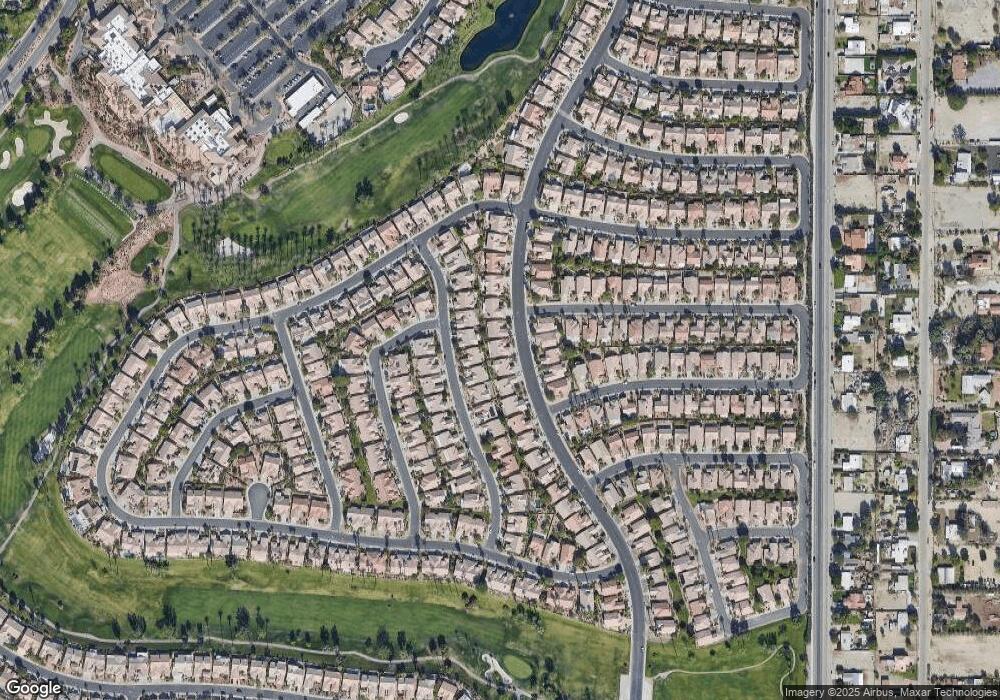

38501 Brandywine Ave Palm Desert, CA 92211

Sun City Palm Desert NeighborhoodEstimated Value: $497,000 - $657,000

2

Beds

2

Baths

1,836

Sq Ft

$305/Sq Ft

Est. Value

About This Home

This home is located at 38501 Brandywine Ave, Palm Desert, CA 92211 and is currently estimated at $559,624, approximately $304 per square foot. 38501 Brandywine Ave is a home located in Riverside County with nearby schools including Ronald Reagan Elementary School, Desert Ridge Academy, and Shadow Hills High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 24, 2009

Sold by

Berlin Carl K

Bought by

Berlin Lynn Carol

Current Estimated Value

Purchase Details

Closed on

Mar 18, 2009

Sold by

Berlin Lynn Carol and Berlin Carl K

Bought by

Kelley Gary and The Gary Kelley Living Trust

Purchase Details

Closed on

Jan 6, 2009

Sold by

Berlin Lynn Carol

Bought by

Berlin Lynn Carol

Purchase Details

Closed on

Dec 19, 2002

Sold by

Antis Jeanette

Bought by

Antis Jeanette and The Jeanette Antis Trust

Purchase Details

Closed on

Jul 17, 2001

Sold by

Greenberg Jill Sumner and Green Patricia Sarah

Bought by

Antis Jeanette

Purchase Details

Closed on

Sep 3, 2000

Sold by

Antis Jeanette

Bought by

The Jeanette Antis Trust

Purchase Details

Closed on

May 18, 1999

Sold by

Green Jack and Green Frances

Bought by

Green Jack and Green Frances C

Purchase Details

Closed on

Oct 25, 1996

Sold by

Del Webb Calif Corp

Bought by

Green Jack and Green Frances

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$173,500

Interest Rate

5.62%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Berlin Lynn Carol | -- | Ticor Title Company | |

| Kelley Gary | $322,500 | Ticor Title Company | |

| Berlin Lynn Carol | -- | None Available | |

| Antis Jeanette | -- | -- | |

| Antis Jeanette | $210,000 | Southland Title Corporation | |

| The Jeanette Antis Trust | -- | -- | |

| Green Jack | -- | -- | |

| Green Jack | $217,000 | First American Title Ins Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Green Jack | $173,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,392 | $415,276 | $124,576 | $290,700 |

| 2023 | $5,392 | $399,152 | $119,740 | $279,412 |

| 2022 | $5,142 | $391,327 | $117,393 | $273,934 |

| 2021 | $5,025 | $383,655 | $115,092 | $268,563 |

| 2020 | $4,695 | $359,923 | $108,191 | $251,732 |

| 2019 | $4,568 | $349,440 | $105,040 | $244,400 |

| 2018 | $4,405 | $336,000 | $101,000 | $235,000 |

| 2017 | $3,968 | $299,000 | $90,000 | $209,000 |

| 2016 | $3,954 | $298,000 | $89,000 | $209,000 |

| 2015 | $4,378 | $327,000 | $98,000 | $229,000 |

| 2014 | $4,265 | $317,000 | $95,000 | $222,000 |

Source: Public Records

Map

Nearby Homes

- 38781 Brandywine Ave

- 38786 Brandywine Ave

- 78948 Waterford Ln

- 38995 Brandywine Ave

- 78664 Platinum Dr

- 78756 Golden Reed Dr

- 78627 Dancing Waters Rd

- 78954 Nectarine Dr

- 78837 Tangerine Ct

- 78585 Autumn Ln

- 39262 Gainsborough Cir

- 39-270 Viana Ct

- 78467 Sterling Ln

- 78976 Apricot Ln

- 78797 Tamarisk Flower Dr

- 78364 Grape Arbor Ave

- 78390 Sterling Ln

- 39335 Blossom Cir

- 78359 Silent Dr

- 78571 Hidden Palms Dr

- 38481 Brandywine Ave

- 38521 Brandywine Ave

- 38508 Bent Palm Dr

- 38488 Bent Palm Dr

- 38528 Bent Palm Dr

- 38541 Brandywine Ave

- 38461 Brandywine Ave

- 38468 Bent Palm Dr

- 78698 Waterford Ln

- 38506 Brandywine Ave

- 38548 Bent Palm Dr

- 38526 Brandywine Ave

- 38486 Brandywine Ave

- 38561 Brandywine Ave

- 38546 Brandywine Ave

- 38448 Bent Palm Dr

- 38441 Brandywine Ave

- 38568 Bent Palm Dr

- 38566 Brandywine Ave

- 38503 Bent Palm Dr