3685 Nutwood Terrace Unit 114 Fremont, CA 94536

Centerville District NeighborhoodEstimated Value: $479,000 - $625,000

1

Bed

1

Bath

936

Sq Ft

$561/Sq Ft

Est. Value

About This Home

This home is located at 3685 Nutwood Terrace Unit 114, Fremont, CA 94536 and is currently estimated at $525,264, approximately $561 per square foot. 3685 Nutwood Terrace Unit 114 is a home located in Alameda County with nearby schools including Oliveira Elementary School, Thornton Middle School, and American High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 19, 2005

Sold by

Valenzuela John and Sutton Joanne

Bought by

Hernandez Hector A and Condio Hernandez Susan L

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$312,000

Outstanding Balance

$161,181

Interest Rate

5.5%

Mortgage Type

Stand Alone First

Estimated Equity

$364,083

Purchase Details

Closed on

Aug 15, 2002

Sold by

Sutton Joanne

Bought by

Valenzuela John and Sutton Joanne

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$111,000

Interest Rate

6.29%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Nov 24, 1997

Sold by

Fuller Daniel C and Fuller Delinda A

Bought by

Sutton Joanne

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$86,800

Interest Rate

7.33%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Hernandez Hector A | $390,000 | California Title Company Of | |

| Valenzuela John | -- | First American Title Co | |

| Sutton Joanne | $124,000 | First American Title Guarant |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Hernandez Hector A | $312,000 | |

| Previous Owner | Valenzuela John | $111,000 | |

| Previous Owner | Sutton Joanne | $86,800 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $6,479 | $525,918 | $159,875 | $373,043 |

| 2024 | $6,479 | $515,470 | $156,741 | $365,729 |

| 2023 | $6,297 | $512,228 | $153,668 | $358,560 |

| 2022 | $6,278 | $495,187 | $150,656 | $351,531 |

| 2021 | $6,131 | $485,343 | $147,703 | $344,640 |

| 2020 | $6,109 | $487,297 | $146,189 | $341,108 |

| 2019 | $6,039 | $477,745 | $143,323 | $334,422 |

| 2018 | $5,919 | $468,381 | $140,514 | $327,867 |

| 2017 | $5,771 | $459,201 | $137,760 | $321,441 |

| 2016 | $5,312 | $420,000 | $126,000 | $294,000 |

| 2015 | $4,720 | $370,000 | $111,000 | $259,000 |

| 2014 | $4,148 | $321,000 | $96,300 | $224,700 |

Source: Public Records

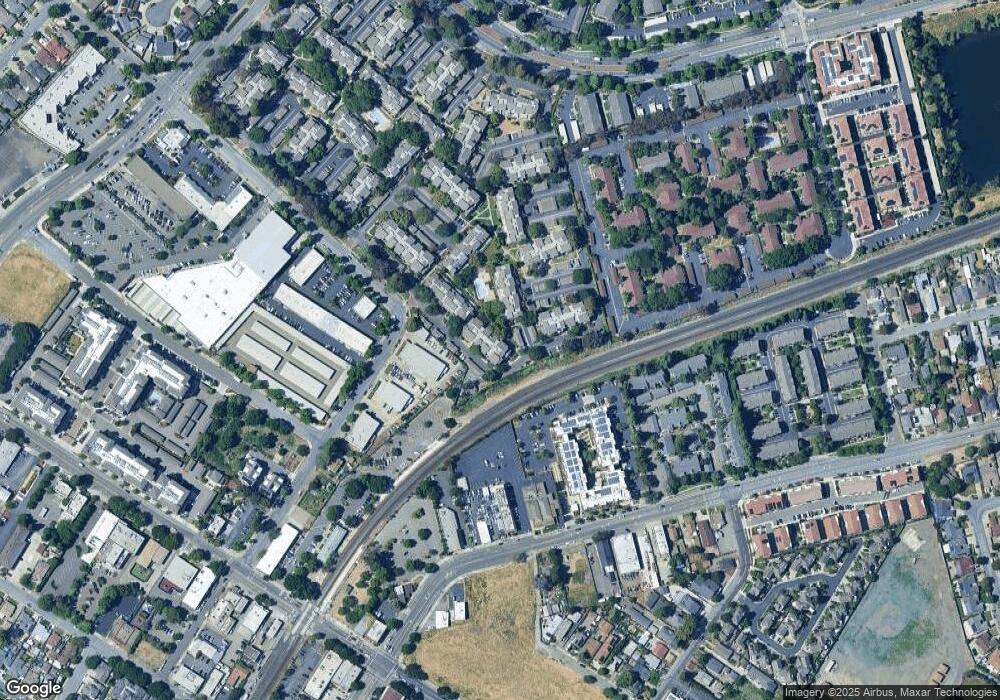

Map

Nearby Homes

- 3507 Buttonwood Terrace Unit 203

- 3530 Oakwood Terrace Unit 102

- 3663 Oakwood Terrace Unit 211

- 3300 Red Cedar Terrace Unit LU25

- 3371 Baywood Terrace Unit 214

- Plan 1629 at Veranda

- Plan 1165 at Veranda

- Plan 1670 at Veranda

- Plan 1455 at Veranda

- Plan 1394 at Veranda

- Plan 1725 at Veranda

- Plan 1378 at Veranda

- Plan 1657 at Veranda

- 37637 Canterbury St

- 3751 Ruskin Place

- 38030 Dundee Common

- 3810 Burton Common

- 3833 Burton Common

- 37993 Ponderosa Terrace

- 37001 Contra Costa Ave

- 3685 Nutwood Terrace Unit 314

- 3685 Nutwood Terrace Unit 113

- 3685 Nutwood Terrace Unit 112

- 3685 Nutwood Terrace Unit 111

- 3685 Nutwood Terrace Unit 313

- 3685 Nutwood Terrace Unit 312

- 3685 Nutwood Terrace Unit 311

- 3685 Nutwood Terrace Unit 214

- 3685 Nutwood Terrace Unit 213

- 3685 Nutwood Terrace Unit 212

- 3685 Nutwood Terrace Unit 211

- 37248 Meadowbrook Common

- 37248 Meadowbrook Common Unit 104

- 37248 Meadowbrook Common Unit 103

- 37248 Meadowbrook Common Unit 102

- 37248 Meadowbrook Common Unit 101

- 37248 Meadowbrook Common Unit 304

- 37248 Meadowbrook Common Unit 303

- 37248 Meadowbrook Common Unit 302

- 37248 Meadowbrook Common Unit 301