Estimated Value: $606,175 - $659,000

4

Beds

3

Baths

2,962

Sq Ft

$214/Sq Ft

Est. Value

About This Home

This home is located at 3915 Shadowind Way, Gotha, FL 34734 and is currently estimated at $634,794, approximately $214 per square foot. 3915 Shadowind Way is a home located in Orange County with nearby schools including Thornebrooke Elementary School, Gotha Middle School, and Olympia High.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 3, 2002

Sold by

Charles C Brown M and Lori-Ann C Brown M

Bought by

Ousley Anthony and Ousley Laura A

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$196,000

Outstanding Balance

$83,560

Interest Rate

6.79%

Mortgage Type

New Conventional

Estimated Equity

$551,234

Purchase Details

Closed on

Nov 4, 1999

Sold by

Luscian Hills Development Limited Part

Bought by

Brown Charles C and Constantino-Bro Lori-Ann

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$198,500

Interest Rate

7.76%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Ousley Anthony | $245,000 | -- | |

| Brown Charles C | $209,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Brown Charles C | $196,000 | |

| Closed | Brown Charles C | $245,000 | |

| Previous Owner | Brown Charles C | $199,000 | |

| Previous Owner | Brown Charles C | $198,500 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,872 | $277,232 | -- | -- |

| 2024 | $3,607 | $269,419 | -- | -- |

| 2023 | $3,607 | $254,200 | $0 | $0 |

| 2022 | $3,475 | $246,796 | $0 | $0 |

| 2021 | $3,417 | $239,608 | $0 | $0 |

| 2020 | $3,251 | $236,300 | $0 | $0 |

| 2019 | $3,341 | $230,987 | $0 | $0 |

| 2018 | $3,312 | $226,680 | $0 | $0 |

| 2017 | $3,262 | $316,253 | $50,000 | $266,253 |

| 2016 | $3,235 | $277,229 | $40,000 | $237,229 |

| 2015 | $3,289 | $270,767 | $40,000 | $230,767 |

| 2014 | $3,345 | $241,585 | $36,000 | $205,585 |

Source: Public Records

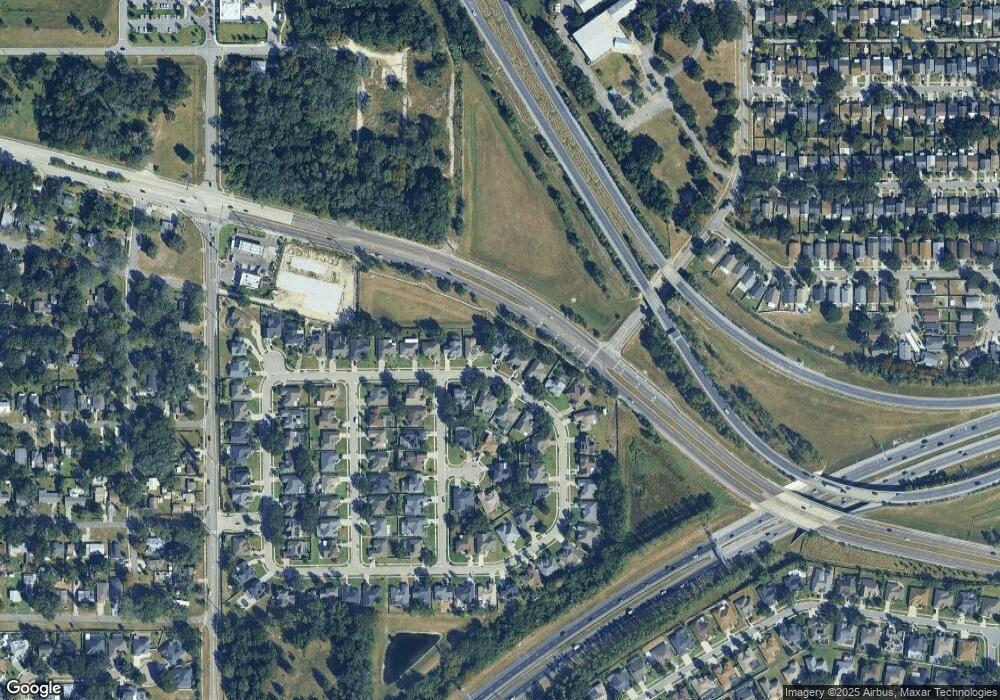

Map

Nearby Homes

- 1658 Hempel Ave

- 9101 Lake Coventry Ct

- 9126 Lake Coventry Ct

- 3625 Pompano Ct

- 3607 Breeders Cup Ct

- 1707 Twin Lake Dr

- 1882 Lake Pearl Dr

- 970 Davenwood Ct

- 935 Davenwood Ct

- 946 Davenwood Ct

- 1101 Vintage Village Ln Unit 104

- 1101 Vintage Village Ln Unit 101

- 537 Woodlawn Cemetery Rd

- 2000 Erving Cir Unit 102

- 2015 Erving Cir Unit 307

- 608 Bridge Creek Blvd

- 2319 Aloha Bay Ct

- 1105 Wineberry Ct

- 2344 Aloha Bay Ct

- 816 Rosemere Cir

- 3921 Shadowind Way

- 3909 Shadowind Way

- 3927 Shadowind Way

- 3903 Shadowind Way

- 3914 Shadowind Way

- 3933 Shadowind Way

- 3904 Shadowind Way

- 3928 Shadowind Way

- 3897 Shadowind Way

- 3934 Shadowind Way

- 3939 Shadowind Way

- 3891 Shadowind Way

- 3907 Ballinore Place

- 1602 Cerulean Way

- 3950 Shadowind Way

- 3945 Shadowind Way

- 1608 Cerulean Way

- 3885 Shadowind Way

- 3912 Ballinore Place

- 1614 Cerulean Way