3816 Emerald Cir Manhattan, KS 66503

CiCo NeighborhoodHighlights

- Deck

- Wood Burning Stove

- Fireplace

- Amanda Arnold Elementary School Rated A

- Ranch Style House

- 2 Car Attached Garage

About This Home

As of June 2022Nice townhome in a quiet neighborhood. Front and side siding replaced in 2014, deck replaced in 2015, and kitchen cabinets updated with a new paint color. The fireplace will keep you warm on cold, rainy days, yet the backyard deck provides shade and private solitude on the warmer days. No more lawn mowing or snow shoveling with this home as the homeowners association takes care of those responsibilities with your monthly dues. Home buyer warranty provided. Fireplace is a real wood log fireplace. Electric logs are for ambiance and can simply be removed.

Last Agent to Sell the Property

Kelly Adams

Coldwell Banker Real Estate Advisors License #BR00045789 Listed on: 05/11/2016

Property Details

Home Type

- Condominium

Est. Annual Taxes

- $2,514

Year Built

- Built in 1986

HOA Fees

- $115 Monthly HOA Fees

Home Design

- Ranch Style House

- Asphalt Roof

- Concrete Siding

Interior Spaces

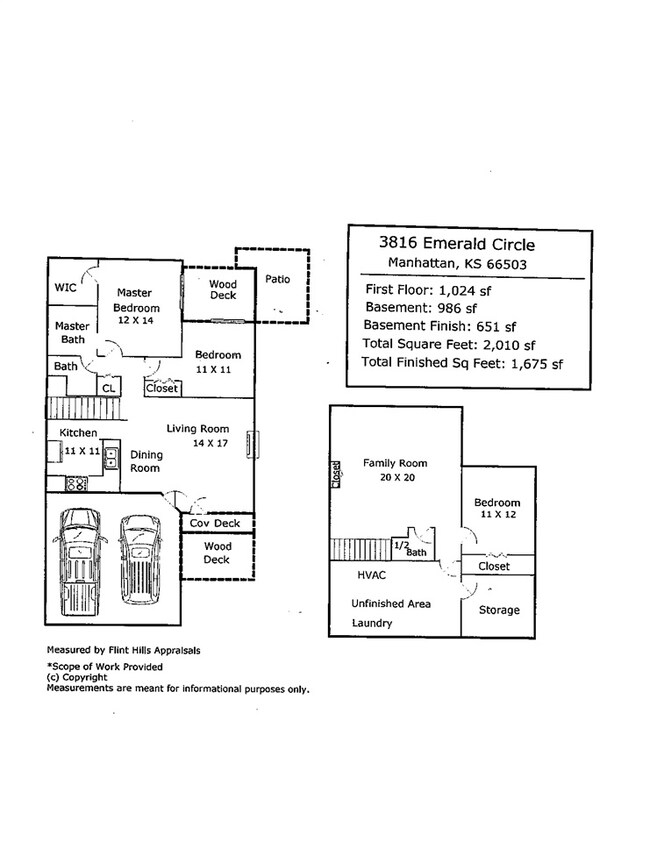

- 2,010 Sq Ft Home

- Fireplace

- Wood Burning Stove

- Laundry on lower level

Bedrooms and Bathrooms

- 3 Bedrooms | 2 Main Level Bedrooms

Partially Finished Basement

- Basement Fills Entire Space Under The House

- 1 Bathroom in Basement

- 1 Bedroom in Basement

Parking

- 2 Car Attached Garage

- Garage Door Opener

- Driveway

Additional Features

- Deck

- Forced Air Heating and Cooling System

Similar Homes in Manhattan, KS

Home Values in the Area

Average Home Value in this Area

Property History

| Date | Event | Price | Change | Sq Ft Price |

|---|---|---|---|---|

| 06/13/2022 06/13/22 | Sold | -- | -- | -- |

| 05/09/2022 05/09/22 | Pending | -- | -- | -- |

| 04/19/2022 04/19/22 | For Sale | $184,000 | +5.1% | $92 / Sq Ft |

| 10/31/2016 10/31/16 | Sold | -- | -- | -- |

| 09/30/2016 09/30/16 | Pending | -- | -- | -- |

| 05/11/2016 05/11/16 | For Sale | $175,000 | -- | $87 / Sq Ft |

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,095 | $21,404 | $2,762 | $18,642 |

| 2024 | $3,095 | $21,404 | $3,140 | $18,264 |

| 2023 | $3,028 | $20,780 | $2,325 | $18,455 |

| 2022 | $2,938 | $19,362 | $1,822 | $17,540 |

| 2021 | $2,757 | $18,844 | $1,779 | $17,065 |

| 2020 | $2,767 | $18,119 | $1,779 | $16,340 |

| 2019 | $2,757 | $17,908 | $1,796 | $16,112 |

| 2018 | $2,562 | $17,557 | $2,030 | $15,527 |

| 2017 | $2,588 | $18,163 | $2,001 | $16,162 |

| 2016 | $2,597 | $18,368 | $1,970 | $16,398 |

| 2014 | -- | $0 | $0 | $0 |

Agents Affiliated with this Home

-

Jim Blanton

Seller's Agent in 2022

Jim Blanton

Blanton Realty

(785) 776-8506

9 in this area

249 Total Sales

-

Melissa Brinkman

Buyer's Agent in 2022

Melissa Brinkman

Rockhill Real Estate Group

(620) 820-1550

5 in this area

126 Total Sales

-

Seller's Agent in 2016

Kelly Adams

Coldwell Banker Real Estate Advisors

(785) 776-1100

Map

Source: Flint Hills Association of REALTORS®

MLS Number: FHR20161109

APN: 212-10-0-10-02-004.00-0

- 2000 Little Kitten Ave

- 1924 Plymouth Rd

- 3700 Plymouth Cir

- 1724 Little Kitten Ave

- 3667 Everett Dr

- 3665 Everett Dr

- 3640 Everett Dr

- 1512 Yorktown Cir

- 1745 Kings Rd

- 2101 Abbott Cir

- 2213 Woodridge Dr

- 3450 Stonehenge Dr

- 2015 Grand Ridge Ct

- 2011 Grand Ridge Ct

- 2145 Grand Ridge Ct

- 1727 Cedar Crest Dr

- 3701 Vanesta Dr

- 2130 Royal Ridge Cir

- 4105 Wycliffe Dr

- 3604 Eastridge Cir