3912 Upland Way Unit 18 Marietta, GA 30066

Sandy Plains NeighborhoodEstimated Value: $751,231 - $793,000

5

Beds

4

Baths

3,292

Sq Ft

$234/Sq Ft

Est. Value

About This Home

This home is located at 3912 Upland Way Unit 18, Marietta, GA 30066 and is currently estimated at $770,808, approximately $234 per square foot. 3912 Upland Way Unit 18 is a home located in Cobb County with nearby schools including Rocky Mount Elementary School, Simpson Middle School, and Lassiter High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 30, 2019

Sold by

Brener Howard

Bought by

Katz Julia and Zinkerman Eric M

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$368,000

Outstanding Balance

$322,889

Interest Rate

4.1%

Mortgage Type

Commercial

Estimated Equity

$447,919

Purchase Details

Closed on

Sep 28, 1999

Sold by

Perry David G and Perry Kari A

Bought by

Brener Howard and Brener Sharon

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$196,750

Interest Rate

7.89%

Mortgage Type

New Conventional

Purchase Details

Closed on

May 20, 1994

Sold by

Deppe Const

Bought by

Lewter David G and Harper Kari A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$20,090

Interest Rate

8.73%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Katz Julia | $460,000 | -- | |

| Brener Howard | $246,000 | -- | |

| Lewter David G | $211,500 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Katz Julia | $368,000 | |

| Previous Owner | Brener Howard | $196,750 | |

| Previous Owner | Lewter David G | $20,090 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $7,163 | $282,116 | $64,000 | $218,116 |

| 2024 | $7,169 | $282,116 | $64,000 | $218,116 |

| 2023 | $6,190 | $261,996 | $44,000 | $217,996 |

| 2022 | $5,446 | $200,952 | $42,000 | $158,952 |

| 2021 | $5,037 | $182,252 | $42,000 | $140,252 |

| 2020 | $5,037 | $182,252 | $42,000 | $140,252 |

| 2019 | $3,859 | $156,160 | $34,000 | $122,160 |

| 2018 | $3,859 | $156,160 | $34,000 | $122,160 |

| 2017 | $3,748 | $156,160 | $34,000 | $122,160 |

| 2016 | $3,347 | $137,660 | $34,000 | $103,660 |

| 2015 | $3,416 | $137,660 | $34,000 | $103,660 |

| 2014 | $3,173 | $125,864 | $0 | $0 |

Source: Public Records

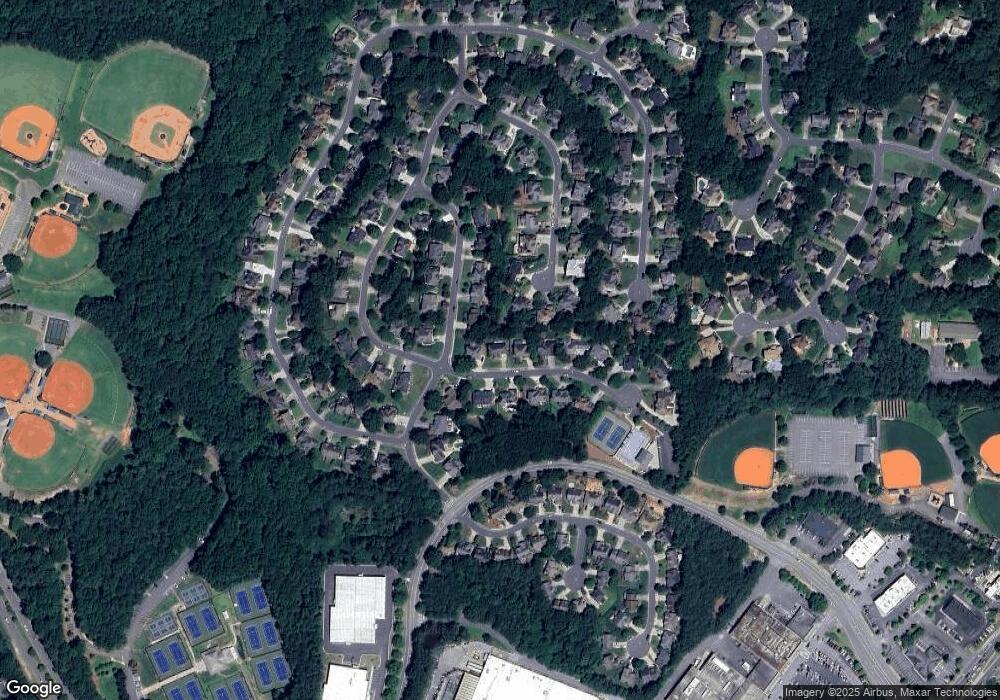

Map

Nearby Homes

- 3798 Upland Dr

- 3505 Bonaire Ct

- 3147 Swallow Dr NE

- 3901 Hazelhurst Dr

- 3130 Maley Ct

- 2696 S Arbor Dr

- 3238 Mountain Hollow Dr

- 3851 Timber Hollow Way

- 2578 Middle Coray Cir

- 4259 Arbor Club Dr

- 3054 Whisper Knob Rd

- 3312 Winter Wood Ct

- 2713 Arbor Summit

- 2477 Bobbie Dr

- 3283 Holly Springs Rd NE

- 3310 Rangers Gate

- 3465 Staci Ct NE

- 3350 Brookhill Cir

- 3912 Upland Way

- 3910 Upland Way Unit 2

- 3914 Upland Way Unit 2

- 3668 Edenbourgh Place Unit 2

- 4001 Upland Trace

- 3911 Upland Way Unit 2

- 3908 Upland Way Unit 2

- 3913 Upland Way

- 3672 Edenbourgh Place Unit 2

- 4000 Upland Trace Unit 2

- 0 Edenbourgh Place Unit 7445987

- 0 Edenbourgh Place Unit 7118286

- 0 Edenbourgh Place Unit 7010578

- 0 Edenbourgh Place Unit 3156361

- 0 Edenbourgh Place Unit 8120627

- 0 Edenbourgh Place Unit 7635853

- 0 Edenbourgh Place Unit 7333902

- 0 Edenbourgh Place Unit 9048285

- 0 Edenbourgh Place Unit 8852407

- 3909 Upland Way