3856 S Oakridge Ct Unit 3856 Milwaukee, WI 53228

Estimated Value: $394,895 - $421,000

2

Beds

3

Baths

1,540

Sq Ft

$266/Sq Ft

Est. Value

About This Home

This home is located at 3856 S Oakridge Ct Unit 3856, Milwaukee, WI 53228 and is currently estimated at $408,974, approximately $265 per square foot. 3856 S Oakridge Ct Unit 3856 is a home located in Milwaukee County with nearby schools including Edgerton Elementary School, Whitnall Middle School, and Whitnall High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 30, 2022

Sold by

Hayburn Bonnie J

Bought by

Hayburn Bonnie J and Hirth Kelly J

Current Estimated Value

Purchase Details

Closed on

Dec 19, 2016

Sold by

Nennig John

Bought by

Hayburn Bonnie J

Purchase Details

Closed on

Jun 1, 2007

Sold by

Hayburn Bonnie J

Bought by

Hayburn Bonnie J and Nennig John G

Purchase Details

Closed on

Nov 27, 2006

Sold by

Kuzdas Mary Ann

Bought by

Hayburn Bonnie J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$116,000

Interest Rate

6.19%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Nov 16, 2002

Sold by

Kuzdas Mary Ann

Bought by

Mary Ann Kuzdas Revocable Living Trust

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Hayburn Bonnie J | -- | None Listed On Document | |

| Hayburn Bonnie J | $102,400 | None Available | |

| Hayburn Bonnie J | $117,500 | None Available | |

| Hayburn Bonnie J | $235,000 | None Available | |

| Mary Ann Kuzdas Revocable Living Trust | -- | -- | |

| Kuzdas Mary Ann | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Hayburn Bonnie J | $116,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $5,464 | $315,700 | $43,000 | $272,700 |

| 2023 | $5,464 | $315,700 | $43,000 | $272,700 |

| 2022 | $5,429 | $204,700 | $33,000 | $171,700 |

| 2021 | $5,258 | $204,700 | $33,000 | $171,700 |

| 2020 | $5,388 | $204,700 | $33,000 | $171,700 |

| 2019 | $5,219 | $204,700 | $33,000 | $171,700 |

| 2018 | $5,735 | $204,700 | $33,000 | $171,700 |

| 2017 | $4,960 | $204,700 | $33,000 | $171,700 |

| 2016 | $4,967 | $204,700 | $33,000 | $171,700 |

| 2015 | $4,154 | $174,400 | $33,000 | $141,400 |

| 2014 | $4,247 | $174,400 | $33,000 | $141,400 |

| 2013 | $4,273 | $174,400 | $33,000 | $141,400 |

Source: Public Records

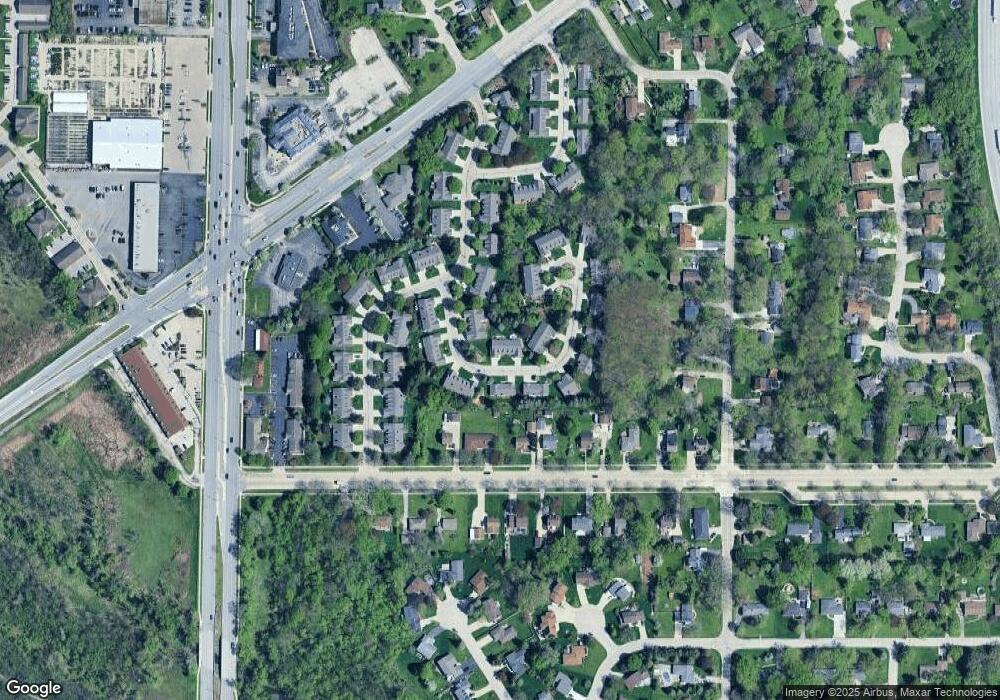

Map

Nearby Homes

- 4013 S 106th St

- 9851 W Beloit Rd Unit C8

- 3562 S 97th St

- 3538 S 96th St

- 3853 S 94th St

- 3608 S 95th St

- 4475 S 108th St

- 9727 W Ohio Ave

- 3436 S 95th St

- 3406 S 95th St

- 3806 S 92nd St

- 3858 S 92nd St Unit 3860

- 3735 S 91st St

- 3558 S 92nd St

- 3167 S 97th St

- 3168 S 97th St

- 3118 S Toldt Pkwy Unit 3118

- 2947 S 106th St

- 11924 W Ohio Ave

- 3122 S 97th St

- 3858 S Oakridge Ct

- 3846 S Oakridge Ct Unit 3846

- 3844 S Oakridge Ct

- 3851 S Oakridge Ct

- 3883 S Oakridge Ct Unit 3883

- 3875 S Oakridge Ct Unit 3875

- 3849 S Oakridge Ct

- 3873 S Oakridge Ct

- 3878 S Oakridge Ct Unit 3878

- 3822 S Oakbrook Dr

- 3861 S Oakridge Ct

- 3859 S Oakridge Ct Unit 3859

- 3821 S Oakridge Ct Unit 3821

- 3847 S Oakridge Ct Unit 3847

- 3820 S Oakbrook Dr

- 3738 S Bayberry Ln

- 3736 S Bayberry Ln

- 3722 S Bayberry Ln Unit 3722

- 3720 S Bayberry Ln Unit 3720

- 3714 S Bayberry Ln Unit 3714