395 Legacy Way Unit 22301 Harrison, OH 45030

Estimated Value: $216,000 - $244,000

3

Beds

2

Baths

1,401

Sq Ft

$164/Sq Ft

Est. Value

About This Home

This home is located at 395 Legacy Way Unit 22301, Harrison, OH 45030 and is currently estimated at $230,253, approximately $164 per square foot. 395 Legacy Way Unit 22301 is a home located in Hamilton County with nearby schools including William Henry Harrison High School, St. John The Baptist School, and Summit Academy of Southwest Ohio.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 22, 2023

Sold by

Spencer Justin L and Spencer Ashley L

Bought by

Mason Tina M

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$185,000

Interest Rate

7.44%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jan 11, 2021

Sold by

Richmond Stacie

Bought by

Spencer Justin L and Spencer Ashley L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$144,000

Interest Rate

2.71%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jan 23, 2017

Sold by

Richmond Ryan

Bought by

Richmond Stacie

Purchase Details

Closed on

May 19, 2010

Sold by

Fischer Attached Homes Ii Llc

Bought by

Richmond Ryan and Richmond Stacie E

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$140,013

Interest Rate

4.62%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Mason Tina M | $220,000 | Northwest Title | |

| Mason Tina M | $220,000 | Northwest Title | |

| Spencer Justin L | $160,000 | Prominent Title Agency Llc | |

| Richmond Stacie | -- | -- | |

| Richmond Ryan | $141,900 | Attorney |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Mason Tina M | $185,000 | |

| Previous Owner | Spencer Justin L | $144,000 | |

| Previous Owner | Richmond Ryan | $140,013 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,336 | $52,556 | $7,280 | $45,276 |

| 2023 | $2,356 | $52,556 | $7,280 | $45,276 |

| 2022 | $2,329 | $45,486 | $5,600 | $39,886 |

| 2021 | $2,302 | $45,486 | $5,600 | $39,886 |

| 2020 | $2,330 | $45,486 | $5,600 | $39,886 |

| 2019 | $2,435 | $45,469 | $5,600 | $39,869 |

| 2018 | $2,448 | $45,469 | $5,600 | $39,869 |

| 2017 | $2,308 | $45,469 | $5,600 | $39,869 |

| 2016 | $2,090 | $44,597 | $5,593 | $39,004 |

| 2015 | $2,115 | $44,597 | $5,593 | $39,004 |

| 2014 | $2,016 | $44,597 | $5,593 | $39,004 |

| 2013 | $2,160 | $47,443 | $5,950 | $41,493 |

Source: Public Records

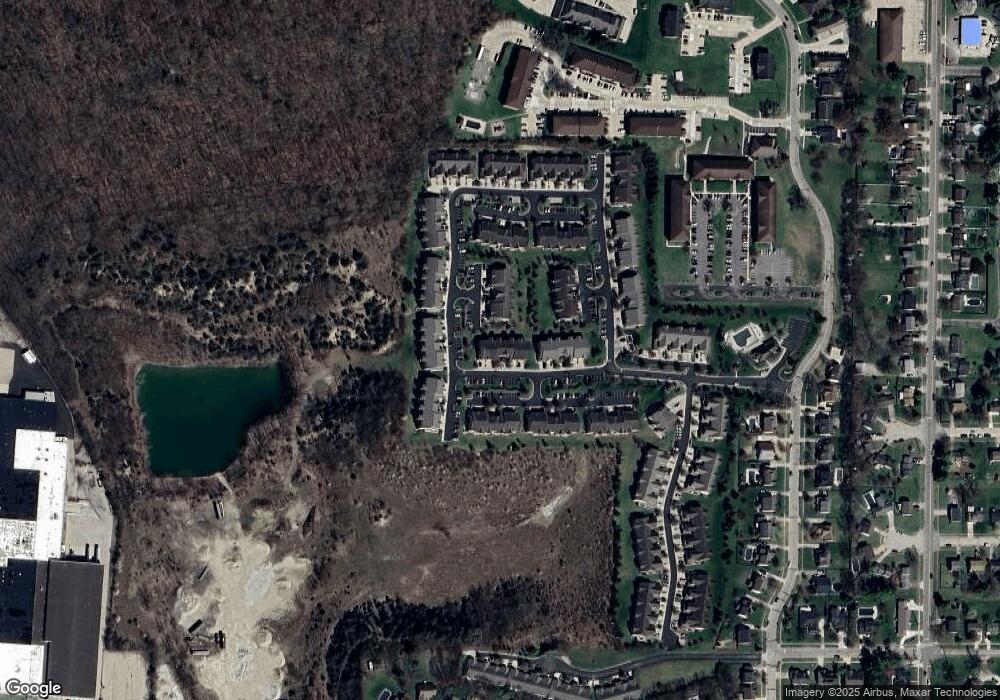

Map

Nearby Homes

- 576 Heritage Square

- 10805 Stone Ridge Way Unit 16

- 10701 Stone Ridge Way

- 620 Wood Bluff Ln

- 10612 Winding Way Dr

- 10884 West Rd

- 0 Campbell Rd Unit 1732658

- 0 Campbell Rd Unit 1729767

- 0 Campbell Rd Unit 1708716

- 623 Deerfield Dr

- 449 Featherwood Dr

- 153 Country View Dr

- 117 Westfield Dr

- 122 Hopping Ct

- 331 Miller Ct

- 329 Miller Ct

- 135 Turner Ridge Dr

- 133 Turner Ridge Dr

- 108 Carrie Dr

- 155 Turner Ridge Dr

- 375 Legacy Way

- 387 Legacy Way

- 399 Legacy Way

- 397 Legacy Way

- 395 Legacy Way

- 379 Legacy Way

- 391 Legacy Way

- 395 Legacy Way

- 387 Legacy Way

- 399 Legacy Way

- 375 Legacy Way

- 383 Legacy Way

- 397 Legacy Way

- 395 Legacy Way Unit 22

- 383 Legacy Way Unit 22103

- 399 Legacy Way Unit 22201

- 397 Legacy Way Unit 22101

- 391 Legacy Way Unit 22302

- 387 Legacy Way Unit 22202

- 379 Legacy Way Unit 22305