391 Danbury Cir Vacaville, CA 95687

Estimated Value: $615,130 - $684,000

5

Beds

3

Baths

2,148

Sq Ft

$299/Sq Ft

Est. Value

About This Home

This home is located at 391 Danbury Cir, Vacaville, CA 95687 and is currently estimated at $642,533, approximately $299 per square foot. 391 Danbury Cir is a home located in Solano County with nearby schools including Cooper Elementary School, Orchard Elementary School, and Vaca Pena Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 22, 2012

Sold by

Glankler Lumaye Heidi Kira and Lumaye Patrick Joseph

Bought by

Roerden Jensen C and Roerden Allison J

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$257,000

Outstanding Balance

$177,881

Interest Rate

3.5%

Mortgage Type

VA

Estimated Equity

$464,652

Purchase Details

Closed on

May 16, 2005

Sold by

Lumaye Raymond W and Lumaye Candy R

Bought by

Lumaye Patrick Joseph and Glankler Lumaye Heidi Kira

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$346,000

Interest Rate

1%

Mortgage Type

Fannie Mae Freddie Mac

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Roerden Jensen C | $257,000 | Old Republic Title Company | |

| Lumaye Patrick Joseph | $489,000 | Chicago Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Roerden Jensen C | $257,000 | |

| Previous Owner | Lumaye Patrick Joseph | $346,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,737 | $320,411 | $86,194 | $234,217 |

| 2024 | $3,737 | $314,129 | $84,504 | $229,625 |

| 2023 | $3,622 | $307,971 | $82,848 | $225,123 |

| 2022 | $3,558 | $301,933 | $81,224 | $220,709 |

| 2021 | $3,579 | $296,014 | $79,632 | $216,382 |

| 2020 | $3,553 | $292,980 | $78,816 | $214,164 |

| 2019 | $3,452 | $287,236 | $77,271 | $209,965 |

| 2018 | $3,418 | $281,605 | $75,756 | $205,849 |

| 2017 | $3,251 | $272,684 | $74,271 | $198,413 |

| 2016 | $3,230 | $267,338 | $72,815 | $194,523 |

| 2015 | $3,188 | $263,324 | $71,722 | $191,602 |

| 2014 | $2,989 | $258,167 | $70,318 | $187,849 |

Source: Public Records

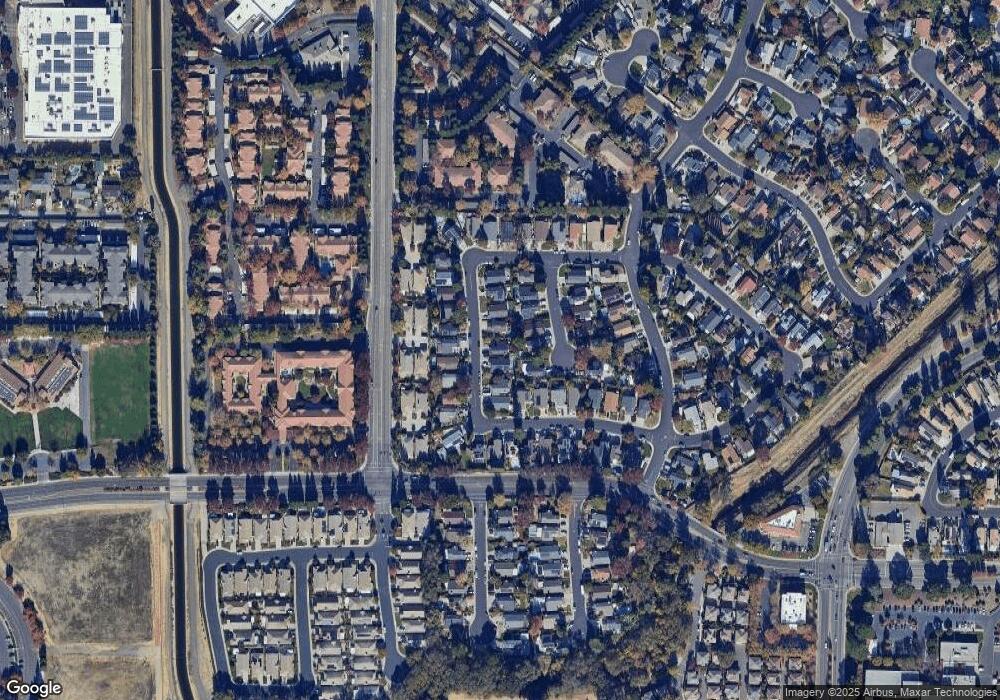

Map

Nearby Homes

- 690 Arcadia Dr

- 631 Sunnyvale Place

- 138 Arcadia Dr

- 526 Regency Cir

- 248 Colby Dr

- 450 Nut Tree Rd

- 197 Rainier Cir

- 875 Christine Dr

- 160 Bristol Dr

- 126 Olympic Cir

- 124 Dover Way

- 207 Arlington Way

- 113 Christine Dr

- 101 Mckinley Cir

- 1030 Boone Ct

- 171 Mckinley Cir

- 178 Mckinley Cir

- 128 Lassen Cir

- 76 Lemon Tree Cir

- 755 Oak Hollow Ave

- 397 Danbury Cir

- 385 Danbury Cir

- 324 Bridgeport Ct

- 403 Danbury Cir

- 318 Bridgeport Ct

- 379 Danbury Cir

- 312 Bridgeport Ct

- 384 Danbury Cir

- 409 Danbury Cir

- 396 Danbury Cir

- 343 Danbury Cir

- 373 Danbury Cir

- 306 Bridgeport Ct

- 402 Danbury Cir

- 337 Danbury Cir

- 372 Danbury Cir

- 415 Danbury Cir

- 300 Bridgeport Ct

- 1110 Burton Dr

Your Personal Tour Guide

Ask me questions while you tour the home.