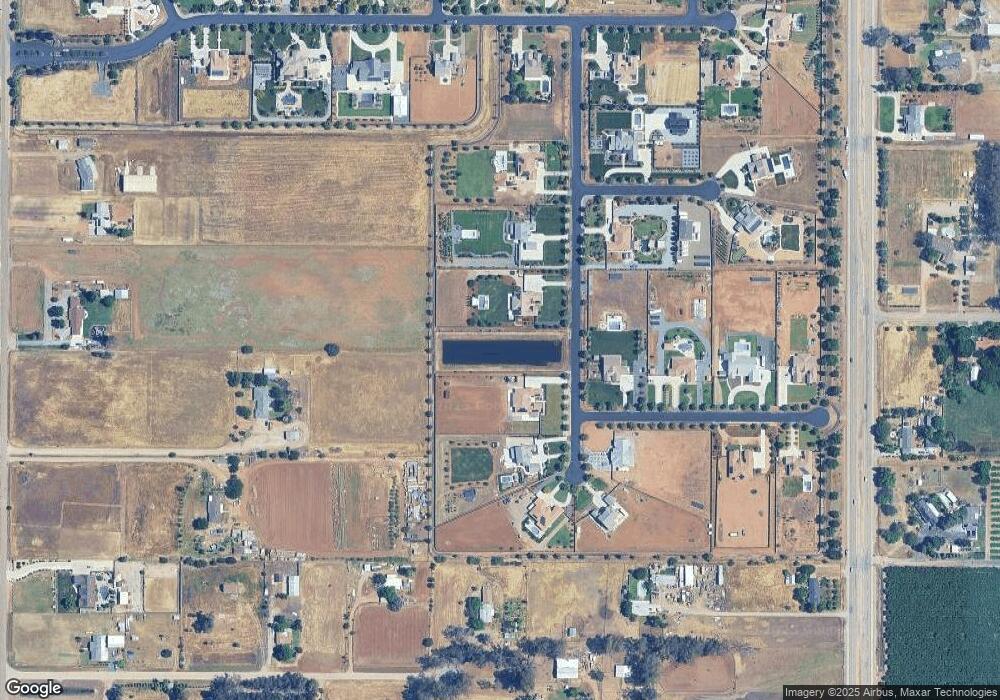

3781 N Mountain Hawk Ct Sanger, CA 93657

Estimated Value: $46,000 - $592,000

--

Bed

--

Bath

--

Sq Ft

1.21

Acres

About This Home

This home is located at 3781 N Mountain Hawk Ct, Sanger, CA 93657 and is currently estimated at $319,000. 3781 N Mountain Hawk Ct is a home located in Fresno County with nearby schools including Fairmont Elementary School, Washington Academic Middle School, and Sanger High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 9, 2018

Sold by

Bmc Red Hawk Llc

Bought by

Red Hawk Homeowners Association

Current Estimated Value

Purchase Details

Closed on

May 21, 2015

Sold by

Bmc Red Hawk Llc

Bought by

Red Hawk Homeowners Association

Purchase Details

Closed on

Jun 20, 2013

Sold by

Bmch California Llc

Bought by

Bmc Red Hawk Llc

Purchase Details

Closed on

Feb 25, 2013

Sold by

Bmch California Llc

Bought by

Bmch California Llc

Purchase Details

Closed on

Nov 28, 2012

Sold by

Bmc Red Hawk Llc

Bought by

Red Hawk Homeowners Association

Purchase Details

Closed on

Jul 19, 2012

Sold by

Red Hawk Community Partners Llc

Bought by

Bmch California Llc

Purchase Details

Closed on

Nov 7, 2005

Sold by

Js Land Co

Bought by

Red Hawk Community Partners Llc

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Red Hawk Homeowners Association | -- | Old Republic Title Company | |

| Red Hawk Homeowners Association | -- | Old Republic Title Company | |

| Bmc Red Hawk Llc | -- | First American | |

| Bmch California Llc | -- | Chicago Title Ins Co | |

| Red Hawk Homeowners Association | -- | First American Title Co | |

| Bmch California Llc | -- | Chicago Title Company | |

| Red Hawk Community Partners Llc | -- | Chicago Title Company |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $453 | $30,779 | $30,779 | -- |

| 2023 | $440 | $29,585 | $29,585 | $0 |

| 2022 | $403 | $29,005 | $29,005 | $0 |

| 2021 | $399 | $28,437 | $28,437 | $0 |

| 2020 | $388 | $28,146 | $28,146 | $0 |

| 2019 | $379 | $27,595 | $27,595 | $0 |

| 2018 | $364 | $27,054 | $27,054 | $0 |

| 2017 | $357 | $26,524 | $26,524 | $0 |

| 2016 | $333 | $26,004 | $26,004 | $0 |

| 2015 | $335 | $25,614 | $25,614 | $0 |

| 2014 | -- | $25,113 | $25,113 | $0 |

Source: Public Records

Map

Nearby Homes

- 12740 E Robinson Ave

- 12602 E Robinson Ave

- 3520 N Bethel Ave

- 13480 E Ashlan Ave

- 12743 E Gettysburg Ave

- 11722 E Ashlan Ave

- 12462 E Clinton Ave

- 5373 N Mendocino Ave

- 12804 E Alamos Ave

- 2383 N Greenwood Ave

- 12000 E Shaw Ave

- 11335 E Ashlan Ave

- 1 N Kittyhawk Ave

- 2176 N Bethel Ave

- 12156 E Mckinley Ave

- 13925 E Shaw Ave

- 2630 N Del Rey Ave

- 5476 Greenwood Ave

- 10911 E Swift Ave

- 4626 N Arrow Ridge Way

- 3795 N Mountain Hawk Ct

- 3767 Mountain Hawk Ct N

- 3784 N Mountain Hawk Ct

- 3751 Mountain Hawk Ct N

- 3813 Mountain Hawk Ct N

- 12892 E Eagles Rock Ct

- 3814 Mountain Hawk Ct N

- 3741 Mountain Hawk Ct N

- 12912 E Eagles Rock Ct

- 3831 Mountain Hawk Ct N

- 3752 Mountain Hawk Ct N Unit 37

- 3742 Mountain Hawk Ct N

- 3590 N Greenwood Ave

- 12928 E Eagles Rock Ct

- 12902 Eagles Nest Ct E

- 12752 E Robinson Ave

- 12627 E Sussex Way

- 12923 Eagles Nest Ct E

- 12929 E Eagles Rock Ct

- 12605 E Sussex Way