3939 Karl Rd Columbus, OH 43224

Clinton Estates NeighborhoodEstimated Value: $83,000 - $97,000

1

Bed

1

Bath

820

Sq Ft

$107/Sq Ft

Est. Value

About This Home

This home is located at 3939 Karl Rd, Columbus, OH 43224 and is currently estimated at $87,419, approximately $106 per square foot. 3939 Karl Rd is a home located in Franklin County with nearby schools including Maize Road Elementary School, Medina Middle School, and Mifflin High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 17, 2018

Sold by

Grened Properties Llc

Bought by

Manigoe Phyllis

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$62,775

Outstanding Balance

$54,524

Interest Rate

4.6%

Mortgage Type

Seller Take Back

Estimated Equity

$32,895

Purchase Details

Closed on

Apr 23, 2013

Sold by

Carol Jeanpack

Bought by

Grened Properties Llc

Purchase Details

Closed on

Feb 2, 2010

Sold by

Rife Elizabeth

Bought by

Jean Pack Carol

Purchase Details

Closed on

Feb 23, 1999

Sold by

Rife Elizabeth and Lapolla Tina

Bought by

Rife Elizabeth

Purchase Details

Closed on

Jul 13, 1998

Sold by

Keller Mary J

Bought by

Keller Mary J and Keller Jack Edward

Purchase Details

Closed on

Oct 21, 1997

Sold by

Whiting Dolores J

Bought by

Keller Mary J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$21,000

Interest Rate

7.65%

Mortgage Type

Balloon

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Manigoe Phyllis | -- | None Available | |

| Grened Properties Llc | $16,000 | Stewart Title Ag | |

| Jean Pack Carol | -- | None Available | |

| Rife Elizabeth | -- | -- | |

| Keller Mary J | $40,000 | Transohio Title | |

| Keller Mary J | $39,000 | Connor Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Manigoe Phyllis | $62,775 | |

| Previous Owner | Keller Mary J | $21,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $1,102 | $24,050 | $2,450 | $21,600 |

| 2023 | $1,088 | $24,050 | $2,450 | $21,600 |

| 2022 | $798 | $15,020 | $2,210 | $12,810 |

| 2021 | $800 | $15,020 | $2,210 | $12,810 |

| 2020 | $801 | $15,020 | $2,210 | $12,810 |

| 2019 | $747 | $12,010 | $1,750 | $10,260 |

| 2018 | $612 | $12,010 | $1,750 | $10,260 |

| 2017 | $636 | $12,010 | $1,750 | $10,260 |

| 2016 | $526 | $7,740 | $1,790 | $5,950 |

| 2015 | $479 | $7,740 | $1,790 | $5,950 |

| 2014 | $480 | $7,740 | $1,790 | $5,950 |

| 2013 | $287 | $9,660 | $2,240 | $7,420 |

Source: Public Records

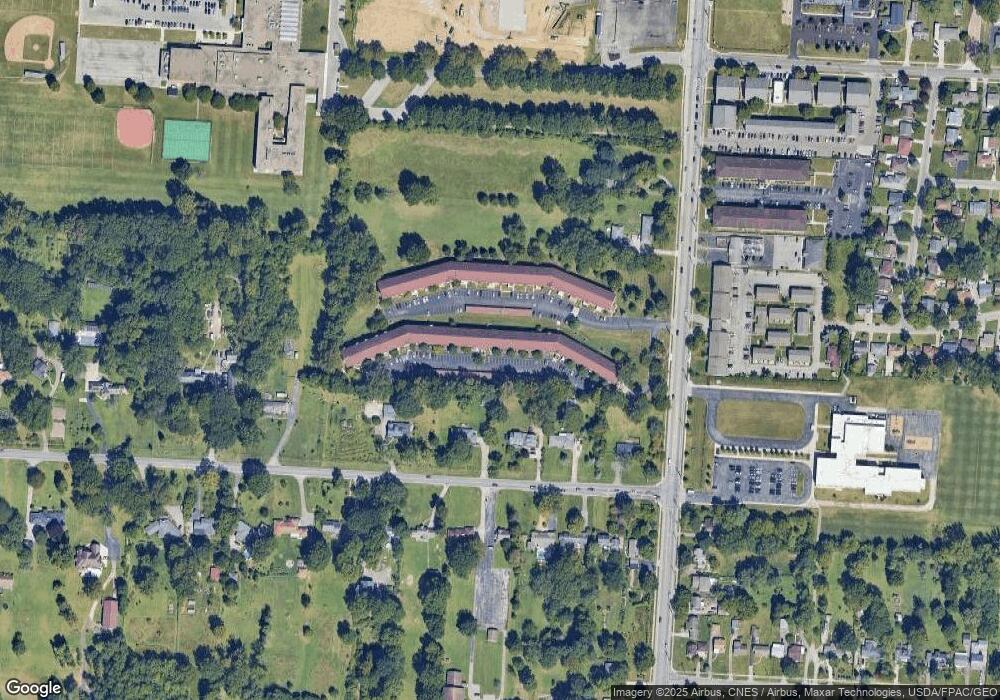

Map

Nearby Homes

- 3939 Karl Rd Unit 108

- 3941 Karl Rd Unit 326

- 3965 Karl Rd Unit 208

- 3967 Karl Rd Unit 125

- 1440 E Cooke Rd

- 1496 E Cooke Rd

- 4143 Karl Rd Unit 314

- 4141 Karl Rd Unit 307

- 1382 Elmore Ave

- 1665 Sale Rd

- 3749 Ganson Dr

- 1734 Ferris Rd

- 1191 Bryson Rd

- 3900 Dresden St

- 1206 Bryson Rd

- 3750 Dresden St

- 1064 Hillsdale Dr

- 3585 Gerbert Rd

- 995 Overbrook Service Dr

- 4455 Kenfield Rd

- 3939 Karl Rd Unit 302

- 3939 Karl Rd Unit 311

- 3939 Karl Rd Unit 109

- 3939 Karl Rd Unit 300

- 3939 Karl Rd Unit 110

- 3939 Karl Rd Unit 304

- 3939 Karl Rd Unit 115

- 3939 Karl Rd Unit 104

- 3939 Karl Rd

- 3939 Karl Rd

- 3939 Karl Rd Unit 103

- 3939 Karl Rd

- 3939 Karl Rd Unit 204

- 3939 Karl Rd Unit 209

- 3939 Karl Rd Unit 107

- 3939 Karl Rd Unit 113

- 3939 Karl Rd Unit 205

- 3939 Karl Rd

- 3939 Karl Rd

- 3939 Karl Rd