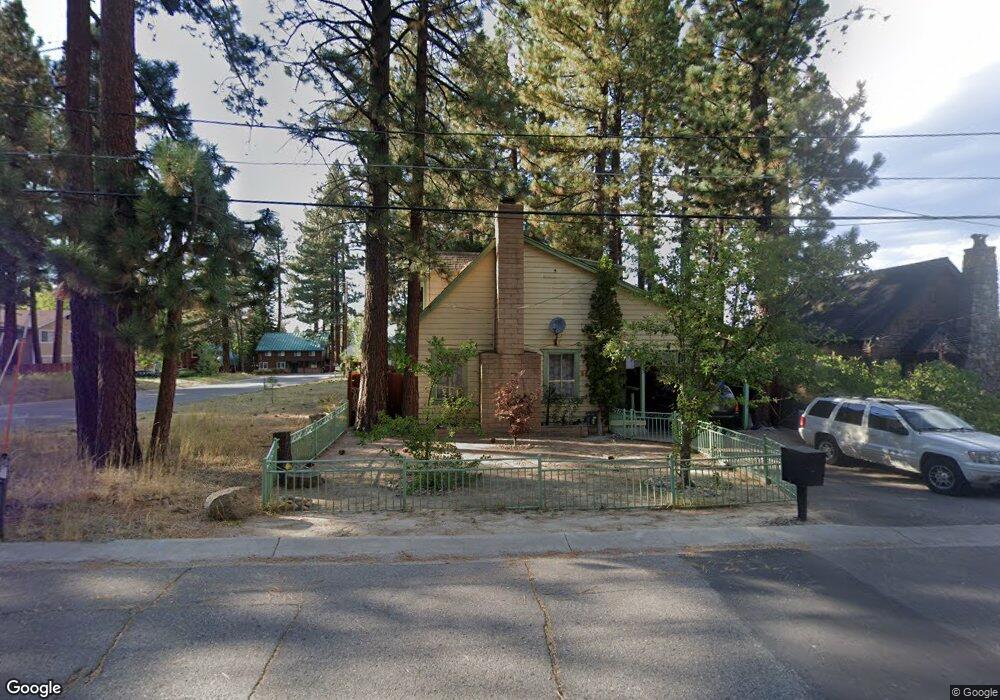

3625 Paradise Ave South Lake Tahoe, CA 96150

Estimated Value: $543,000 - $634,000

3

Beds

2

Baths

1,330

Sq Ft

$431/Sq Ft

Est. Value

About This Home

This home is located at 3625 Paradise Ave, South Lake Tahoe, CA 96150 and is currently estimated at $572,931, approximately $430 per square foot. 3625 Paradise Ave is a home located in El Dorado County with nearby schools including Bijou Community, South Tahoe Middle School, and South Tahoe High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 19, 2007

Sold by

Arciga Jose Luis Herrera and Jose Luis Herrera A

Bought by

Arciga Jose Luis Herrera

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$155,000

Outstanding Balance

$92,059

Interest Rate

6.1%

Mortgage Type

New Conventional

Estimated Equity

$480,872

Purchase Details

Closed on

Aug 13, 2004

Sold by

Rojas Jorge C

Bought by

Herrera A Jose Luis

Purchase Details

Closed on

Aug 6, 1998

Sold by

Rojas Elena

Bought by

Rojas Jorge C

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$106,391

Interest Rate

6.88%

Mortgage Type

FHA

Purchase Details

Closed on

Jan 17, 1996

Sold by

Huey Lily

Bought by

Huey Lily and Revocable Living Trust Of Lily

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Arciga Jose Luis Herrera | -- | First American Title Ins Co | |

| Herrera A Jose Luis | -- | -- | |

| Rojas Jorge C | -- | Old Republic Title Company | |

| Herrera-A Jose Luis | $109,000 | Old Republic Title Company | |

| Huey Lily | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Arciga Jose Luis Herrera | $155,000 | |

| Previous Owner | Herrera-A Jose Luis | $106,391 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,160 | $295,055 | $75,339 | $219,716 |

| 2024 | $3,160 | $289,270 | $73,862 | $215,408 |

| 2023 | $3,106 | $283,599 | $72,414 | $211,185 |

| 2022 | $3,075 | $278,040 | $70,995 | $207,045 |

| 2021 | $3,028 | $272,589 | $69,603 | $202,986 |

| 2020 | $2,985 | $269,795 | $68,890 | $200,905 |

| 2019 | $2,970 | $264,506 | $67,540 | $196,966 |

| 2018 | $3,509 | $259,320 | $66,216 | $193,104 |

| 2017 | $3,419 | $254,236 | $64,918 | $189,318 |

| 2016 | $2,802 | $249,252 | $63,646 | $185,606 |

| 2015 | $2,772 | $245,510 | $62,691 | $182,819 |

| 2014 | $2,661 | $240,703 | $61,464 | $179,239 |

Source: Public Records

Map

Nearby Homes

- 3535 Lake Tahoe Blvd Unit 130

- 3535 Lake Tahoe Blvd Unit 231

- 3535 Lake Tahoe Blvd Unit 623

- 3535 Lake Tahoe Blvd Unit 520

- 3535 Lake Tahoe Blvd Unit 506

- 3535 Lake Tahoe Blvd Unit 499

- 3535 Lake Tahoe Blvd Unit 329

- 3535 Lake Tahoe Blvd Unit 313

- 3535 Lake Tahoe Blvd Unit 131

- 3608 Aspen Ave

- 3508 Fawn Way

- 1160 Bowers Ave

- 3754 Forest Ave

- 920 Balbijou Rd Unit 229

- 3696 Birch Ave

- 3520 Cloverdale Ave

- 1152 Sonora Ave

- 3680 Tamarack Ave

- 1115 Glenwood Way

- 1181 Ski Run Blvd

- 3627 Paradise Ave

- 3624 Osgood Ave

- 3628 Osgood Ave

- 3628 Paradise Ave

- 3613 Paradise Ave Unit A-B

- 3613 Paradise Ave Unit A

- 3624 Paradise Ave

- 3630 Paradise Ave

- 3609 Paradise Ave Unit A

- 3609 Paradise Ave

- 3608 Osgood Ave

- 3612 Paradise Ave

- 3636 Paradise Ave

- 3605 Paradise Ave

- 3621 Osgood Ave

- 3629 Osgood Ave

- 3629 Forest Ave

- 3615 Osgood Ave

- 3604 Osgood Ave

- 3633 Forest Ave