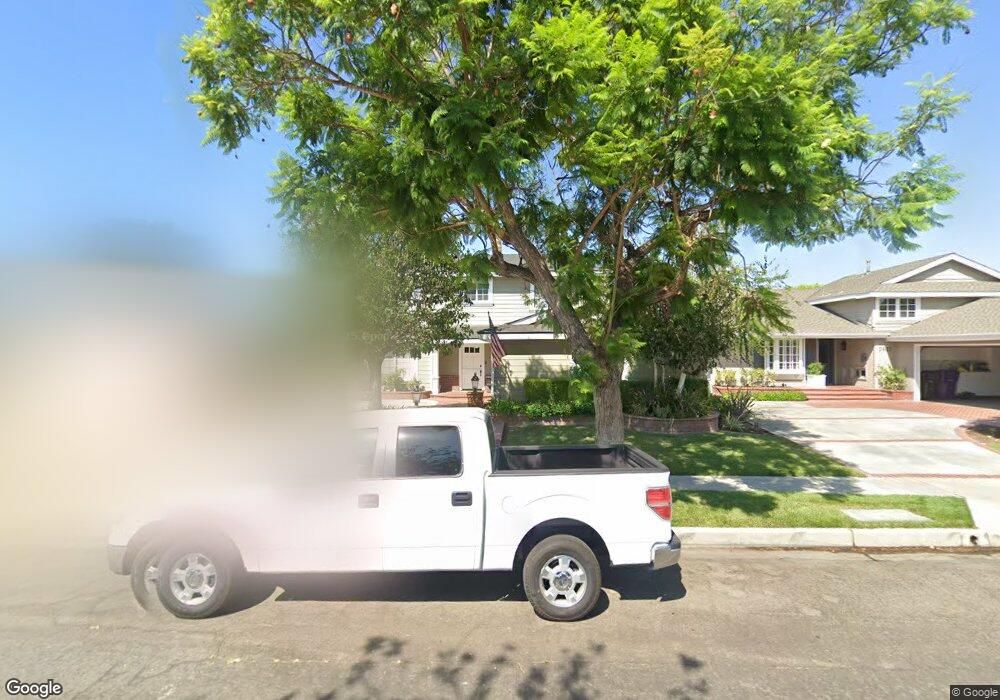

3611 Julian Ave Long Beach, CA 90808

El Dorado Park NeighborhoodEstimated Value: $1,508,000 - $1,537,516

6

Beds

4

Baths

2,712

Sq Ft

$562/Sq Ft

Est. Value

About This Home

This home is located at 3611 Julian Ave, Long Beach, CA 90808 and is currently estimated at $1,523,129, approximately $561 per square foot. 3611 Julian Ave is a home located in Los Angeles County with nearby schools including Newcomb Academy and Millikan High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 30, 2012

Sold by

Peters Michael M and Peters Beverly D

Bought by

Peters Michael M and Peters Beverly D

Current Estimated Value

Purchase Details

Closed on

Oct 3, 2002

Sold by

Real Solutions

Bought by

Peters Michael M and Peters Beverly D

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$332,000

Interest Rate

5.89%

Purchase Details

Closed on

May 16, 2002

Sold by

Marcus Tamera D

Bought by

Real Solutions

Purchase Details

Closed on

Aug 15, 1995

Sold by

Danufsky Philip G and Danufsky Harriet E

Bought by

Marcus Tamera D

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$227,500

Interest Rate

7.8%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Peters Michael M | -- | None Available | |

| Peters Michael M | $590,000 | First American Title Co | |

| Real Solutions | $5,000 | California Title Company | |

| Marcus Tamera D | $325,000 | South Coast Title | |

| Marcus Tamera D | -- | South Coast Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Peters Michael M | $332,000 | |

| Previous Owner | Marcus Tamera D | $227,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $10,858 | $854,500 | $400,311 | $454,189 |

| 2024 | $10,858 | $837,746 | $392,462 | $445,284 |

| 2023 | $10,686 | $821,320 | $384,767 | $436,553 |

| 2022 | $10,036 | $805,217 | $377,223 | $427,994 |

| 2021 | $9,841 | $789,429 | $369,827 | $419,602 |

| 2019 | $9,697 | $766,015 | $358,858 | $407,157 |

| 2018 | $9,367 | $750,996 | $351,822 | $399,174 |

| 2016 | $8,600 | $721,836 | $338,161 | $383,675 |

| 2015 | $8,251 | $710,994 | $333,082 | $377,912 |

| 2014 | $8,187 | $697,068 | $326,558 | $370,510 |

Source: Public Records

Map

Nearby Homes

- 22428 Devlin Ave

- 22330 Clarkdale Ave

- 22320 Clarkdale Ave

- 7815 E Torin St

- 22414 Horst Ave

- 8065 E Ring St

- 22315 Ibex Ave

- 22209 Ibex Ave

- 22022 Pioneer Blvd

- 22020 Pioneer Blvd

- 21918 Juan Ave

- 12322 Brittain St

- 21925 Belshire Ave Unit 7

- 21913 Belshire Ave Unit 16

- 3260 Lilly Ave

- 8036 E Damar St

- 21908 Belshire Ave Unit 204

- 21607 Juan Ave Unit 39

- 3091 Marna Ave

- 3862 Toland Ave

- 3601 Julian Ave

- 3621 Julian Ave

- 3591 Julian Ave

- 3631 Julian Ave

- 3596 Claremore Ave

- 3610 Claremore Ave

- 3590 Claremore Ave

- 3620 Claremore Ave

- 3600 Claremore Ave

- 3581 Julian Ave

- 3641 Julian Ave

- 3630 Claremore Ave

- 3580 Claremore Ave

- 3620 Julian Ave

- 3600 Julian Ave

- 3640 Julian Ave

- 3590 Julian Ave

- 3640 Claremore Ave

- 3571 Julian Ave

- 3660 Julian Ave