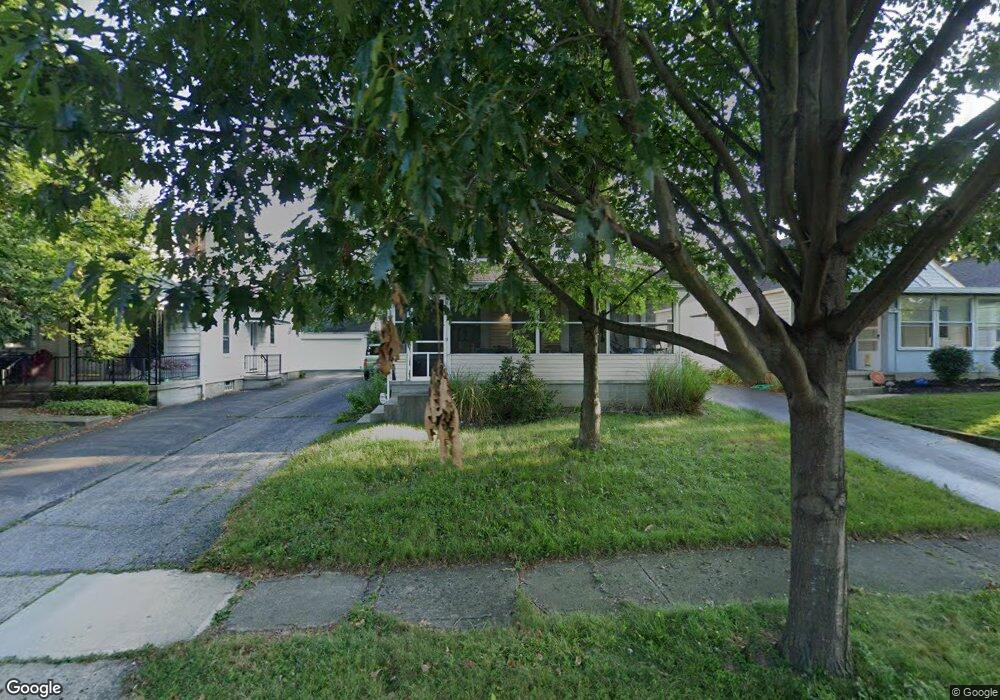

368 E Royal Forest Blvd Columbus, OH 43214

Clintonville NeighborhoodEstimated Value: $360,000 - $445,000

3

Beds

2

Baths

1,704

Sq Ft

$238/Sq Ft

Est. Value

About This Home

This home is located at 368 E Royal Forest Blvd, Columbus, OH 43214 and is currently estimated at $404,738, approximately $237 per square foot. 368 E Royal Forest Blvd is a home located in Franklin County with nearby schools including Indian Springs Elementary School, Dominion Middle School, and Whetstone High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 7, 2009

Sold by

Jones Melanie L

Bought by

Prospal Jeffrey R

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$144,434

Outstanding Balance

$94,890

Interest Rate

5.36%

Mortgage Type

FHA

Estimated Equity

$309,848

Purchase Details

Closed on

Jun 14, 2002

Sold by

Fox Karl F and Fox Beverly A

Bought by

Prospal Jeffrey R and Jones Melanie L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$138,700

Interest Rate

6.93%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Oct 5, 2000

Sold by

Bauer Stephen and Bauer Marilyn

Bought by

Fox Karl F and Fox Beverly A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$108,000

Interest Rate

7.99%

Purchase Details

Closed on

Nov 15, 1993

Bought by

Bauer Stephen and Bauer Marilyn

Purchase Details

Closed on

Jun 15, 1989

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Prospal Jeffrey R | -- | Attorney | |

| Prospal Jeffrey R | $143,000 | -- | |

| Fox Karl F | $135,000 | Lawyers Title | |

| Bauer Stephen | $88,200 | -- | |

| -- | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Prospal Jeffrey R | $144,434 | |

| Previous Owner | Prospal Jeffrey R | $138,700 | |

| Previous Owner | Fox Karl F | $108,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $5,405 | $120,440 | $41,300 | $79,140 |

| 2023 | $5,336 | $120,435 | $41,300 | $79,135 |

| 2022 | $4,831 | $93,140 | $25,030 | $68,110 |

| 2021 | $4,839 | $93,140 | $25,030 | $68,110 |

| 2020 | $4,846 | $93,140 | $25,030 | $68,110 |

| 2019 | $4,276 | $70,490 | $19,250 | $51,240 |

| 2018 | $3,948 | $70,490 | $19,250 | $51,240 |

| 2017 | $4,135 | $70,490 | $19,250 | $51,240 |

| 2016 | $3,997 | $60,340 | $16,100 | $44,240 |

| 2015 | $3,628 | $60,340 | $16,100 | $44,240 |

| 2014 | $3,637 | $60,340 | $16,100 | $44,240 |

| 2013 | $1,709 | $57,470 | $15,330 | $42,140 |

Source: Public Records

Map

Nearby Homes

- 381 E Jeffrey Place

- 420 E Beechwold Blvd

- 518 E Royal Forest Blvd

- 522 E Beechwold Blvd

- 597 Morse Rd

- 601 Morse Rd

- 411 Garden Rd

- 255 Garden Rd

- 156 E Weisheimer Rd

- 4 W Royal Forest Blvd

- 4299 Colerain Ave

- 116 Rathbone Ave

- 125 Sheffield Rd

- 4193 Eastlea Dr

- 202 Rathbone Ave

- 197 E Cooke Rd

- 87 Charleston Ave

- 49 W Henderson Rd

- 814 Meadowview Dr

- 4464 Zeller Rd

- 366 E Royal Forest Blvd

- 376 E Royal Forest Blvd

- 382 E Royal Forest Blvd

- 360 E Royal Forest Blvd

- 388 E Royal Forest Blvd

- 352 E Royal Forest Blvd

- 371 E Jeffrey Place

- 375 E Jeffrey Place

- 365 E Jeffrey Place

- 392 E Royal Forest Blvd

- 359 E Jeffrey Place

- 371 E Royal Forest Blvd

- 355 E Jeffrey Place

- 365 E Royal Forest Blvd

- 387 E Jeffrey Place

- 375 E Royal Forest Blvd

- 344 E Royal Forest Blvd

- 398 E Royal Forest Blvd

- 381 E Royal Forest Blvd

- 391 E Jeffrey Place