3729 Salem Rd Oxford, NC 27565

Estimated Value: $165,161 - $250,000

2

Beds

1

Bath

968

Sq Ft

$228/Sq Ft

Est. Value

About This Home

This home is located at 3729 Salem Rd, Oxford, NC 27565 and is currently estimated at $220,790, approximately $228 per square foot. 3729 Salem Rd is a home located in Granville County with nearby schools including Stovall-Shaw Elementary School, Northern Granville Middle School, and Hill City High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 13, 2008

Sold by

Dunston William E and Dunston Frances T

Bought by

Dunston Frances T

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$135,000

Interest Rate

3.46%

Mortgage Type

Reverse Mortgage Home Equity Conversion Mortgage

Purchase Details

Closed on

Jul 11, 2008

Sold by

Dunston William E and Mcmullen Dunston Sandra K

Bought by

Dunston Frances T

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$135,000

Interest Rate

3.46%

Mortgage Type

Reverse Mortgage Home Equity Conversion Mortgage

Purchase Details

Closed on

Jul 7, 1990

Bought by

Dunston Frances T

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Dunston Frances T | -- | -- | |

| Dunston Frances T | -- | -- | |

| Dunston Frances T | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Dunston Frances T | $135,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $352 | $99,908 | $25,120 | $74,788 |

| 2024 | $352 | $99,908 | $25,120 | $74,788 |

| 2023 | $265 | $58,443 | $14,590 | $43,853 |

| 2022 | $269 | $58,443 | $14,590 | $43,853 |

| 2021 | $256 | $58,443 | $14,590 | $43,853 |

| 2020 | $256 | $58,443 | $14,590 | $43,853 |

| 2019 | $260 | $58,443 | $14,590 | $43,853 |

| 2018 | $256 | $58,443 | $14,590 | $43,853 |

| 2016 | $281 | $61,139 | $15,610 | $45,529 |

| 2015 | $270 | $61,139 | $15,610 | $45,529 |

| 2014 | $270 | $61,139 | $15,610 | $45,529 |

| 2013 | -- | $61,139 | $15,610 | $45,529 |

Source: Public Records

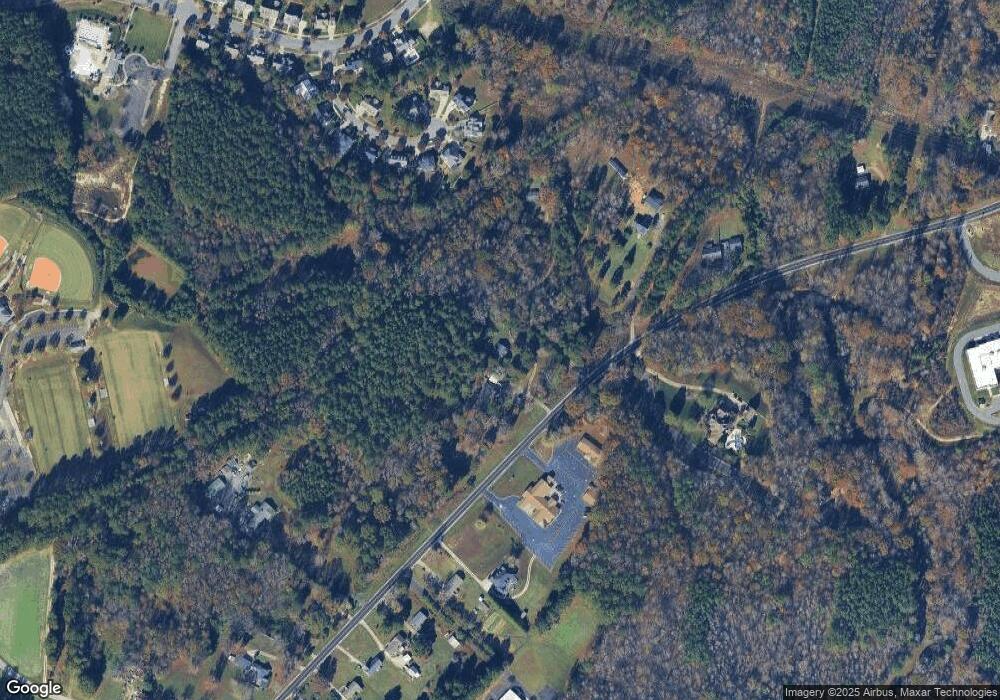

Map

Nearby Homes

- 105 Byron Ct

- 126 Kipling Dr

- 203 Kipling Dr

- 00 Salem Rd

- 101 Cambridge Way

- 3679 Oak Lawn Farm Rd

- 0 Hillandale Dr

- 715 Williamsboro St

- 103 Forest Rd

- 100 Maluli Dr

- 200 W Westbury Dr

- 110 Maluli Dr

- 104 Parker St

- 230 Saddletree Rd

- 505 Forest Rd

- 304 Lanier St

- 102 Royall Rd

- 6609 Clearwater Dr

- 6018 W Tom Parham Rd

- 112 Rectory St