365 Shoemaker Ln Unit 79 Solana Beach, CA 92075

Estimated Value: $1,470,000 - $1,601,000

2

Beds

3

Baths

1,304

Sq Ft

$1,184/Sq Ft

Est. Value

About This Home

This home is located at 365 Shoemaker Ln Unit 79, Solana Beach, CA 92075 and is currently estimated at $1,543,333, approximately $1,183 per square foot. 365 Shoemaker Ln Unit 79 is a home located in San Diego County with nearby schools including Skyline Elementary School, Solana Vista Elementary School, and Earl Warren Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 12, 2022

Sold by

Elaine Cherry

Bought by

Hanley Family Trust

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$650,000

Outstanding Balance

$617,761

Interest Rate

5.3%

Mortgage Type

New Conventional

Estimated Equity

$925,572

Purchase Details

Closed on

Dec 22, 1998

Sold by

Kroesch Mark

Bought by

Cherry Elaine

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$240,000

Interest Rate

6.73%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Jan 11, 1994

Sold by

Tennenhouse Leonard W and Armstrong Nancy

Bought by

Kroesch Mark D

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$196,800

Interest Rate

7.29%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Dec 30, 1985

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Hanley Family Trust | $1,300,000 | Lawyers Title | |

| Cherry Elaine | $305,000 | Southland Title Company | |

| Kroesch Mark D | -- | First American Title Co | |

| -- | $155,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Hanley Family Trust | $650,000 | |

| Previous Owner | Cherry Elaine | $240,000 | |

| Previous Owner | Kroesch Mark D | $196,800 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $14,781 | $1,379,560 | $1,061,200 | $318,360 |

| 2024 | $14,781 | $1,327,000 | $1,020,000 | $307,000 |

| 2023 | $13,732 | $1,231,000 | $946,000 | $285,000 |

| 2022 | $5,554 | $450,553 | $261,616 | $188,937 |

| 2021 | $5,467 | $441,720 | $256,487 | $185,233 |

| 2020 | $5,426 | $437,192 | $253,858 | $183,334 |

| 2019 | $5,334 | $428,621 | $248,881 | $179,740 |

| 2018 | $5,230 | $420,217 | $244,001 | $176,216 |

| 2017 | $180 | $411,978 | $239,217 | $172,761 |

| 2016 | $4,781 | $403,901 | $234,527 | $169,374 |

| 2015 | $4,704 | $397,835 | $231,005 | $166,830 |

| 2014 | $4,605 | $390,043 | $226,480 | $163,563 |

Source: Public Records

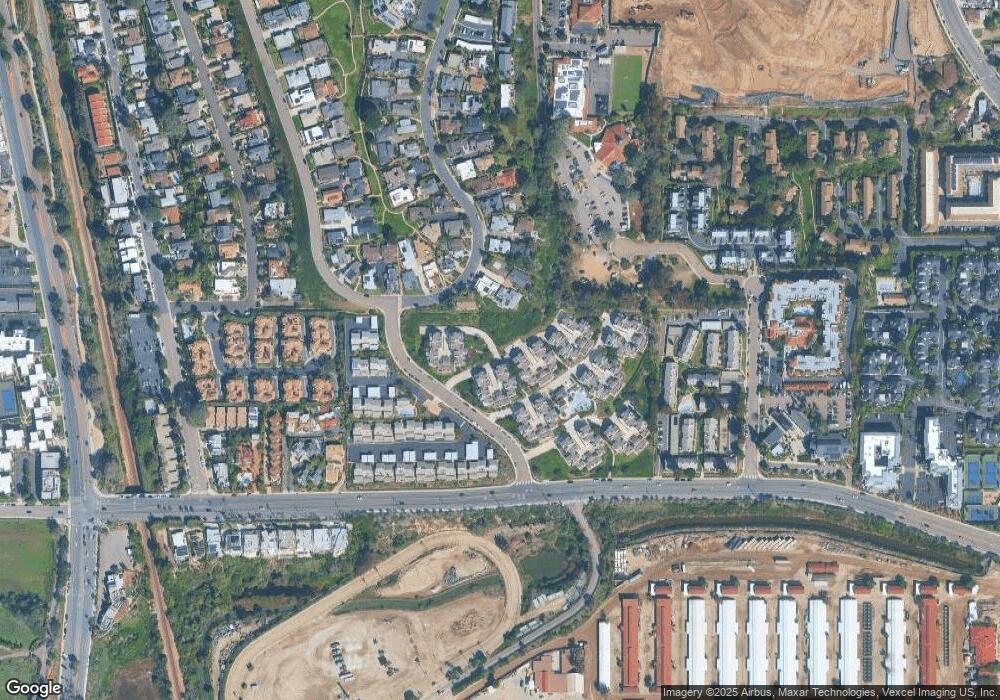

Map

Nearby Homes

- 234 Turf View Dr

- 773 E Solana Cir

- 876 Cofair Ct

- 121 Via de la Valle

- 834 S Cedros Ave

- 542 Via de la Valle Unit J

- 747 S Cedros Ave

- 524 Via de La Valla H

- 521 S Rios Ave

- 929 Border Ave

- 501 S Rios Ave

- 818 Viva Ct

- 190 Del Mar Shores Terrace Unit 69

- 701 Valley Ave

- 515 S Sierra Ave Unit 119

- 429 S Sierra Ave Unit 328

- 429 S Sierra Ave Unit 151

- 441 S Sierra Ave Unit 208

- 3000 Sandy Ln

- 2921 Sandy Pointe Unit 3

- 309 Shoemaker Ln Unit 63

- 307 Shoemaker Ln

- 342 Shoemaker Ct

- 338 Shoemaker Ct

- 336 Shoemaker Ct

- 334 Shoemaker Ct Unit 56

- 332 Shoemaker Ct

- 324 Shoemaker Ct

- 363 Shoemaker Ln

- 359 Shoemaker Ln

- 355 Shoemaker Ln

- 353 Shoemaker Ln

- 349 Shoemaker Ln

- 323 Shoemaker Ln

- 317 Shoemaker Ln Unit 67

- 313 Shoemaker Ln

- 339 Shoemaker Ln

- 335 Shoemaker Ln

- 333 Shoemaker Ln

- 315 Shoemaker Ln