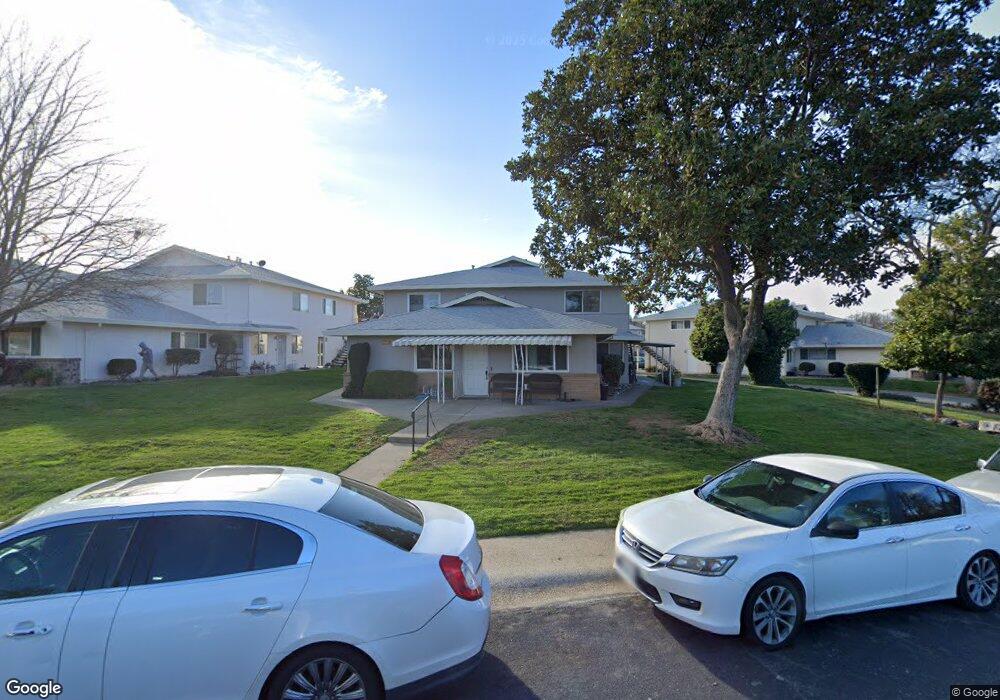

3713 Park Dr Unit 2 Auburn, CA 95602

Northwest Auburn NeighborhoodEstimated Value: $90,000 - $221,891

2

Beds

1

Bath

922

Sq Ft

$195/Sq Ft

Est. Value

About This Home

This home is located at 3713 Park Dr Unit 2, Auburn, CA 95602 and is currently estimated at $179,473, approximately $194 per square foot. 3713 Park Dr Unit 2 is a home located in Placer County with nearby schools including Placer High School, EV Cain Middle, and St. Joseph Catholic School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 11, 2016

Sold by

Pfeffer George and Pfeffer George

Bought by

Tydeman Trust and Tydeman Ellen F

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$70,000

Outstanding Balance

$55,857

Interest Rate

3.98%

Mortgage Type

Seller Take Back

Estimated Equity

$123,616

Purchase Details

Closed on

Aug 9, 2004

Sold by

Pfeffer George and Pfeffer Cozette C

Bought by

The George & Cozette Family Trust and Pfeffer Cozette C

Purchase Details

Closed on

May 22, 2002

Sold by

Calori Katherine J and Katherine J Calori Living Trus

Bought by

Pfeffer George and Pfeffer Cozette C

Purchase Details

Closed on

Jun 7, 1994

Sold by

Brown James E and Brown Janet M

Bought by

Calori Katherine J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$39,500

Interest Rate

8.35%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Tydeman Trust | $70,000 | None Available | |

| The George & Cozette Family Trust | $3,636 | None Available | |

| Pfeffer George | $89,000 | North American Title Co | |

| Calori Katherine J | $43,500 | Placer Title Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Tydeman Trust | $70,000 | |

| Previous Owner | Calori Katherine J | $39,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,861 | $82,859 | $29,591 | $53,268 |

| 2023 | $1,861 | $79,643 | $28,443 | $51,200 |

| 2022 | $1,728 | $78,083 | $27,886 | $50,197 |

| 2021 | $1,697 | $76,553 | $27,340 | $49,213 |

| 2020 | $1,691 | $75,769 | $27,060 | $48,709 |

| 2019 | $1,676 | $74,284 | $26,530 | $47,754 |

| 2018 | $1,633 | $72,828 | $26,010 | $46,818 |

| 2017 | $1,619 | $71,400 | $25,500 | $45,900 |

| 2016 | $1,685 | $78,000 | $31,600 | $46,400 |

| 2015 | $1,586 | $76,000 | $30,700 | $45,300 |

| 2014 | $1,588 | $76,000 | $30,700 | $45,300 |

Source: Public Records

Map

Nearby Homes

- 3677 Galena Dr Unit 3

- 11632 Quartz Dr Unit 4

- 11582 Quartz Dr Unit 3

- 3643 Galena Dr Unit 4

- 11521 Garnet Way Unit 2

- 11670 Garnet Way Unit 4

- 3765 Grass Valley Hwy Unit 282

- 3765 Grass Valley Hwy Unit 263

- 3765 Grass Valley Hwy Unit 14

- 3765 Grass Valley Hwy Unit 117

- 3765 Grass Valley Hwy Unit 226

- 11510 Garnet Way Unit 4

- 3277 Professional Dr

- 3222 Fortune Ct

- 11325 Tahoe St

- 11441 White Doe Ct

- 0 Bell Rd Unit 225114567

- 11614 Sherwood Way

- 3620 Rancho Sierra Rd

- 2059 Bell Rd

- 3713 Park Dr

- 3713 Park Dr

- 3713 Park Dr

- 3713 Park Dr Unit 3

- 22443 Alexis Drive Lot 52

- 3723 Park Dr Unit 1

- 3723 Park Dr Unit 2

- 3723 Park Dr Unit 4

- 3723 Park Dr Unit 3

- 3723 Park Dr

- 3723 Park Dr

- 3723 Park Dr

- 3723 Park Dr

- 3723 Park Dr

- 3733 Park Dr Unit 3

- 3733 Park Dr

- 3733 Park Dr

- 3733 Park Dr Unit 1

- 3733 Park Dr Unit 4

- 3703 Park Dr Unit 4