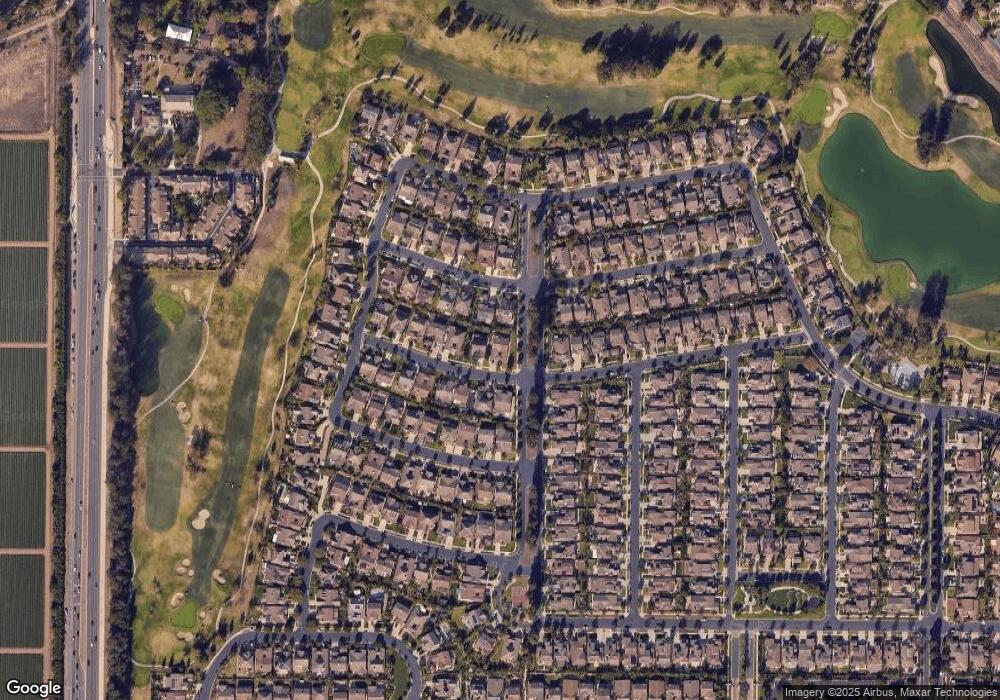

3615 Eagle Bend Ln Oxnard, CA 93036

West Outer Oxnard NeighborhoodEstimated Value: $1,178,000 - $1,287,000

3

Beds

3

Baths

2,623

Sq Ft

$463/Sq Ft

Est. Value

About This Home

This home is located at 3615 Eagle Bend Ln, Oxnard, CA 93036 and is currently estimated at $1,214,927, approximately $463 per square foot. 3615 Eagle Bend Ln is a home located in Ventura County with nearby schools including Thurgood Marshall Elementary School, Oxnard High School, and Our Redeemer's Nursery School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 3, 2025

