363 Dragonfly Cove Toccoa, GA 30577

Estimated Value: $633,000 - $813,357

6

Beds

6

Baths

4,355

Sq Ft

$174/Sq Ft

Est. Value

About This Home

This home is located at 363 Dragonfly Cove, Toccoa, GA 30577 and is currently estimated at $756,089, approximately $173 per square foot. 363 Dragonfly Cove is a home located in Stephens County with nearby schools including Stephens County High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 16, 2018

Sold by

Nationstar Reo Sub 1B Llc

Bought by

Kulzer John Peter and Liggett Jamie Renee

Current Estimated Value

Purchase Details

Closed on

Feb 7, 2017

Sold by

King Aubrey C

Bought by

Wilmington Savings Fund Societ and Nationstar Hecm Acquisition

Purchase Details

Closed on

Jan 14, 2010

Sold by

King Aubry C

Bought by

King Aubry C and Joyce King

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$303,500

Interest Rate

4.94%

Mortgage Type

New Conventional

Purchase Details

Closed on

Apr 21, 2008

Sold by

Not Provided

Bought by

King Aubrey C and King Joyce

Purchase Details

Closed on

Feb 10, 2006

Sold by

Eidt William P

Bought by

King Aubry and King Joyce

Purchase Details

Closed on

Nov 7, 2005

Sold by

Hodges Barry W

Bought by

Eidt William P

Purchase Details

Closed on

Feb 27, 1998

Sold by

Angelette A M

Bought by

Hodges Barry W and Hodges Sarah W

Purchase Details

Closed on

Oct 7, 1987

Sold by

Loudermilk Jack

Bought by

Angelette A M

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Kulzer John Peter | $270,000 | -- | |

| Nationstar Reo Sub 1B Llc | -- | -- | |

| Wilmington Savings Fund Societ | $405,000 | -- | |

| King Aubry C | -- | -- | |

| King Aubrey C | -- | -- | |

| King Aubry | -- | -- | |

| King Aubry | $165,000 | -- | |

| Eidt William P | -- | -- | |

| Eidt William P | $100,500 | -- | |

| Hodges Barry W | $60,000 | -- | |

| Angelette A M | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | King Aubry C | $303,500 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,505 | $232,994 | $41,480 | $191,514 |

| 2024 | $4,030 | $168,364 | $41,480 | $126,884 |

| 2023 | $3,209 | $159,401 | $41,480 | $117,921 |

| 2022 | $3,470 | $152,512 | $41,480 | $111,032 |

| 2021 | $3,358 | $143,347 | $41,480 | $101,867 |

| 2020 | $3,650 | $143,540 | $41,480 | $102,060 |

| 2019 | $2,539 | $142,986 | $41,480 | $101,506 |

| 2018 | $4,537 | $143,067 | $41,480 | $101,587 |

| 2017 | $4,608 | $143,067 | $41,480 | $101,587 |

| 2016 | $4,537 | $143,066 | $41,480 | $101,586 |

| 2015 | $4,751 | $143,066 | $41,480 | $101,586 |

| 2014 | $3,682 | $145,198 | $41,480 | $103,718 |

| 2013 | -- | $163,840 | $41,480 | $122,360 |

Source: Public Records

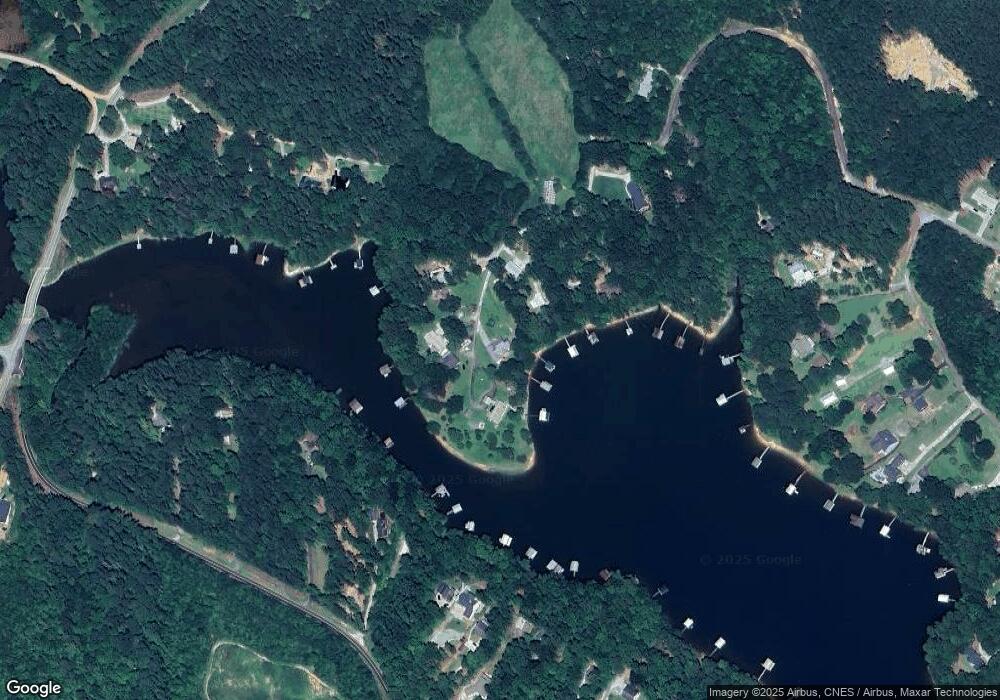

Map

Nearby Homes

- 88 Currahee Place

- 0 Cheyenne Trail Unit 10633853

- 571 Suttles Rd

- 679 Suttles Rd

- 347 River Trail

- 287 Spring Branch Cir

- 49 Currahee Point

- 112 Laura Dr

- 53 Raven Ct

- 173 Laura Dr

- 455 Chase Landing Rd

- 23 Wren Ct

- 286 Country Club Dr

- 8 Fornoff Dr

- 120 Ridgemore Cir

- 604 Mckinney Way

- 0 Blue Jay Place Unit 10670861

- 0 Blue Jay Place Unit 7703150

- 117 Sparrow Way

- 130 Shorewood Cir

- 380 Dragonfly Cove

- 364 Dragonfly Cove

- 381 Dragonfly Cove

- 327 Dragonfly Cove

- 336 Dragonfly Cove

- 265 Dragonfly Cove

- 255 Dragonfly Cove

- 170 GREENOCK Cove Lake

- 170 Greenock Cove

- 156 Greenock Cove

- 156 Greenock Cove

- 156 & Greenock Cove

- 156 Greenock Cove

- 277 Suttles Rd

- 277 Suttles Rd Unit 4-B

- 163 Greenock Cove

- 317 Suttles Rd

- 299 Suttles Rd

- 537 Shawnee Trail

- 257 Suttles Rd