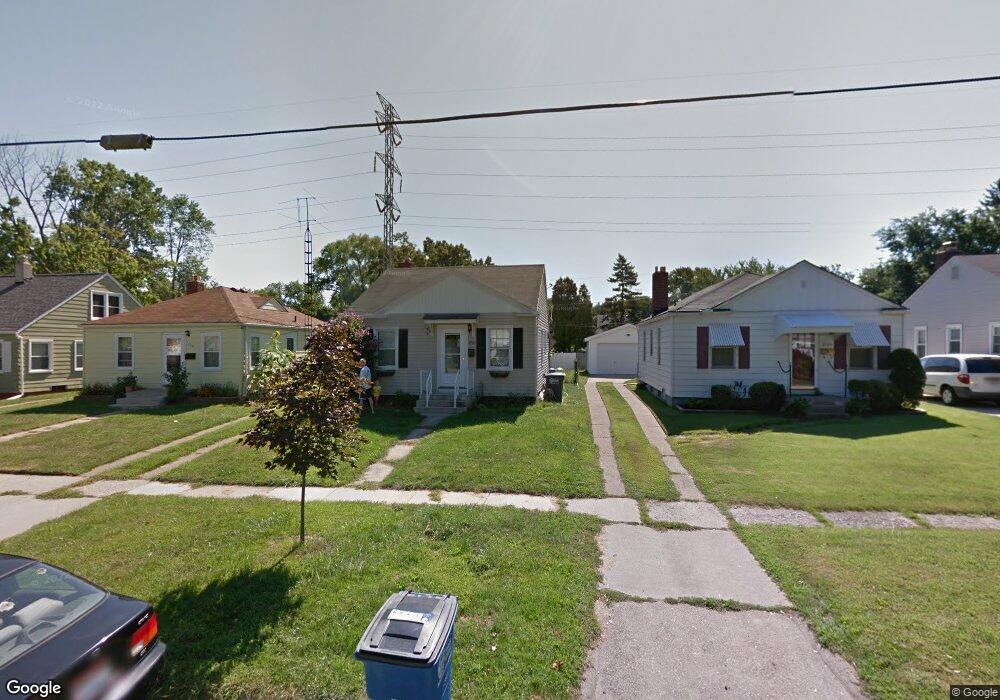

3710 Bellevue Rd Toledo, OH 43613

DeVeaux NeighborhoodEstimated Value: $87,750 - $137,000

2

Beds

1

Bath

720

Sq Ft

$163/Sq Ft

Est. Value

About This Home

This home is located at 3710 Bellevue Rd, Toledo, OH 43613 and is currently estimated at $117,688, approximately $163 per square foot. 3710 Bellevue Rd is a home located in Lucas County with nearby schools including DeVeaux Elementary School, Start High School, and Horizon Science Academy - Toledo High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 6, 2018

Sold by

Cook Nicholas and Cook Kelly

Bought by

Stearns William G

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$70,695

Outstanding Balance

$63,014

Interest Rate

5.5%

Mortgage Type

FHA

Estimated Equity

$54,674

Purchase Details

Closed on

Nov 15, 2007

Sold by

Shirk Randy R and Shirk Jody L

Bought by

Cook Nicholas and Cook Kelly

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$81,500

Interest Rate

6.45%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Jun 8, 2005

Sold by

Lundquist Alvina and Lundquist Alvina E

Bought by

Shirk Randy R and Shirk Jody L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$66,821

Interest Rate

5.91%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Stearns William G | $72,000 | None Available | |

| Cook Nicholas | $82,000 | None Available | |

| Shirk Randy R | $66,900 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Stearns William G | $70,695 | |

| Previous Owner | Cook Nicholas | $81,500 | |

| Previous Owner | Shirk Randy R | $66,821 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $444 | $23,030 | $6,895 | $16,135 |

| 2023 | $797 | $20,440 | $6,510 | $13,930 |

| 2022 | $823 | $20,440 | $6,510 | $13,930 |

| 2021 | $835 | $20,440 | $6,510 | $13,930 |

| 2020 | $879 | $19,530 | $4,655 | $14,875 |

| 2019 | $1,435 | $19,530 | $4,655 | $14,875 |

| 2018 | $1,437 | $19,530 | $4,655 | $14,875 |

| 2017 | $1,473 | $19,075 | $4,550 | $14,525 |

| 2016 | $1,472 | $54,500 | $13,000 | $41,500 |

| 2015 | $1,458 | $54,500 | $13,000 | $41,500 |

| 2014 | $1,200 | $19,080 | $4,550 | $14,530 |

| 2013 | $1,200 | $19,080 | $4,550 | $14,530 |

Source: Public Records

Map

Nearby Homes

- 3656 Bellevue Rd

- 3621 Sherbrooke Rd

- 2220 Beaufort Ave

- 3560 Bellevue Rd

- 3715 Shelbourne Ave

- 2146 Marlow Rd

- 3540 Kershaw Ave

- 2106 Fairfax Rd

- 2426 Berdan Ave

- 2050 Berdan Ave

- 2056 Fairfax Rd

- 2433 Georgetown Ave

- 2040 Fairfax Rd

- 2035 Barrows St

- 2045 Fairfax Rd

- 2022 Berdan Ave

- 2012 Berdan Ave

- 2447 Portsmouth Ave

- 3306 Saint Bernard Dr

- 3251 Northwood Ave

- 3714 Bellevue Rd

- 3706 Bellevue Rd

- 3702 Bellevue Rd

- 3718 Bellevue Rd

- 3664 Bellevue Rd

- 3722 Bellevue Rd

- 3660 Bellevue Rd

- 3726 Bellevue Rd

- 3705 Bellevue Rd

- 3711 Bellevue Rd

- 3711 Sherbrooke Rd

- 3719 Bellevue Rd

- 3730 Bellevue Rd

- 3701 Sherbrooke Rd

- 3719 Sherbrooke Rd

- 3725 Bellevue Rd

- 3700 Roanoke Rd

- 3721 Sherbrooke Rd

- 3652 Bellevue Rd

- 3727 Sherbrooke Rd