3714 Fallon Cir San Diego, CA 92130

Carmel Valley NeighborhoodEstimated Value: $1,046,000 - $1,384,000

3

Beds

3

Baths

1,602

Sq Ft

$759/Sq Ft

Est. Value

About This Home

This home is located at 3714 Fallon Cir, San Diego, CA 92130 and is currently estimated at $1,215,710, approximately $758 per square foot. 3714 Fallon Cir is a home located in San Diego County with nearby schools including Solana Highlands Elementary School, Carmel Valley Middle School, and Torrey Pines High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 8, 2016

Sold by

Doak Jeffery M and Doak Dana L

Bought by

Motsenbocker Deanne Love

Current Estimated Value

Purchase Details

Closed on

Jan 27, 2016

Sold by

Doak Nancy

Bought by

Doak Jeffery M

Purchase Details

Closed on

Jan 21, 2016

Sold by

Hc Steely Llc

Bought by

Doak Jeffrey M and Doak Dana L

Purchase Details

Closed on

Jan 19, 2016

Sold by

Doak Susan

Bought by

Doak Dana L

Purchase Details

Closed on

Feb 18, 2010

Sold by

H C Steely Limited Partnership

Bought by

H C Steely Llc

Purchase Details

Closed on

May 12, 1997

Sold by

Trust Steely Helene C Revocable Residuary and Steely Helene C

Bought by

H C Steely Ltd Partnership

Purchase Details

Closed on

Dec 1, 1993

Sold by

Allan Gloria Clark

Bought by

Steely Helene C

Purchase Details

Closed on

Oct 30, 1987

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Motsenbocker Deanne Love | $370,000 | First American Title Company | |

| Doak Jeffery M | -- | First American Title | |

| Doak Jeffrey M | -- | First American Title | |

| Doak Dana L | -- | First American Title | |

| H C Steely Llc | -- | None Available | |

| H C Steely Ltd Partnership | -- | -- | |

| Steely Helene C | $218,000 | Fidelity National Title | |

| -- | $171,500 | -- |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $7,979 | $761,397 | $399,312 | $362,085 |

| 2024 | $7,979 | $746,469 | $391,483 | $354,986 |

| 2023 | $7,802 | $731,833 | $383,807 | $348,026 |

| 2022 | $7,674 | $717,484 | $376,282 | $341,202 |

| 2021 | $7,539 | $703,416 | $368,904 | $334,512 |

| 2020 | $7,473 | $696,204 | $365,122 | $331,082 |

| 2019 | $7,328 | $682,554 | $357,963 | $324,591 |

| 2018 | $7,188 | $669,172 | $350,945 | $318,227 |

| 2017 | $81 | $656,052 | $344,064 | $311,988 |

| 2016 | $3,292 | $311,549 | $109,309 | $202,240 |

| 2015 | $3,244 | $306,871 | $107,668 | $199,203 |

| 2014 | $3,179 | $300,860 | $105,559 | $195,301 |

Source: Public Records

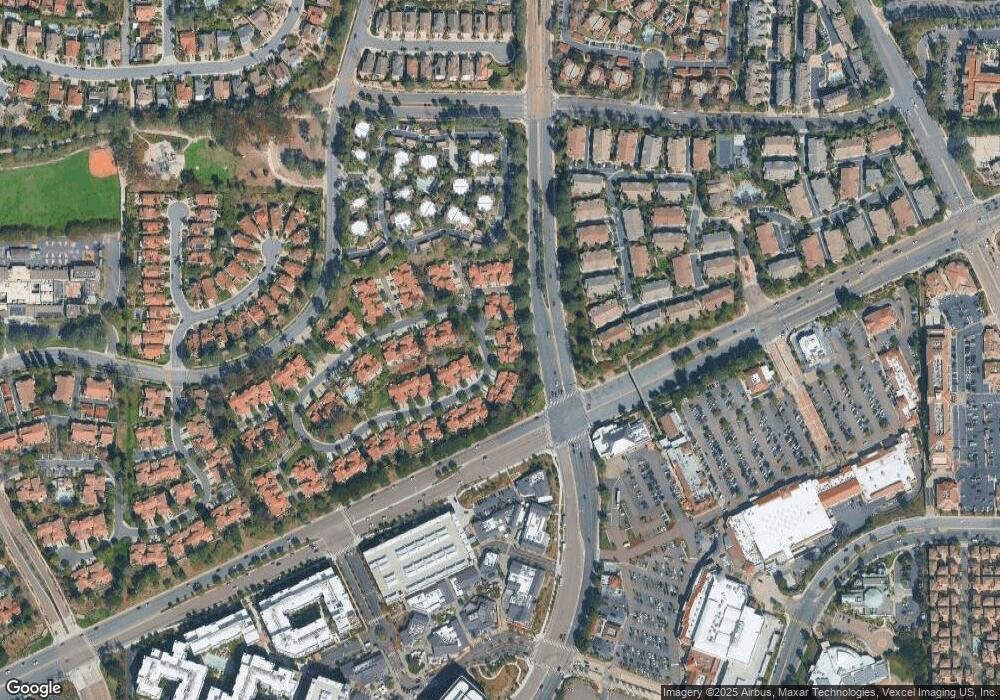

Map

Nearby Homes

- 3694 Fallon Cir

- 12654 Carmel Country Rd Unit 91

- 13398 Tiverton Rd

- 3877 Pell Place Unit 108

- 3510 Voyager Cir Unit 67

- 3720 Mykonos Ln Unit 155

- 12364 Carmel Country Rd Unit C306

- 3965 Via Holgura

- 12368 Carmel Country Rd Unit 303

- 13404 Kibbings Rd

- 4035 Carmel View Rd Unit 114

- 12372 Carmel Country Rd Unit 202

- 12372 Carmel Country Rd Unit 207

- 4049 Carmel View Rd Unit 75

- 3537 Caminito el Rincon Unit 259

- 4029 Carmel View Rd Unit 142

- 13742 Ruette le Parc Unit C

- 2582 Del Mar Heights Rd Unit 17

- 13754 Mango Dr Unit 111

- 4436 Heritage Glen Ln

- 3720 Fallon Cir

- 3708 Fallon Cir

- 3702 Fallon Cir Unit 72

- 3726 Fallon Cir

- 3732 Fallon Cir

- 3749 Fallon Cir

- 3738 Fallon Cir

- 3738 Fallon Cir

- 3755 Fallon Cir

- 3744 Fallon Cir

- 3688 Fallon Cir

- 3761 Fallon Cir

- 3750 Fallon Cir

- 3643 Fallon Cir

- 3767 Fallon Cir

- 3756 Fallon Cir

- 3639 Fallon Cir

- 3631 Fallon Cir

- 3762 Fallon Cir

- 3674 Fallon Cir Unit 77