3929 Deerpath Place West Lafayette, IN 47906

Estimated Value: $530,000 - $588,000

5

Beds

4

Baths

2,760

Sq Ft

$202/Sq Ft

Est. Value

About This Home

This home is located at 3929 Deerpath Place, West Lafayette, IN 47906 and is currently estimated at $557,717, approximately $202 per square foot. 3929 Deerpath Place is a home located in Tippecanoe County with nearby schools including Klondike Elementary School, Klondike Middle School, and William Henry Harrison High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 15, 2020

Sold by

Stonehenge Development Corp

Bought by

Lifton Nathaniel A and Lifton Maureen C

Current Estimated Value

Purchase Details

Closed on

Sep 23, 2013

Sold by

Lifton Nathaniel A and Lifton Maureen C

Bought by

Lifton Trust

Purchase Details

Closed on

Jul 16, 2010

Sold by

Cooke J Aaron and Cooke Heather A

Bought by

Lifton Nathaniel A and Lifton Maureen C

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$260,000

Interest Rate

4.83%

Mortgage Type

New Conventional

Purchase Details

Closed on

May 19, 2003

Sold by

Hughes Keith A and Hughes Jean C

Bought by

Cooke J Aaron and Cooke Heather A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$235,000

Interest Rate

5.87%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Lifton Nathaniel A | -- | None Available | |

| Lifton Trust | -- | -- | |

| Lifton Nathaniel A | -- | None Available | |

| Cooke J Aaron | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Lifton Nathaniel A | $260,000 | |

| Previous Owner | Cooke J Aaron | $235,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,691 | $455,400 | $70,200 | $385,200 |

| 2023 | $3,472 | $436,800 | $70,200 | $366,600 |

| 2022 | $3,209 | $383,700 | $70,200 | $313,500 |

| 2021 | $3,000 | $373,300 | $70,200 | $303,100 |

| 2020 | $3,040 | $373,300 | $70,200 | $303,100 |

| 2019 | $2,903 | $368,200 | $70,200 | $298,000 |

| 2018 | $2,776 | $358,900 | $64,800 | $294,100 |

| 2017 | $2,766 | $359,100 | $64,800 | $294,300 |

| 2016 | $2,703 | $353,200 | $64,800 | $288,400 |

| 2014 | $2,280 | $322,100 | $64,800 | $257,300 |

| 2013 | $2,379 | $319,400 | $64,800 | $254,600 |

Source: Public Records

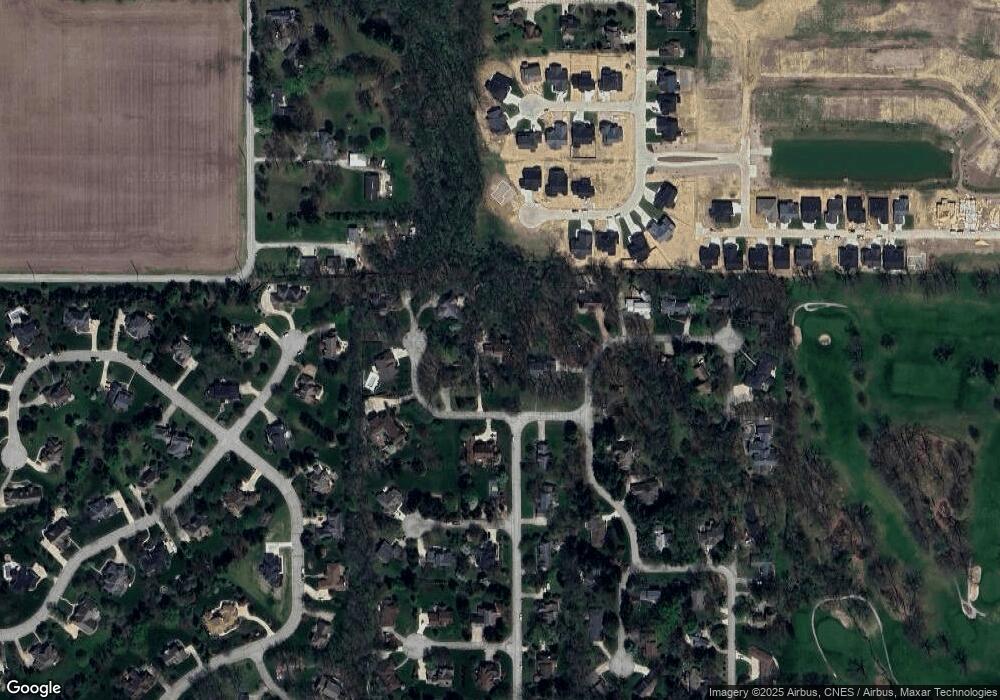

Map

Nearby Homes

- 3933 Deerpath Place

- 3505 Durrington Ct

- 4091 Amesbury Dr

- 3314 Langford Way

- 3300 Langford Way

- 4093 N 375 W

- 3801 W Capilano Dr

- 4069 Peterborough Rd

- 4081 Peterborough Rd

- 4220 Peterborough Rd

- 4312 Cathedral Ct

- 3507 W Capilano Dr

- 4008 N 300 W

- 4413 Cairnapple Ct

- 3220 Morallion Dr

- 3216 Kildaire Dr

- 2715 Wyndham Ct

- 2733 Demmings Ct

- 4801 Homewood Dr

- 2855 Bentbrook Ln

- 3925 Deerpath Place

- 3937 Deerpath Place

- 3740 Capilano Dr

- 3914 Deerpath Place

- 3930 Deerpath Place

- 3926 Deerpath Place Unit 117

- 3926 Deerpath Place Unit 117

- 3739 Capilano Dr

- 3739 Capilano Dr

- 3922 Deerpath Place

- 3742 Capilano Dr

- 3738 Capilano Dr

- 3819 Sunnycroft Place

- 3743 Capilano Dr

- 3917 W Capilano Dr

- 24 Eaglecrest Ct

- 4067 N 375 W

- 3823 Sunnycroft Place

- 3744 Capilano Dr

- 3745 Capilano Dr