Sold by

Alinaya-Velasco Yolanda

Bought by

Yolanda Alinaya-Velasco Living Trust and Alinaya-Velasco

Current Estimated Value

Purchase Details

Closed on

Oct 4, 2016

Sold by

Velasco Yolanda

Bought by

Alinaya Velasco Yolanda and Velasco Yolanda

Purchase Details

Closed on

Mar 19, 2015

Sold by

Alinaya Velasco Yolanda

Bought by

Alinaya Velasco Yolanda

Purchase Details

Closed on

Sep 13, 2011

Sold by

The Bank Of New York Mellon

Bought by

Velasco Yolanda

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$511,691

Interest Rate

4.37%

Mortgage Type

FHA

Purchase Details

Closed on

Jul 26, 2011

Sold by

Alvarado Raymond and Alvarado Stacy

Bought by

The Bank Of New York Mellon

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$511,691

Interest Rate

4.37%

Mortgage Type

FHA

Purchase Details

Closed on

Feb 28, 2007

Sold by

Deal Beverly Ann

Bought by

Alvarado Raymond and Alvarado Stacy

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$608,000

Interest Rate

6.29%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jan 22, 2007

Sold by

Wilfong David W and Wilfong Sarah D

Bought by

Deal Beverly Ann

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$608,000

Interest Rate

6.29%

Mortgage Type

New Conventional

Purchase Details

Closed on

Aug 16, 2006

Sold by

Blum Tyrone J and Lyons Blum Patricia A

Bought by

Wilfong David W and Wilfong Sarah D

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$600,000

Interest Rate

6.5%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Aug 8, 2003

Sold by

D R Horton Los Angeles Holding Co Inc

Bought by

Blum Tyrone and Lyons Blum Patricia Ann

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$460,130

Interest Rate

5.62%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Yolanda Alinaya-Velasco Living Trust | -- | None Listed On Document | |

| Alinaya-Velasco Yolanda | -- | None Listed On Document | |

| Alinaya Velasco Yolanda | -- | None Available | |

| Alinaya Velasco Yolanda | -- | None Available | |

| Velasco Yolanda | $525,000 | Chicago Title Company | |

| The Bank Of New York Mellon | $469,350 | Landsafe Title | |

| Alvarado Raymond | -- | Chicago Title Co | |

| Deal Beverly Ann | -- | Chicago Title Company | |

| Wilfong David W | $829,000 | Chicago Title Company | |

| Blum Tyrone | $575,500 | Lawyers Title Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Velasco Yolanda | $511,691 | |

| Previous Owner | Alvarado Raymond | $608,000 | |

| Previous Owner | Wilfong David W | $600,000 | |

| Previous Owner | Blum Tyrone | $460,130 | |

| Closed | Blum Tyrone | $57,516 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $7,923 | $659,413 | $329,708 | $329,705 |

| 2024 | $7,923 | $646,484 | $323,243 | $323,241 |

| 2023 | $7,633 | $633,808 | $316,905 | $316,903 |

| 2022 | $7,402 | $621,381 | $310,691 | $310,690 |

| 2021 | $7,341 | $609,198 | $304,599 | $304,599 |

| 2020 | $7,477 | $602,954 | $301,477 | $301,477 |

| 2019 | $7,265 | $591,132 | $295,566 | $295,566 |

| 2018 | $7,161 | $579,542 | $289,771 | $289,771 |

| 2017 | $6,795 | $568,180 | $284,090 | $284,090 |

| 2016 | $6,747 | $557,040 | $278,520 | $278,520 |

| 2015 | $6,941 | $548,676 | $274,338 | $274,338 |

| 2014 | $6,867 | $537,930 | $268,965 | $268,965 |

Source: Public Records

Map

Nearby Homes

- 3325 Eagle Bend Ln

- 2056 Mission Hills Dr

- 2310 Crown Point Ct

- 1420 Ebony Dr

- 2134 Cold Stream Ct

- 2176 Eastridge Loop

- 1721 Joanne Way

- 670 Joliet Place

- 1920 Oneida Place

- 1655 Range Rd

- 2100 Norma St

- 1510 Holly Ave

- 1300 Bluebell St

- 1231 Bluebell St

- 1251 Gardenia St

- 1131 Janetwood Dr

- 1000 Camellia St

- 1127 Douglas Ave

- 462 N M St

- 1920 N H St Unit 235

- 3625 Eagle Bend Ln

- 3604 Fairmont Ln

- 3614 Fairmont Ln

- 3635 Eagle Bend Ln

- 3606 Eagle Bend Ln

- 3616 Eagle Bend Ln

- 3535 Eagle Bend Ln

- 3624 Fairmont Ln

- 3626 Eagle Bend Ln

- 3536 Fairmont Ln

- 3645 Eagle Bend Ln

- 3636 Eagle Bend Ln

- 3525 Eagle Bend Ln

- 3634 Fairmont Ln

- 2070 Pavin Dr

- 3646 Eagle Bend Ln

- 3526 Fairmont Ln

- 3655 Eagle Bend Ln

- 3613 Fairmont Ln

- 2060 Pavin Dr