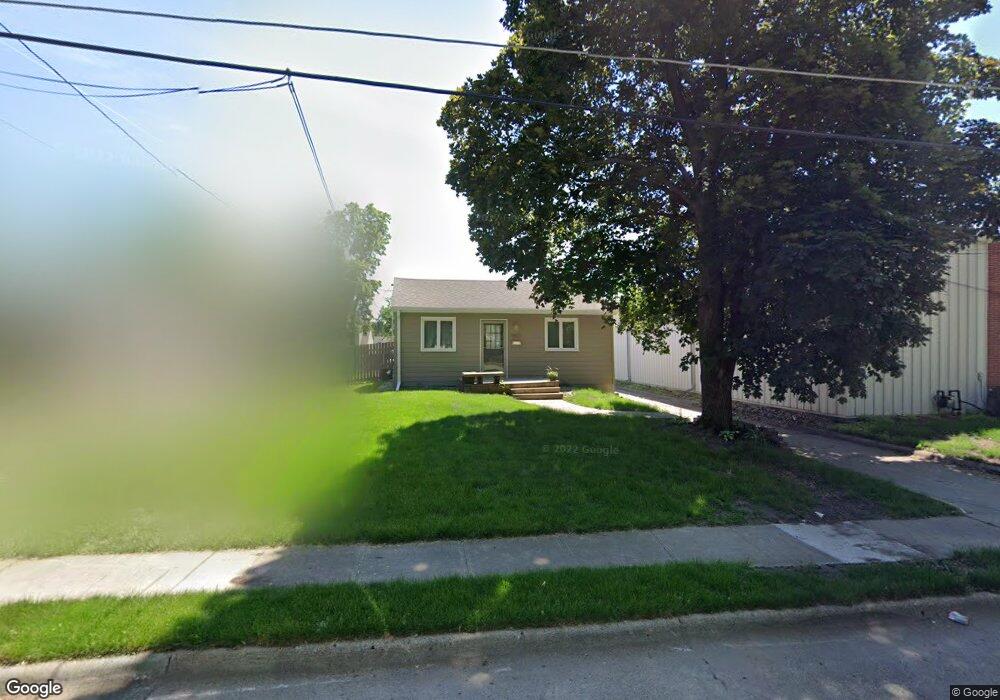

3809 68th St Urbandale, IA 50322

Estimated Value: $118,000 - $160,000

2

Beds

1

Bath

648

Sq Ft

$215/Sq Ft

Est. Value

About This Home

This home is located at 3809 68th St, Urbandale, IA 50322 and is currently estimated at $139,266, approximately $214 per square foot. 3809 68th St is a home located in Polk County with nearby schools including Urbandale Middle School, Urbandale High School, and St Pius X School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 12, 2006

Sold by

Christian Brian and Christian Angela

Bought by

Abc Property Management Llc

Current Estimated Value

Purchase Details

Closed on

Feb 15, 2006

Sold by

Christian Richard G and Christian Patricia F

Bought by

Christian Brian and Christian Angela

Purchase Details

Closed on

Jan 12, 2006

Sold by

Wachovia Bank Of Delaware Na

Bought by

Christian Richard

Purchase Details

Closed on

Sep 26, 2005

Sold by

Light Carol Sue and Lopez Carol Sue

Bought by

Wachovia Bank Of Delaware Na

Purchase Details

Closed on

Jun 28, 2000

Sold by

Kading Rick D and Kading Mary M

Bought by

Lopez Mario J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$55,120

Interest Rate

7.99%

Mortgage Type

Balloon

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Abc Property Management Llc | -- | None Available | |

| Christian Brian | $56,500 | None Available | |

| Christian Richard | $56,500 | None Available | |

| Wachovia Bank Of Delaware Na | -- | -- | |

| Lopez Mario J | $68,500 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Lopez Mario J | $55,120 | |

| Closed | Lopez Mario J | $10,335 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,680 | $102,200 | $48,500 | $53,700 |

| 2024 | $1,680 | $92,300 | $43,200 | $49,100 |

| 2023 | $1,734 | $92,300 | $43,200 | $49,100 |

| 2022 | $1,714 | $80,500 | $37,700 | $42,800 |

| 2021 | $1,654 | $80,500 | $37,700 | $42,800 |

| 2020 | $1,628 | $73,700 | $34,300 | $39,400 |

| 2019 | $1,516 | $73,700 | $34,300 | $39,400 |

| 2018 | $1,464 | $65,500 | $30,300 | $35,200 |

| 2017 | $1,408 | $65,500 | $30,300 | $35,200 |

| 2016 | $1,372 | $62,000 | $28,300 | $33,700 |

| 2015 | $1,372 | $62,000 | $28,300 | $33,700 |

| 2014 | $1,324 | $59,300 | $26,600 | $32,700 |

Source: Public Records

Map

Nearby Homes

- 3814 67th St

- 3818 66th St

- 3814 66th St

- 3626 64th St

- 4006 66th St

- 6908 Maryland Dr Unit 6908

- 6717 Roseland Dr

- 3929 64th St

- 4017 68th St

- 7105 Madison Ave

- 3233 68th St

- 4105 65th St

- 3808 72nd St

- 7204 Douglas Ave

- 7017 Winston Ave

- 7307 Douglas Ave

- 3320 61st St

- 3411 61st St

- 4211 65th St Unit 1

- 3333 61st St