3840 Pascolo Bend Chaska, MN 55318

Estimated Value: $679,341 - $737,000

5

Beds

4

Baths

3,850

Sq Ft

$183/Sq Ft

Est. Value

About This Home

This home is located at 3840 Pascolo Bend, Chaska, MN 55318 and is currently estimated at $706,335, approximately $183 per square foot. 3840 Pascolo Bend is a home located in Carver County with nearby schools including Jonathan Elementary School, Chaska Middle School East, and Chaska High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 8, 2020

Sold by

Bailey Scott S and Bailey Chasitv D

Bought by

Jones Rodney and Jones Jodie

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$495,000

Outstanding Balance

$438,465

Interest Rate

2.8%

Mortgage Type

New Conventional

Estimated Equity

$267,870

Purchase Details

Closed on

Sep 7, 2012

Sold by

Mattamy Partnership

Bought by

Bailey Scott S and Bailey Chasity D

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$400,465

Interest Rate

3.56%

Mortgage Type

New Conventional

Purchase Details

Closed on

Nov 18, 2011

Sold by

Chevalle Development Company

Bought by

Mattamy Minneapolis Partnership

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Jones Rodney | $550,000 | Trademark Title Services Inc | |

| Bailey Scott S | $435,000 | Title Recording Services Inc | |

| Mattamy Minneapolis Partnership | $1,260,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Jones Rodney | $495,000 | |

| Previous Owner | Bailey Scott S | $400,465 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $8,570 | $682,600 | $120,800 | $561,800 |

| 2024 | $8,368 | $677,000 | $120,800 | $556,200 |

| 2023 | $7,684 | $677,100 | $120,800 | $556,300 |

| 2022 | $6,930 | $653,100 | $119,500 | $533,600 |

| 2021 | $6,586 | $536,800 | $119,500 | $417,300 |

| 2020 | $6,728 | $543,200 | $119,500 | $423,700 |

| 2019 | $6,346 | $497,200 | $113,900 | $383,300 |

| 2018 | $6,216 | $497,200 | $113,900 | $383,300 |

| 2017 | $6,144 | $481,500 | $113,600 | $367,900 |

| 2016 | $6,180 | $449,100 | $0 | $0 |

| 2015 | $5,786 | $423,200 | $0 | $0 |

| 2014 | $5,786 | $401,500 | $0 | $0 |

Source: Public Records

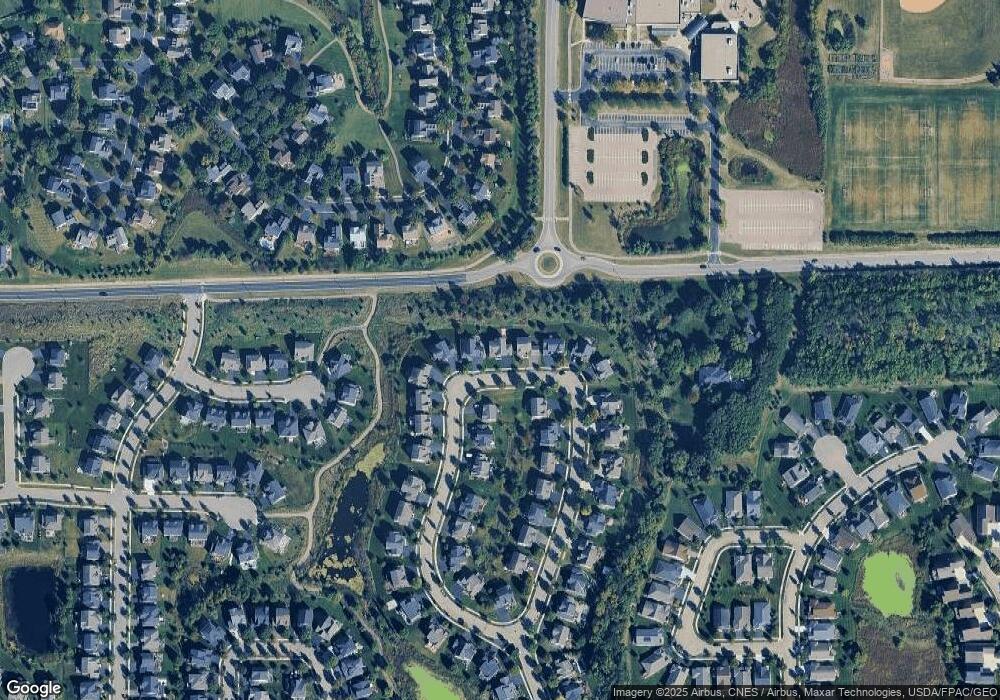

Map

Nearby Homes

- 3828 Pascolo Bend

- 3776 Talero Curve

- 1009 Victoria Greens Blvd

- 3673 Lerive Way

- 8345 Grace Ct

- 8973 Deer Run Dr

- 8064 Narcissus St

- 1595 Fox Hunt Way

- 1778 Green Crest Dr

- 4511 Obsidian Way

- 8830 Wedgemere Dr

- 4707 Obsidian Way

- 1255 78th St

- 7789 Vincent Dr

- 1776 Stieger Lake Ln Unit 203

- 2065 Woodstone Ct

- 7769 Madelyn Creek Dr

- 7691 77th Place

- 7688 77th Place

- 1031 Anthony Way

- 3842 Pascolo Bend

- 3844 Pascolo Bend

- 3847 Pascolo Bend

- 3829 Pascolo Bend

- 3846 Pascolo Bend

- 3834 Pascolo Bend

- TBD Pascolo Bend N

- XXX Pascolo Bend N

- 3849 Pascolo Bend

- 3848 Pascolo Bend

- 3827 Pascolo Bend

- 3850 Pascolo Bend

- 3832 Pascolo Bend

- 3830 Pascolo Bend

- 3851 Pascolo Bend

- 3825 Pascolo Bend

- 3852 Pascolo Bend

- 8551 Allegheny Grove Blvd

- 8561 Allegheny Grove Blvd

- 4065 San Vitero Cir

Your Personal Tour Guide

Ask me questions while you tour the home.