37275 Weeping Branch St Palmdale, CA 93550

East Palmdale NeighborhoodEstimated Value: $612,348 - $663,000

5

Beds

4

Baths

3,090

Sq Ft

$205/Sq Ft

Est. Value

About This Home

This home is located at 37275 Weeping Branch St, Palmdale, CA 93550 and is currently estimated at $634,087, approximately $205 per square foot. 37275 Weeping Branch St is a home located in Los Angeles County with nearby schools including Palm Tree Elementary School, David G. Millen Magnet Academy, and Palmdale High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 7, 2009

Sold by

Federal Home Loan Mortgage Corporation

Bought by

Mendez Fidel and Marquez Edith D

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$225,834

Outstanding Balance

$147,240

Interest Rate

5.05%

Mortgage Type

FHA

Estimated Equity

$486,847

Purchase Details

Closed on

Apr 21, 2009

Sold by

Arevalo Ana Victoria

Bought by

Federal Home Loan Mortgage Corporation

Purchase Details

Closed on

Mar 6, 2007

Sold by

Arevalo Jose Luis

Bought by

Arevalo Ana Victoria

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$361,052

Interest Rate

6.14%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Mendez Fidel | $230,000 | First American Title Ins Co | |

| Federal Home Loan Mortgage Corporation | $269,900 | First American Title Ins Co | |

| Arevalo Ana Victoria | -- | Lawyers Title | |

| Arevalo Ana Victoria | $451,500 | Lawyers Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Mendez Fidel | $225,834 | |

| Previous Owner | Arevalo Ana Victoria | $361,052 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,401 | $296,872 | $59,370 | $237,502 |

| 2024 | $5,401 | $291,052 | $58,206 | $232,846 |

| 2023 | $5,346 | $285,346 | $57,065 | $228,281 |

| 2022 | $5,134 | $279,752 | $55,947 | $223,805 |

| 2021 | $4,995 | $274,267 | $54,850 | $219,417 |

| 2020 | $4,907 | $271,456 | $54,288 | $217,168 |

| 2019 | $4,838 | $266,134 | $53,224 | $212,910 |

| 2018 | $4,763 | $260,917 | $52,181 | $208,736 |

| 2016 | $4,428 | $250,787 | $50,155 | $200,632 |

| 2015 | $4,391 | $247,021 | $49,402 | $197,619 |

| 2014 | $4,171 | $226,900 | $45,400 | $181,500 |

Source: Public Records

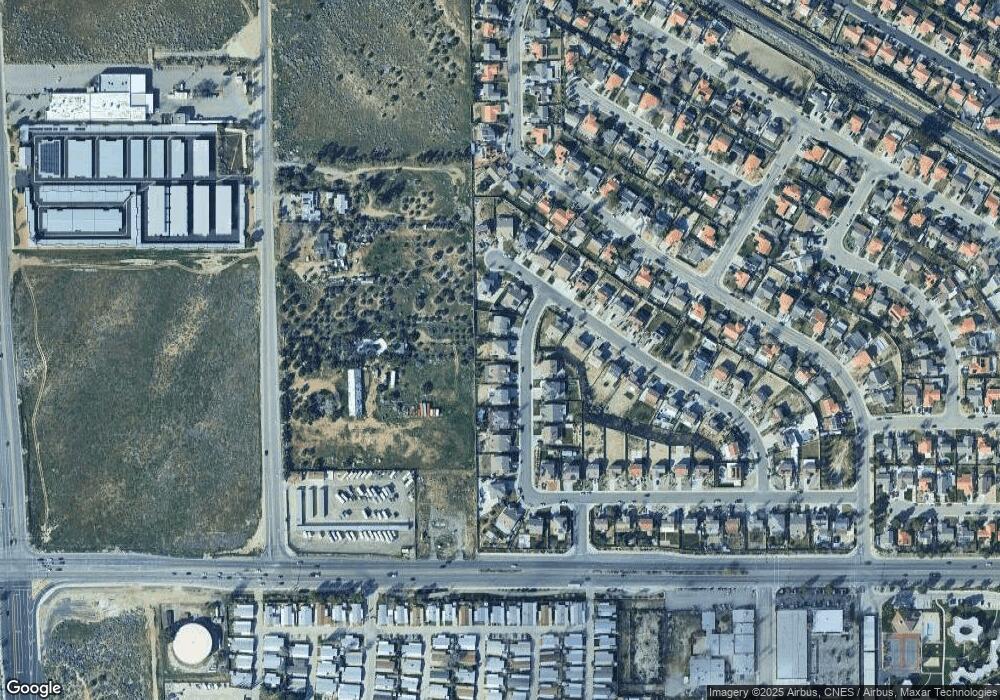

Map

Nearby Homes

- 1030 East Ave S Unit 186

- 1030 East Ave S Unit Spc 88

- 1030 E S Unit 31

- 1030 E S Unit 115

- 1030 E S Unit 108

- 1030 E S Unit 186

- 1030 E S Unit 88

- 37630 12th St E

- 0 E Sierra Hwy Unit SR25133162

- 0 E Sierra Hwy Unit HD25112239

- 0 E Sierra Hwy Unit SR24198621

- 0 E Sierra Hwy Unit V1-22641

- 1144 E Avenue r6

- 1223 E Avenue r7

- 37632 15th St E

- 37026 Casa Grande Ave

- 1611 Avon Ct

- 1726 E Avenue r12

- 566 E Avenue r8

- 37510 Conifer Dr

- 37303 Weeping Branch St

- 37261 Weeping Branch St

- 37253 Weeping Branch St

- 37371 Wild Tree St

- 37266 Weeping Branch St

- 37266 Weeping Branch St

- 37355 Wild Tree St

- 37393 Wild Tree St

- 37241 Weeping Branch St

- 37258 Weeping Branch St

- 37934 Wild Tree St

- 37349 Wild Tree St Unit TREE

- 37349 Wild Tree St

- 37246 Weeping Branch St

- 39312 Wild Tree St

- 37233 Weeping Branch St

- 37394 Wild Tree St

- 37343 Wild Tree St

- 37238 Weeping Branch St

- 37368 Wild Tree St