363 Caliente Cir San Leandro, CA 94578

Floresta Gardens-Bradrick NeighborhoodEstimated Value: $484,000 - $549,000

3

Beds

2

Baths

1,245

Sq Ft

$419/Sq Ft

Est. Value

About This Home

This home is located at 363 Caliente Cir, San Leandro, CA 94578 and is currently estimated at $522,255, approximately $419 per square foot. 363 Caliente Cir is a home located in Alameda County with nearby schools including Monroe Elementary School, John Muir Middle School, and San Leandro High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 31, 2016

Sold by

Simonson Bernadette

Bought by

Simonson Joshua J

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$110,000

Outstanding Balance

$87,804

Interest Rate

3.66%

Mortgage Type

New Conventional

Estimated Equity

$434,451

Purchase Details

Closed on

Jul 11, 2011

Sold by

Masana Ariel

Bought by

Simonson Joshua and Simonson Bernadette

Purchase Details

Closed on

Oct 22, 2004

Sold by

Masana Cherry

Bought by

Masana Ariel

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$230,000

Interest Rate

5.74%

Mortgage Type

Stand Alone Refi Refinance Of Original Loan

Purchase Details

Closed on

Dec 3, 1997

Sold by

Javier Eugenio I

Bought by

Masana Ariel

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$100,000

Interest Rate

7.31%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Simonson Joshua J | $102,000 | North American Title Co Inc | |

| Simonson Joshua | $145,000 | North American Title Company | |

| Masana Ariel | -- | Financial Title Company | |

| Masana Ariel | $681,818 | First American Title Guarant |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Simonson Joshua J | $110,000 | |

| Previous Owner | Masana Ariel | $230,000 | |

| Previous Owner | Masana Ariel | $100,000 | |

| Closed | Masana Ariel | $20,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,875 | $182,117 | $54,635 | $127,482 |

| 2024 | $2,875 | $178,548 | $53,564 | $124,984 |

| 2023 | $2,896 | $175,047 | $52,514 | $122,533 |

| 2022 | $2,797 | $171,615 | $51,484 | $120,131 |

| 2021 | $2,707 | $168,251 | $50,475 | $117,776 |

| 2020 | $2,628 | $166,527 | $49,958 | $116,569 |

| 2019 | $2,542 | $163,263 | $48,979 | $114,284 |

| 2018 | $2,493 | $160,063 | $48,019 | $112,044 |

| 2017 | $2,359 | $156,925 | $47,077 | $109,848 |

| 2016 | $2,282 | $153,848 | $46,154 | $107,694 |

| 2015 | $2,236 | $151,538 | $45,461 | $106,077 |

| 2014 | $2,217 | $148,570 | $44,571 | $103,999 |

Source: Public Records

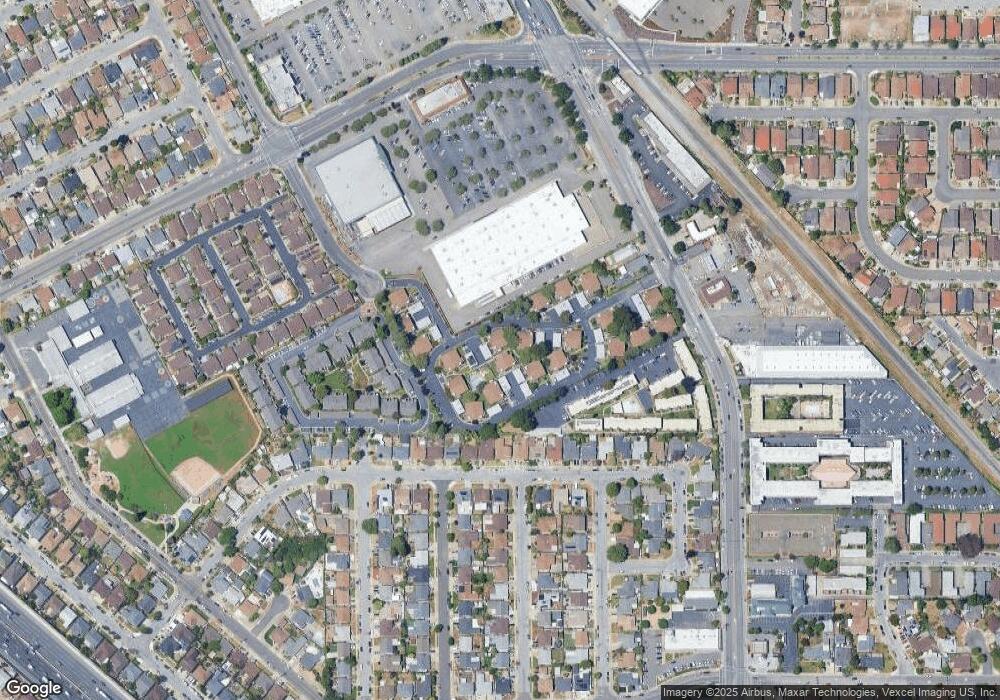

Map

Nearby Homes

- 365 Caliente Cir

- 3847 Yorkshire St Unit 8

- 3811 Yorkshire St Unit 2

- 774 Hamlin Way

- 3672 Del Monte Way

- 391 Anza Way

- 14820 Crosby St

- 455 Lloyd Ave

- 14875 Western Ave

- 14828 Martell Ave

- 3411 Del Monte Way

- 688 Garside Ct

- 3419 Del Valle Cir

- 475 Nabor St

- 1207 147th Ave Unit D

- 1203 147th Ave

- 15009 Kesterson St

- 15049 Kesterson St

- 1112 Adason Dr

- 619 Beatrice St

- 361 Caliente Cir Unit 25

- 367 Caliente Cir Unit 28

- 385 Caliente Cir

- 387 Caliente Cir

- 371 Caliente Cir

- 375 Caliente Cir Unit 22

- 381 Caliente Cir

- 345 Caliente Cir

- 383 Caliente Cir Unit 19

- 398 Caliente Dr

- 333 Caliente Cir Unit 43

- 347 Caliente Cir Unit 36

- 347 Caliente Cir

- 341 Caliente Cir

- 377 Caliente Cir Unit 24

- 331 Caliente Cir Unit 41

- 343 Caliente Cir Unit 35

- 335 Caliente Cir

- 394 Caliente Dr

- 396 Caliente Dr Unit 14