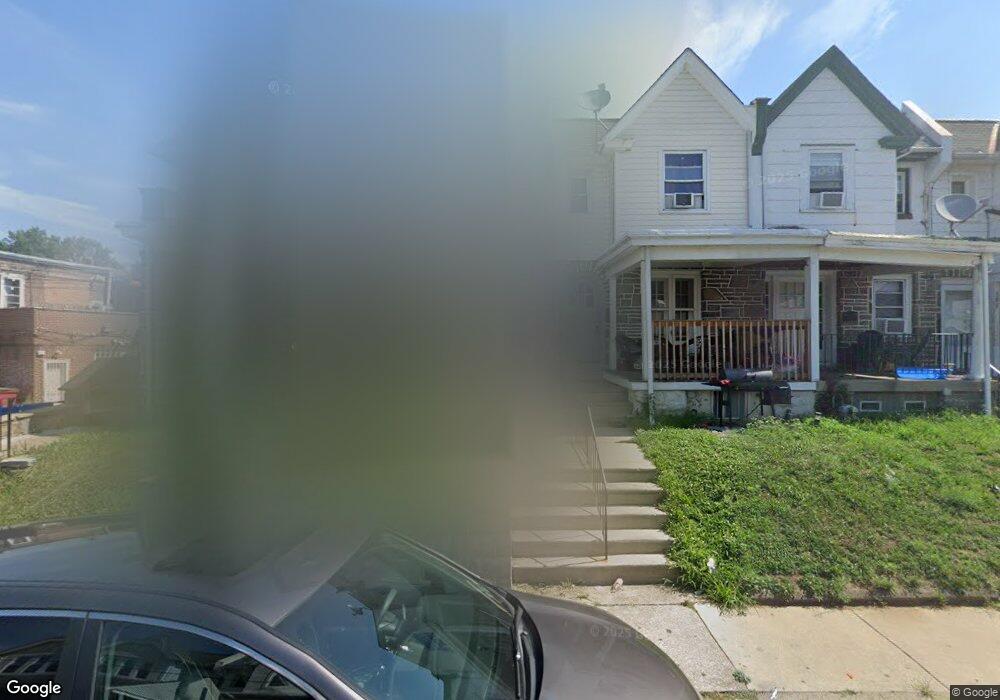

389 Wembly Rd Upper Darby, PA 19082

Estimated Value: $186,016 - $207,000

3

Beds

1

Bath

1,227

Sq Ft

$162/Sq Ft

Est. Value

About This Home

This home is located at 389 Wembly Rd, Upper Darby, PA 19082 and is currently estimated at $198,504, approximately $161 per square foot. 389 Wembly Rd is a home located in Delaware County with nearby schools including Bywood Elementary School, Upper Darby Kdg Center, and Upper Darby High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 6, 2015

Sold by

Wahid Rahela B and Estate Of Abdul Wahid

Bought by

Wahid Rahela B

Current Estimated Value

Purchase Details

Closed on

May 23, 2007

Sold by

Baylis Sherita

Bought by

Wahid Abdul

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$80,000

Outstanding Balance

$48,847

Interest Rate

6.24%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$149,657

Purchase Details

Closed on

Feb 10, 2003

Sold by

Medaglia Albert S and Medaglia Margaret M

Bought by

Stewart Claude H and Baylis Sherita

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$65,863

Interest Rate

5.88%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Wahid Rahela B | -- | Attorney | |

| Wahid Abdul | $100,000 | None Available | |

| Stewart Claude H | $67,900 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Wahid Abdul | $80,000 | |

| Previous Owner | Stewart Claude H | $65,863 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,297 | $77,970 | $21,720 | $56,250 |

| 2024 | $3,297 | $77,970 | $21,720 | $56,250 |

| 2023 | $3,266 | $77,970 | $21,720 | $56,250 |

| 2022 | $3,179 | $77,970 | $21,720 | $56,250 |

| 2021 | $4,286 | $77,970 | $21,720 | $56,250 |

| 2020 | $3,219 | $49,760 | $16,900 | $32,860 |

| 2019 | $3,162 | $49,760 | $16,900 | $32,860 |

| 2018 | $3,126 | $49,760 | $0 | $0 |

| 2017 | $3,045 | $49,760 | $0 | $0 |

| 2016 | $273 | $49,760 | $0 | $0 |

| 2015 | $273 | $49,760 | $0 | $0 |

| 2014 | $273 | $49,760 | $0 | $0 |

Source: Public Records

Map

Nearby Homes

- 329 Sanford Rd

- 312 Bayard Rd

- 367 Margate Rd

- 311 Margate Rd

- 212 Huntley Rd

- 512 Fairfield Ave

- 253 Shirley Rd

- 228 Long Ln

- 234 Long Ln

- 232 Long Ln

- 7124 Pennsylvania Ave

- 360 Huntley Rd

- 1434 Bywood Ave

- 207 Berbro Ave

- 235 Ashby Rd

- 107 S Keystone Ave

- 163 Springton Rd

- 210 Copley Rd

- 232 Copley Rd

- 212 Copley Rd