3941 Karl Rd Columbus, OH 43224

Clinton Estates NeighborhoodEstimated Value: $93,570 - $99,000

2

Beds

2

Baths

902

Sq Ft

$106/Sq Ft

Est. Value

About This Home

This home is located at 3941 Karl Rd, Columbus, OH 43224 and is currently estimated at $95,893, approximately $106 per square foot. 3941 Karl Rd is a home located in Franklin County with nearby schools including Maize Road Elementary School, Medina Middle School, and Mifflin High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 6, 2019

Sold by

Sedrakyan Svetlana

Bought by

Wilkinson Donna R

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$48,950

Outstanding Balance

$42,496

Interest Rate

4%

Mortgage Type

New Conventional

Estimated Equity

$53,397

Purchase Details

Closed on

Oct 26, 2017

Sold by

Keysor Rose M

Bought by

Sedrakyan Svetlana

Purchase Details

Closed on

Nov 26, 2004

Sold by

Lee Linda J

Bought by

Keysor Adelbert G and Keysor Rose M

Purchase Details

Closed on

Apr 23, 2002

Sold by

Smith William K and Estate Of Betty C Smith

Bought by

Lee Linda J

Purchase Details

Closed on

Jun 20, 1997

Sold by

Sloan Beulah

Bought by

Smith Betty C

Purchase Details

Closed on

Dec 1, 1992

Purchase Details

Closed on

Sep 19, 1989

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Wilkinson Donna R | $55,500 | Chicago Title | |

| Sedrakyan Svetlana | $44,000 | Valmer Land Title Agtency | |

| Keysor Adelbert G | -- | -- | |

| Lee Linda J | $50,900 | Chicago Title West | |

| Smith Betty C | $52,000 | Transohio Title | |

| -- | $58,000 | -- | |

| -- | $52,400 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Wilkinson Donna R | $48,950 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $1,175 | $26,180 | $2,450 | $23,730 |

| 2023 | $1,160 | $26,180 | $2,450 | $23,730 |

| 2022 | $866 | $16,700 | $2,210 | $14,490 |

| 2021 | $868 | $16,700 | $2,210 | $14,490 |

| 2020 | $869 | $16,700 | $2,210 | $14,490 |

| 2019 | $809 | $13,340 | $1,750 | $11,590 |

| 2018 | $404 | $13,340 | $1,750 | $11,590 |

| 2017 | $278 | $13,340 | $1,750 | $11,590 |

| 2016 | $0 | $8,480 | $1,790 | $6,690 |

| 2015 | -- | $8,480 | $1,790 | $6,690 |

| 2014 | $55 | $8,480 | $1,790 | $6,690 |

| 2013 | $55 | $10,605 | $2,240 | $8,365 |

Source: Public Records

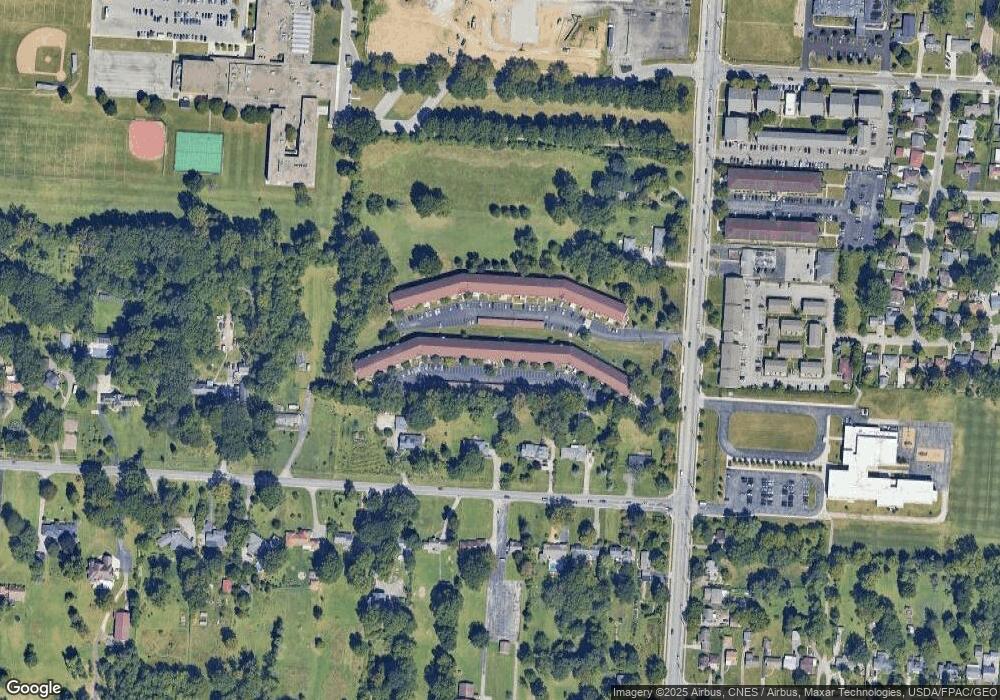

Map

Nearby Homes

- 4117 Karl Rd Unit 208

- 4057 Estates Place

- 4143 Karl Rd Unit 314

- 4145 Karl Rd Unit 4222

- 4145 Karl Rd Unit 223

- 3749 Ganson Dr

- 1507 Elmore Ave

- 1130 Carbone Dr

- 1734 Ferris Rd

- 3750 Dresden St

- 4455 Kenfield Rd

- 958 Janet Dr

- 991 Hidden Acres Ct Unit 991

- 1863 Ward Rd

- 1874 Sale Rd

- 3583 Dresden St

- 3591 Bremen St

- 3491 Ontario St

- 1090 Pauline Ave

- 924 Northridge Rd

- 3941 Karl Rd Unit 220

- 3941 Karl Rd Unit 120

- 3941 Karl Rd Unit 328

- 3941 Karl Rd Unit 325

- 3941 Karl Rd Unit 121

- 3941 Karl Rd Unit 227

- 3941 Karl Rd Unit 226

- 3941 Karl Rd Unit 232

- 3941 Karl Rd Unit 126

- 3941 Karl Rd Unit 228

- 3941 Karl Rd Unit 327

- 3941 Karl Rd

- 3941 Karl Rd Unit 122

- 3941 Karl Rd Unit 125

- 3941 Karl Rd Unit 333

- 3941 Karl Rd Unit 218

- 3941 Karl Rd

- 3941 Karl Rd Unit 326

- 3941 Karl Rd Unit 332

- 3941 Karl Rd