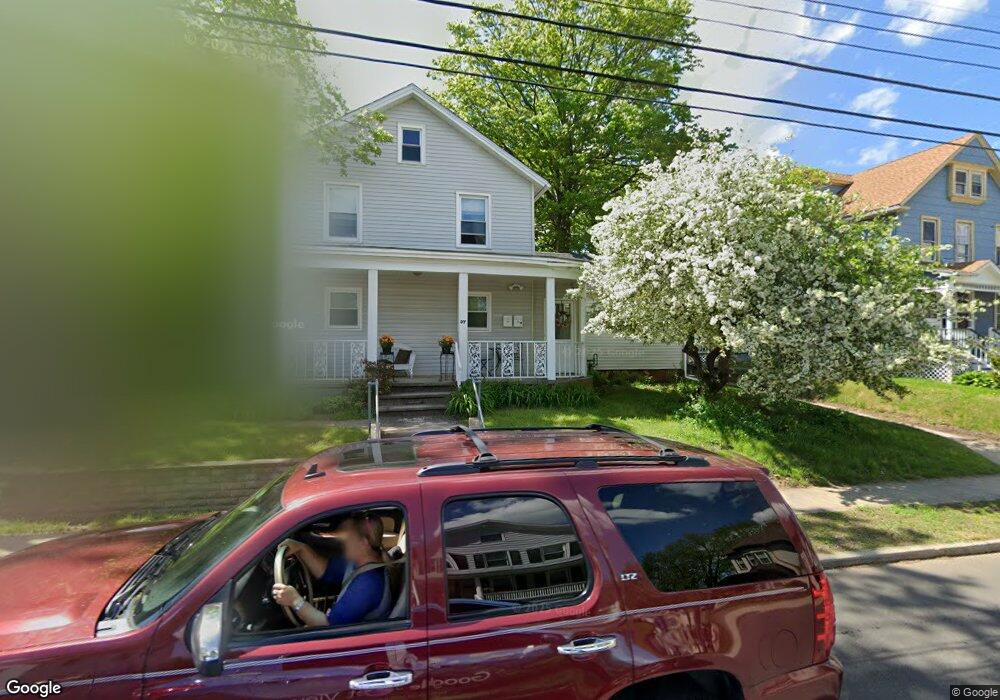

37-39 N Third Meriden, CT 06451

Estimated Value: $275,000 - $339,000

4

Beds

2

Baths

1,789

Sq Ft

$174/Sq Ft

Est. Value

About This Home

This home is located at 37-39 N Third, Meriden, CT 06451 and is currently estimated at $310,425, approximately $173 per square foot. 37-39 N Third is a home located in New Haven County with nearby schools including John Barry School, Lincoln Middle School, and Orville H. Platt High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 14, 2013

Sold by

Kwok Chun

Bought by

Zygmont Katherine L

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$140,389

Outstanding Balance

$96,153

Interest Rate

2.75%

Mortgage Type

FHA

Estimated Equity

$214,272

Purchase Details

Closed on

Dec 4, 2008

Sold by

Deutsche Bank Natl T C

Bought by

Kwok Chun

Purchase Details

Closed on

Sep 7, 2005

Sold by

Rahman Mujib U

Bought by

Javed Jemina E

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$109,600

Interest Rate

6.54%

Purchase Details

Closed on

Nov 18, 2004

Sold by

Rossi Joseph J

Bought by

Rahamn Mujib U

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Zygmont Katherine L | $143,000 | -- | |

| Kwok Chun | $48,000 | -- | |

| Javed Jemina E | $137,000 | -- | |

| Rahamn Mujib U | $92,130 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Rahamn Mujib U | $140,389 | |

| Closed | Rahamn Mujib U | $11,700 | |

| Previous Owner | Rahamn Mujib U | $109,600 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,519 | $119,210 | $38,360 | $80,850 |

| 2024 | $4,591 | $119,210 | $38,360 | $80,850 |

| 2023 | $4,425 | $119,210 | $38,360 | $80,850 |

| 2022 | $4,175 | $119,210 | $38,360 | $80,850 |

| 2021 | $3,757 | $86,310 | $32,830 | $53,480 |

| 2020 | $3,747 | $86,310 | $32,830 | $53,480 |

| 2019 | $3,715 | $86,310 | $32,830 | $53,480 |

| 2018 | $3,729 | $86,310 | $32,830 | $53,480 |

| 2017 | $3,630 | $86,310 | $32,830 | $53,480 |

| 2016 | $3,319 | $85,610 | $31,150 | $54,460 |

| 2015 | $3,319 | $85,610 | $31,150 | $54,460 |

| 2014 | $3,239 | $85,610 | $31,150 | $54,460 |

Source: Public Records

Map

Nearby Homes

- 44 4th St

- 236 W Main St

- 54 North Ave

- 230 W Main St

- 23 N 1st St

- 56 N First St

- 60 Capitol Ave

- 66 S 3rd St

- 124 Windsor Ave

- 55 Lewis Ave

- 86 Linsley Ave

- 61 Randolph Ave

- 179 Winthrop Terrace

- 185 Springdale Ave

- 74 Randolph Ave

- 68 Reservoir Ave

- 70 Andrews St Unit 3

- 127 Lambert Ave

- 49 Prospect St

- 16 Park Place