36340 Capel Rd Grafton, OH 44044

Estimated Value: $406,000 - $504,992

3

Beds

2

Baths

2,504

Sq Ft

$181/Sq Ft

Est. Value

About This Home

This home is located at 36340 Capel Rd, Grafton, OH 44044 and is currently estimated at $452,248, approximately $180 per square foot. 36340 Capel Rd is a home located in Lorain County with nearby schools including Midview West Elementary School, Midview North Elementary School, and Midview East Intermediate School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 19, 2025

Sold by

Surman David E and Surman Lisa L

Bought by

Surman David E and Surman Lisa L

Current Estimated Value

Purchase Details

Closed on

Mar 25, 2004

Sold by

Parkinson Diane M

Bought by

Surman David E and Surman Lisa L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$204,000

Interest Rate

5.74%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Aug 30, 1995

Sold by

Haynes Ronald F

Bought by

Parkinson Diane M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$122,400

Interest Rate

7.55%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Surman David E | -- | None Listed On Document | |

| Surman David E | $240,000 | Premier Title | |

| Parkinson Diane M | $153,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Surman David E | $204,000 | |

| Previous Owner | Parkinson Diane M | $122,400 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $7,845 | $165,400 | $86,310 | $79,090 |

| 2023 | $5,186 | $96,460 | $37,555 | $58,905 |

| 2022 | $5,097 | $96,460 | $37,555 | $58,905 |

| 2021 | $5,111 | $96,460 | $37,555 | $58,905 |

| 2020 | $6,273 | $80,260 | $31,250 | $49,010 |

| 2019 | $4,058 | $80,260 | $31,250 | $49,010 |

| 2018 | $4,116 | $80,260 | $31,250 | $49,010 |

| 2017 | $4,131 | $70,900 | $28,190 | $42,710 |

| 2016 | $4,184 | $70,900 | $28,190 | $42,710 |

| 2015 | $4,205 | $70,900 | $28,190 | $42,710 |

| 2014 | $2,481 | $70,900 | $28,190 | $42,710 |

| 2013 | $2,481 | $70,900 | $28,190 | $42,710 |

Source: Public Records

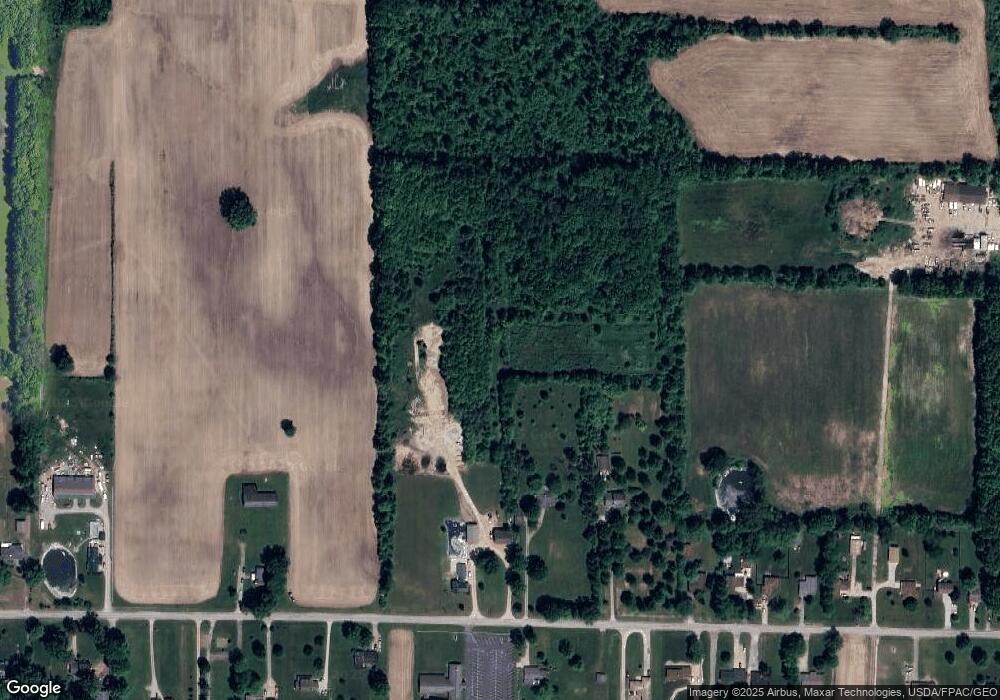

Map

Nearby Homes

- 37340 Capel Rd

- 35293 Elm Rd

- V/L Capel Rd

- 11855 Avon Belden Rd

- 12159 Alton Dr

- Grand Cayman w/ Finished Basement Plan at Eaton Crossing

- Eden Cay w/ Finished Basement Plan at Eaton Crossing

- Grand Bahama w/ Finished Basement Plan at Eaton Crossing

- Aruba Bay W/ Covered Porch Plan at Eaton Crossing

- 1041 Plymouth Dr

- 1077 Yarmouth Rd

- 11950 Castleton Ln

- 1099 Huntsman Ct

- 1013 N Willow St

- 1129 Fox Run

- 694 Erie St

- 551 N Main St

- 1166 Hunting Hollow

- 697 Main St

- 1167 Fox Run