3717 Cibola Ct Chino Hills, CA 91709

South Chino Hills NeighborhoodEstimated Value: $921,811 - $1,020,000

4

Beds

2

Baths

2,079

Sq Ft

$472/Sq Ft

Est. Value

About This Home

This home is located at 3717 Cibola Ct, Chino Hills, CA 91709 and is currently estimated at $981,953, approximately $472 per square foot. 3717 Cibola Ct is a home located in San Bernardino County with nearby schools including Glenmeade Elementary School, Robert O. Townsend Junior High School, and Chino Hills High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 23, 2022

Sold by

Kraft Ada L

Bought by

Bruce Dale Kraft And Ada Kraft Family Trust

Current Estimated Value

Purchase Details

Closed on

Jun 17, 2022

Sold by

Bruce Dale Kraft And Ada Kraft Family Tr

Bought by

Kraft Ada L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$165,000

Interest Rate

5.25%

Mortgage Type

Credit Line Revolving

Purchase Details

Closed on

Jan 24, 2012

Sold by

Kraft Bruce D

Bought by

Kraft Bruce Dale and Kraft Ada

Purchase Details

Closed on

Aug 31, 2001

Sold by

Kraft Bruce Dale

Bought by

Kraft Bruce D and Kraft Ada I

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$139,700

Interest Rate

7.05%

Purchase Details

Closed on

Sep 30, 1998

Sold by

Kraft Bruce D and Kraft Ada L

Bought by

Kraft Bruce Dale and Kraft Ada

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Bruce Dale Kraft And Ada Kraft Family Trust | -- | -- | |

| Kraft Ada L | -- | First American Title | |

| Kraft Bruce Dale | -- | None Available | |

| Kraft Bruce D | -- | Orange Coast Title | |

| Kraft Bruce Dale | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Kraft Ada L | $165,000 | |

| Previous Owner | Kraft Bruce D | $139,700 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,910 | $365,465 | $114,002 | $251,463 |

| 2024 | $3,910 | $358,299 | $111,767 | $246,532 |

| 2023 | $3,801 | $351,273 | $109,575 | $241,698 |

| 2022 | $3,777 | $344,385 | $107,426 | $236,959 |

| 2021 | $3,703 | $337,633 | $105,320 | $232,313 |

| 2020 | $3,654 | $334,171 | $104,240 | $229,931 |

| 2019 | $3,589 | $327,619 | $102,196 | $225,423 |

| 2018 | $3,509 | $321,195 | $100,192 | $221,003 |

| 2017 | $3,445 | $314,897 | $98,227 | $216,670 |

| 2016 | $3,219 | $308,723 | $96,301 | $212,422 |

| 2015 | $3,154 | $304,085 | $94,854 | $209,231 |

| 2014 | $3,090 | $298,128 | $92,996 | $205,132 |

Source: Public Records

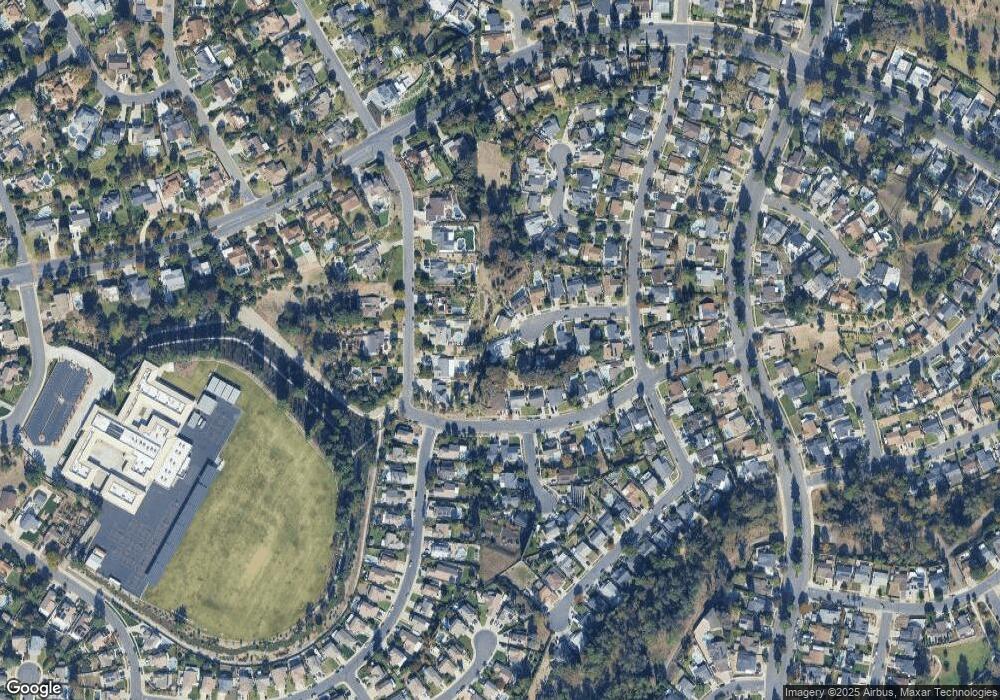

Map

Nearby Homes

- 15335 Rolling Ridge Dr

- 3692 Glen Ridge Dr

- 3581 Hillsdale Ranch Rd

- 3741 Aspen Ln

- 3966 Laurel Ct

- 15410 Elm Ln

- 3695 Terrace Dr

- 3473 Terrace Dr

- 15507 Oakdale Rd

- 4184 Gird Ave

- 14969 Redwood Ln

- 15413 Oakgrove Ct

- 3372 Buckingham Rd

- 15526 Oakhurst St

- 15740 Willow Run Dr

- 3099 Oaktrail Rd

- 15531 Oakflats Rd

- 3964 Alder Place

- 3474 Autumn Ave

- 4407 Lilac Cir

- 3725 Cibola Ct

- 3718 Cibola Ct

- 3706 Teak Ln

- 3733 Cibola Ct

- 3720 Teak Ln

- 3726 Cibola Ct

- 15355 Hawthorn Ave

- 15341 Hawthorn Ave

- 3730 Teak Ln

- 3739 Cibola Ct

- 15371 Hawthorn Ave

- 3740 Teak Ln

- 15325 Hawthorn Ave

- 3734 Cibola Ct

- 1017 -261-13

- 14844 Kelly Ct

- 3750 Teak Ln

- 3749 Cibola Ct

- 3740 Cibola Ct

- 15311 Hawthorn Ave