393 Ambleside Way Unit 85393 Amherst, OH 44001

Estimated Value: $282,000 - $296,279

3

Beds

3

Baths

2,587

Sq Ft

$112/Sq Ft

Est. Value

About This Home

This home is located at 393 Ambleside Way Unit 85393, Amherst, OH 44001 and is currently estimated at $289,070, approximately $111 per square foot. 393 Ambleside Way Unit 85393 is a home located in Lorain County with nearby schools including Powers Elementary School, Walter G. Nord Middle School, and Amherst Junior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 29, 2010

Sold by

Hsbc Bank Usa National Association

Bought by

Meggitt Anne W

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$85,000

Outstanding Balance

$56,753

Interest Rate

5.05%

Mortgage Type

New Conventional

Estimated Equity

$232,317

Purchase Details

Closed on

Jun 22, 2009

Sold by

Roller Daniel L and Roller Daniel Lee

Bought by

Hsbc Bank Usa National Association

Purchase Details

Closed on

Aug 22, 2005

Sold by

Allsop Kenneth L and Allsop Joan M

Bought by

Roller Daniel Lee and Roller Daniel L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$153,200

Interest Rate

7.05%

Mortgage Type

Fannie Mae Freddie Mac

Purchase Details

Closed on

Jun 10, 1998

Sold by

R L R Construction Inc

Bought by

Allsop Kenneth L and Allsop Joan M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$84,000

Interest Rate

7.22%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Meggitt Anne W | $135,000 | None Available | |

| Hsbc Bank Usa National Association | $120,000 | Lawyers Title | |

| Roller Daniel Lee | $191,500 | Easton Title Services Llc | |

| Allsop Kenneth L | $164,200 | Lorain County Title Co Inc |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Meggitt Anne W | $85,000 | |

| Previous Owner | Roller Daniel Lee | $153,200 | |

| Previous Owner | Allsop Kenneth L | $84,000 | |

| Closed | Allsop Kenneth L | $25,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,935 | $97,433 | $10,325 | $87,108 |

| 2023 | $2,586 | $53,977 | $8,610 | $45,367 |

| 2022 | $2,479 | $53,977 | $8,610 | $45,367 |

| 2021 | $2,486 | $53,977 | $8,610 | $45,367 |

| 2020 | $2,846 | $54,860 | $8,750 | $46,110 |

| 2019 | $2,789 | $54,860 | $8,750 | $46,110 |

| 2018 | $3,003 | $58,770 | $8,750 | $50,020 |

| 2017 | $2,444 | $44,890 | $8,050 | $36,840 |

| 2016 | $2,530 | $44,890 | $8,050 | $36,840 |

| 2015 | $2,518 | $44,890 | $8,050 | $36,840 |

| 2014 | $2,664 | $47,250 | $8,470 | $38,780 |

| 2013 | $2,673 | $47,250 | $8,470 | $38,780 |

Source: Public Records

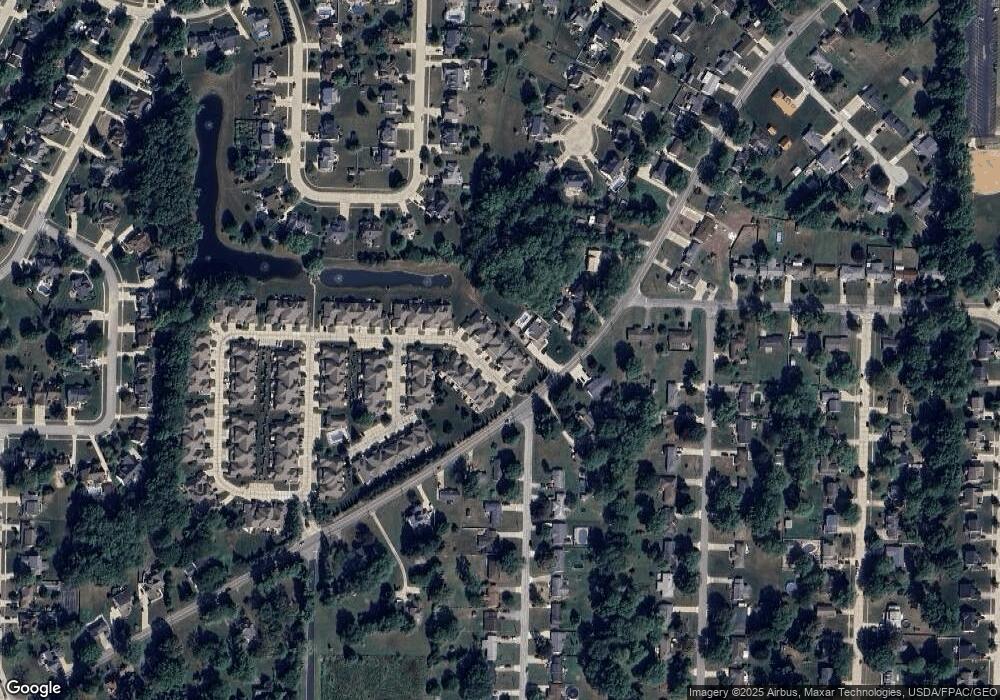

Map

Nearby Homes

- V/L Middle Ridge Rd

- 281 English Lakes Blvd Unit 67281

- 133 Ambleside Way

- 923 Longitude Ln

- 812 Bearing Ct

- 653 Brennan Dr

- 0 Middle Ridge Rd Unit 5102632

- 0 Middle Ridge Rd Unit 5160578

- 335 Copper Creek

- 2176 Myla Way

- 2180 Myla Way

- 891 Park Ave

- 621 Van Oaks Dr

- 8030 Pyle South Amherst Rd

- 7475 S Dewey Rd

- 1140 Woodside Dr

- 168 Orchard Hill Dr

- Bernstein Plan at K. Hovnanian's® Four Seasons at Sandstone

- Astaire Plan at K. Hovnanian's® Four Seasons at Sandstone

- Jenkins Plan at K. Hovnanian's® Four Seasons at Sandstone

- 393 Ambleside Way Unit 85

- 395 Ambleside Way Unit 86395

- 391 Ambleside Way

- 397 Ambleside Way

- 389 Ambleside Way

- 387 Ambleside Way Unit 82387

- 399 Ambleside Way

- 392 Ambleside Way Unit 78392

- 396 Ambleside Way

- 398 Ambleside Way Unit 75398

- 394 Ambleside Way

- 390 Ambleside Way Unit 79390

- 385 Ambleside Way

- 388 Ambleside Way Unit 80388

- 46740 Middle Ridge Rd

- 379 Ambleside Way

- 383 Ambleside Way Unit 53383

- 381 Ambleside Way

- 46720 Middle Ridge Rd

- 377 Ambleside Way