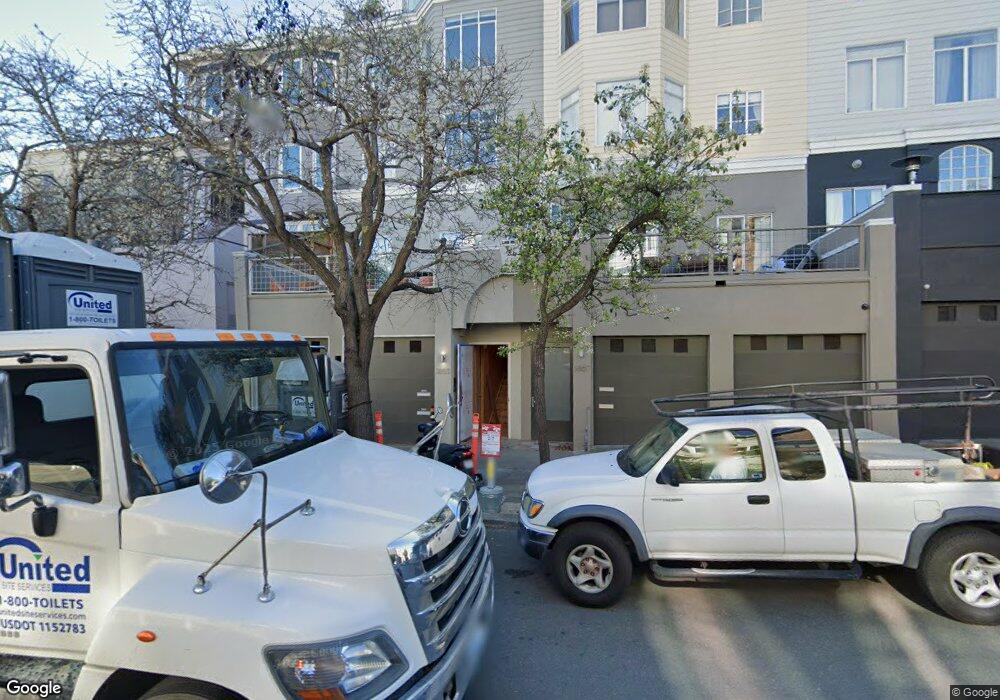

3865 19th St Unit IT1 San Francisco, CA 94114

Eureka Valley-Dolores Heights NeighborhoodEstimated Value: $1,216,000 - $1,613,000

--

Bed

--

Bath

973

Sq Ft

$1,359/Sq Ft

Est. Value

About This Home

This home is located at 3865 19th St Unit IT1, San Francisco, CA 94114 and is currently estimated at $1,322,475, approximately $1,359 per square foot. 3865 19th St Unit IT1 is a home located in San Francisco County with nearby schools including Harvey Milk Civil Rights Academy, Everett Middle School, and Children's Day School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 3, 2008

Sold by

Giltinan David

Bought by

Giltinan David

Current Estimated Value

Purchase Details

Closed on

May 18, 2001

Sold by

Forke Rachel

Bought by

Giltinan David

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$340,000

Interest Rate

6.57%

Purchase Details

Closed on

Jun 15, 2000

Sold by

Shekter William B Revocable Trust and Walker Robert

Bought by

Forke Rachel

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$440,000

Interest Rate

8.12%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Giltinan David | -- | None Available | |

| Giltinan David | $580,000 | First American Title Co | |

| Forke Rachel | $550,000 | Fidelity National Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Closed | Giltinan David | $340,000 | |

| Previous Owner | Forke Rachel | $440,000 | |

| Closed | Forke Rachel | $55,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $10,826 | $873,948 | $524,371 | $349,577 |

| 2024 | $10,826 | $856,813 | $514,090 | $342,723 |

| 2023 | $10,659 | $840,013 | $504,010 | $336,003 |

| 2022 | $10,448 | $823,543 | $494,128 | $329,415 |

| 2021 | $10,261 | $807,396 | $484,440 | $322,956 |

| 2020 | $10,317 | $799,118 | $479,473 | $319,645 |

| 2019 | $9,966 | $783,450 | $470,072 | $313,378 |

| 2018 | $9,631 | $768,089 | $460,855 | $307,234 |

| 2017 | $9,220 | $753,029 | $451,819 | $301,210 |

| 2016 | $9,058 | $738,264 | $442,960 | $295,304 |

| 2015 | $8,945 | $727,176 | $436,307 | $290,869 |

| 2014 | $8,710 | $712,933 | $427,761 | $285,172 |

Source: Public Records

Map

Nearby Homes

- 592 Sanchez St

- 29 Hancock St

- 3960 20th St

- 3939 19th St Unit 3939

- 4106 20th St

- 3747 17th St

- 516 Church St

- 3749 17th St Unit B

- 72-74 Cumberland St

- 376 Hill St

- 4038 18th St

- 785 Dolores St

- 20-24 Cumberland St

- 795 Dolores St

- 380 Dolores St Unit 9

- 350 Dolores St

- 578 Guerrero St

- 2335 Market St

- 892-894 Guerrero St

- 65 Collingwood St Unit 1

- 3865 19th St Unit 1

- 3865 19th St

- 3865 19th St Unit 2

- 3867 19th St Unit 2

- 3867 19th St Unit 1

- 3861 19th St

- 3863 19th St

- 3869 19th St Unit B

- 3869B 19th St Unit B

- 3869 19th St Unit A

- 3871 19th St Unit B

- 3871 19th St Unit NIT

- 3871 19th St Unit NIT

- 3873 19th St Unit B

- 3873 19th St Unit A

- 258 Cumberland St

- 262 Cumberland St

- 3875 19th St

- 266 Cumberland St

- 272 Cumberland St Unit 272