3946 Freshwind Cir Westlake Village, CA 91361

Estimated Value: $1,804,388 - $2,671,000

2

Beds

2

Baths

2,061

Sq Ft

$1,141/Sq Ft

Est. Value

About This Home

This home is located at 3946 Freshwind Cir, Westlake Village, CA 91361 and is currently estimated at $2,351,597, approximately $1,140 per square foot. 3946 Freshwind Cir is a home located in Los Angeles County with nearby schools including White Oak Elementary School, Lindero Canyon Middle School, and Agoura High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 3, 2004

Sold by

Mcinerney Brian and Mcinerney Kathy

Bought by

Davis Carolyn J

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$500,000

Outstanding Balance

$225,015

Interest Rate

5.25%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$2,126,582

Purchase Details

Closed on

Apr 25, 2002

Sold by

Porter John Mccarty and Strittmatter Rosemary Christine

Bought by

Mcinerney Brian and Mcinerney Kathy

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$525,000

Interest Rate

6.94%

Purchase Details

Closed on

Jun 21, 1999

Sold by

Trust Moone E Michael And Valerie Trs Mo

Bought by

Porter John Mccarty and Strittmatter Rosemary Christine

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$439,200

Interest Rate

3.95%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Davis Carolyn J | $1,095,000 | Fidelity National Title | |

| Mcinerney Brian | $750,000 | Fidelity National Title Co | |

| Porter John Mccarty | $549,000 | American Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Davis Carolyn J | $500,000 | |

| Previous Owner | Mcinerney Brian | $525,000 | |

| Previous Owner | Porter John Mccarty | $439,200 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $17,203 | $1,554,000 | $1,220,173 | $333,827 |

| 2024 | $17,203 | $1,523,531 | $1,196,249 | $327,282 |

| 2023 | $16,984 | $1,493,659 | $1,172,794 | $320,865 |

| 2022 | $16,456 | $1,464,373 | $1,149,799 | $314,574 |

| 2021 | $16,439 | $1,435,660 | $1,127,254 | $308,406 |

| 2019 | $15,850 | $1,393,079 | $1,093,820 | $299,259 |

| 2018 | $15,717 | $1,365,765 | $1,072,373 | $293,392 |

| 2016 | $14,915 | $1,312,733 | $1,030,733 | $282,000 |

| 2015 | $14,658 | $1,293,016 | $1,015,251 | $277,765 |

| 2014 | $11,264 | $982,000 | $771,000 | $211,000 |

Source: Public Records

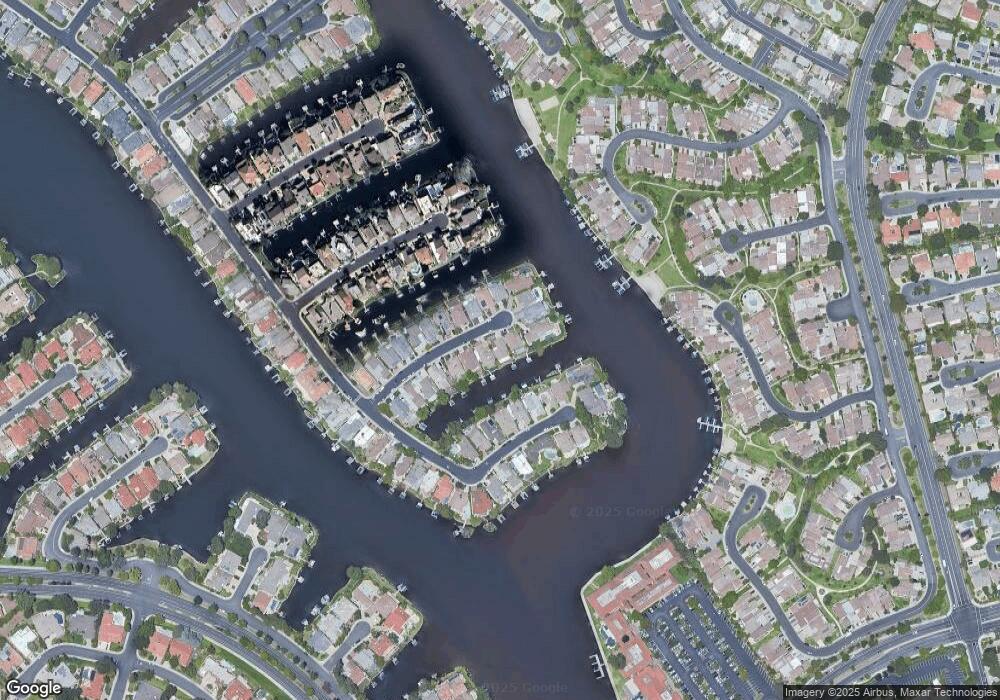

Map

Nearby Homes

- 3924 Fairbreeze Cir

- 4008 Mariner Cir

- 32200 Oakshore Dr

- 3708 Brigantine Cir

- 3808 Charthouse Cir

- 32377 Lake Pleasant Dr

- 32141 Lake Meadow Ln

- 32017 Wallington Ct

- 2772 Lakeridge Ln

- 3827 Mainsail Cir

- 2849 Shoreview Cir

- 2567 Oakshore Dr

- 3740 Summershore Ln

- 3728 Summershore Ln

- 3628 Summershore Ln

- 32300 Blue Rock Ridge

- 1218 Landsburn Cir

- 2546 Oakshore Dr

- 1223 Landsburn Cir

- 31906 Lyndbrook Ct

- 3940 Freshwind Cir

- 3952 Freshwind Cir

- 3936 Freshwind Cir

- 3956 Freshwind Cir

- 3943 Freshwind Cir

- 3949 Freshwind Cir

- 3930 Freshwind Cir

- 3958 Freshwind Cir

- 3939 Freshwind Cir

- 3953 Freshwind Cir

- 3957 Freshwind Cir

- 3935 Freshwind Cir

- 3922 Freshwind Cir

- 3931 Fairbreeze Cir

- 3955 Freshwind Cir

- 3927 Fairbreeze Cir

- 3935 Fairbreeze Cir

- 3929 Freshwind Cir

- 3921 Fairbreeze Cir

- 3941 Fairbreeze Cir