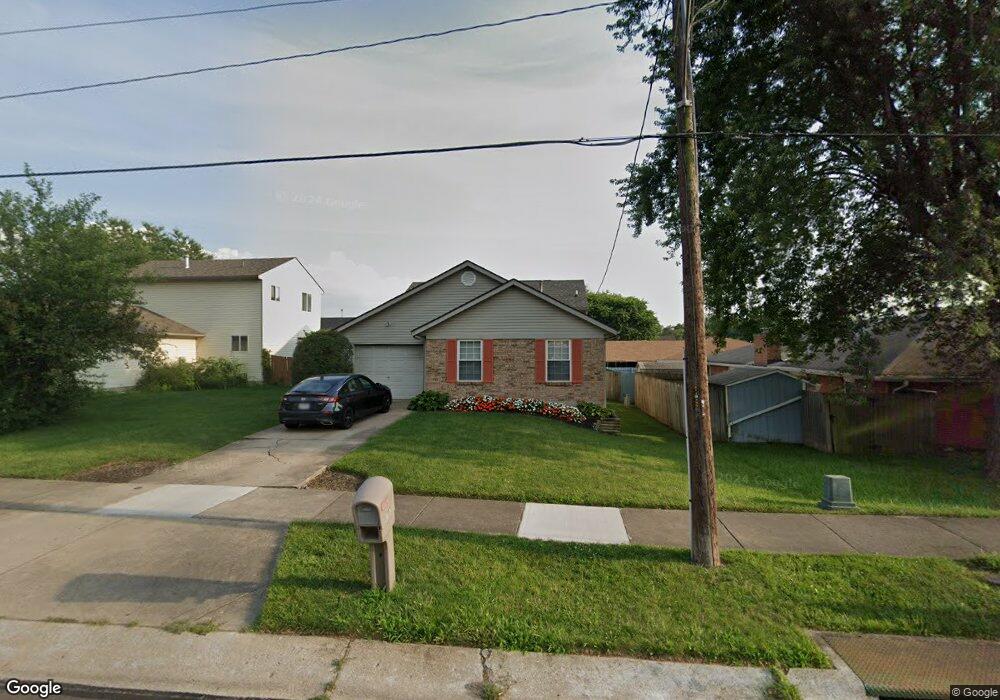

3710 Long Ln Middletown, OH 45044

Greenfields NeighborhoodEstimated Value: $217,000 - $261,000

3

Beds

2

Baths

1,260

Sq Ft

$189/Sq Ft

Est. Value

About This Home

This home is located at 3710 Long Ln, Middletown, OH 45044 and is currently estimated at $238,161, approximately $189 per square foot. 3710 Long Ln is a home located in Butler County with nearby schools including Mayfield Elementary School, Highview 6th Grade Center, and Middletown Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 24, 2006

Sold by

Senften Charles A and Senften Tracey R

Bought by

Gibson Jeffrey S and Cox Kelli A

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$119,262

Outstanding Balance

$70,379

Interest Rate

6.83%

Mortgage Type

FHA

Estimated Equity

$167,782

Purchase Details

Closed on

Jul 26, 2004

Sold by

Senften Charles A and Senften Tracey R

Bought by

Gibson Jeffrey Scott

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$115,000

Interest Rate

8.21%

Mortgage Type

Seller Take Back

Purchase Details

Closed on

Apr 30, 2001

Sold by

Puhala Kevin M and Puhala Regina K

Bought by

Martini Tracey R and Senften Charles A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$112,106

Interest Rate

6.95%

Mortgage Type

FHA

Purchase Details

Closed on

Mar 1, 1993

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Gibson Jeffrey S | $120,200 | None Available | |

| Gibson Jeffrey Scott | $120,000 | -- | |

| Martini Tracey R | $113,000 | -- | |

| -- | $80,200 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Gibson Jeffrey S | $119,262 | |

| Closed | Gibson Jeffrey Scott | $115,000 | |

| Closed | Martini Tracey R | $112,106 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,086 | $59,740 | $5,880 | $53,860 |

| 2024 | $3,086 | $59,740 | $5,880 | $53,860 |

| 2023 | $3,067 | $57,720 | $5,880 | $51,840 |

| 2022 | $2,369 | $40,770 | $5,880 | $34,890 |

| 2021 | $2,279 | $40,770 | $5,880 | $34,890 |

| 2020 | $2,374 | $40,770 | $5,880 | $34,890 |

| 2019 | $2,392 | $33,000 | $6,830 | $26,170 |

| 2018 | $2,082 | $33,000 | $6,830 | $26,170 |

| 2017 | $2,086 | $33,000 | $6,830 | $26,170 |

| 2016 | $2,177 | $33,000 | $6,830 | $26,170 |

| 2015 | $2,146 | $33,000 | $6,830 | $26,170 |

| 2014 | $1,863 | $33,000 | $6,830 | $26,170 |

| 2013 | $1,863 | $31,200 | $6,830 | $24,370 |

Source: Public Records

Map

Nearby Homes

- 2029 Waynedale Ct

- 3611 Greenwood Dr

- 1619 Carriage St

- 1619 Carriage Dr

- 2128 Lamberton St

- 4205 Helton Dr

- 4204 Roosevelt Blvd

- 2014 S Breiel Blvd Unit 2014

- 2120 Fernwood St

- 2105 Winton St

- 3220 Barbara Dr

- 1932 Winton St

- 3200 Lefferson Rd

- 1318 S Breiel Blvd

- 3218 Keays Ave

- 1913 Brentwood St

- 1700 Johns Rd

- 1508 Johns Rd

- 602 Ross St

- 4524 Shawnray Dr Unit 21

- 1900 Monarch Dr

- 1928 Circle Kelly Jo

- 1930 Circle Kelly Jo

- 1902 Monarch Dr

- 1926 Circle Kelly Jo

- 1904 Monarch Dr

- 1929 Circle Kelly Jo

- 1931 Circle Kelly Jo

- 1924 Circle Kelly Jo

- 3700 Burbank Ave

- 1927 Circle Kelly Jo

- 1906 Monarch Dr

- 1901 Monarch Dr

- 3708 Burbank Ave

- 1925 Circle Kelly Jo

- 1908 Monarch Dr

- 3710 Burbank Ave

- 1903 Monarch Dr

- 1922 Circle Kelly Jo

- 1920 Circle Kelly Jo