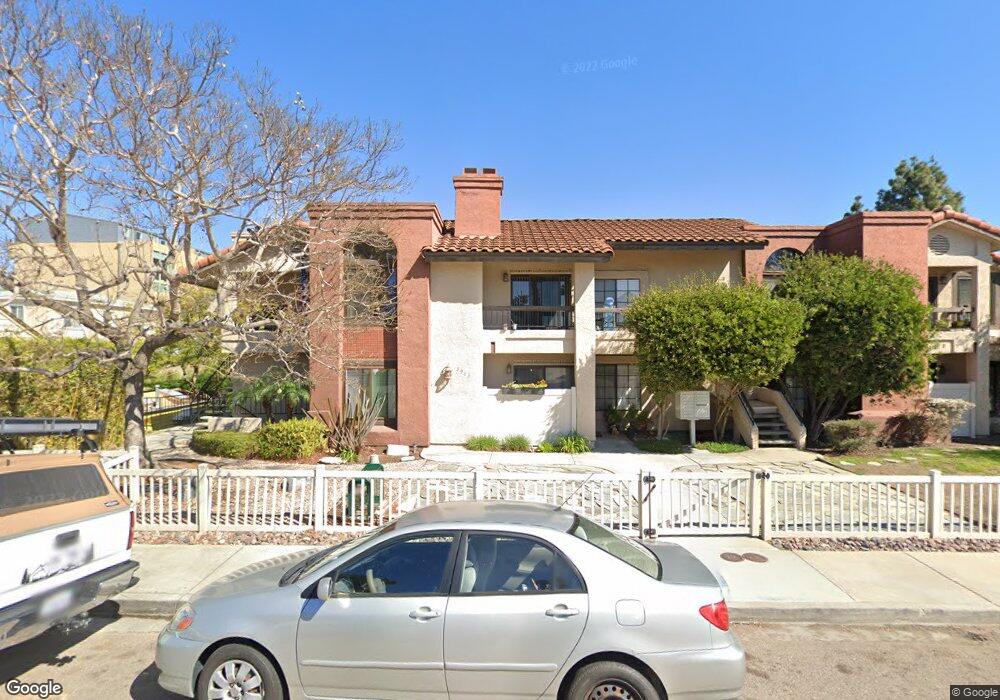

3963 Eagle St Unit 7 San Diego, CA 92103

Hillcrest NeighborhoodEstimated Value: $591,000 - $641,907

2

Beds

2

Baths

965

Sq Ft

$645/Sq Ft

Est. Value

About This Home

This home is located at 3963 Eagle St Unit 7, San Diego, CA 92103 and is currently estimated at $621,977, approximately $644 per square foot. 3963 Eagle St Unit 7 is a home located in San Diego County with nearby schools including Grant K-8, Richard Henry Dana Middle School, and Roosevelt International Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 17, 2019

Sold by

Ernst David B and David B Ernst Trust

Bought by

Ernst David B and Ernst Villa Trust

Current Estimated Value

Purchase Details

Closed on

Jul 24, 2006

Sold by

Ernst David B

Bought by

Ernst David B

Purchase Details

Closed on

Apr 5, 2002

Sold by

Buckingham Equities Llc

Bought by

Ernst David B

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$125,000

Outstanding Balance

$51,707

Interest Rate

6.78%

Estimated Equity

$570,270

Purchase Details

Closed on

Feb 6, 2002

Sold by

El Rosal Condominiums Inc

Bought by

Buckingham Equities Llc

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$125,000

Outstanding Balance

$51,707

Interest Rate

6.78%

Estimated Equity

$570,270

Purchase Details

Closed on

Jul 23, 2001

Sold by

Passiglia Frank A and Passiglia Ava M

Bought by

El Rosal Condominiums Inc

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Ernst David B | -- | None Available | |

| Ernst David B | -- | None Available | |

| Ernst David B | $255,000 | Commonwealth Land Title Ins | |

| Buckingham Equities Llc | -- | Commonwealth Land Title Co | |

| El Rosal Condominiums Inc | -- | Commonwealth Land Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Ernst David B | $125,000 | |

| Previous Owner | Buckingham Equities Llc | $1,212,912 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,504 | $376,684 | $251,127 | $125,557 |

| 2024 | $2,504 | $369,299 | $246,203 | $123,096 |

| 2023 | $4,402 | $362,059 | $241,376 | $120,683 |

| 2022 | $4,282 | $354,961 | $236,644 | $118,317 |

| 2021 | $4,251 | $434,454 | $303,108 | $131,346 |

| 2020 | $4,198 | $344,445 | $229,631 | $114,814 |

| 2019 | $4,122 | $337,692 | $225,129 | $112,563 |

| 2018 | $3,854 | $331,071 | $220,715 | $110,356 |

| 2017 | $80 | $324,581 | $216,388 | $108,193 |

| 2016 | $3,699 | $318,218 | $212,146 | $106,072 |

| 2015 | $3,643 | $313,439 | $208,960 | $104,479 |

| 2014 | $3,585 | $307,300 | $204,867 | $102,433 |

Source: Public Records

Map

Nearby Homes

- 630 W Washington St

- 4055 Falcon St Unit 102

- 845 Fort Stockton Dr Unit 312

- 845 Fort Stockton Dr Unit 308

- 3922 Albatross St Unit 1

- 4057 Brant St Unit 8

- 616 W Lewis St

- 720 W Lewis St Unit 6

- 3905 Ibis St

- 4095 Albatross St

- 711 W Pennsylvania Ave

- 4109 Ibis St

- 3830 1st Ave Unit 13

- 4144 Ibis St

- 3769 1st Ave Unit 11

- 4171 1st Ave

- 4152 Bachman Place

- 4139 Bachman Place

- 3566 Albatross St

- 3606 1st Ave Unit 106

- 3963 Eagle St Unit 10

- 3963 Eagle St Unit 9

- 3963 Eagle St Unit 6

- 3963 Eagle St Unit 5

- 3963 Eagle St Unit 4

- 3963 Eagle St Unit 3

- 3963 Eagle St Unit 2

- 3963 Eagle St Unit 1

- 3958 Dove St Unit 64

- 3952 - 396 Dove St

- 3964 Dove St

- 3984 Dove St

- 3966 Dove St

- 3952 Dove St

- 3976 Dove St

- 3974-76 Dove St

- 3972 Dove St

- 3968 Dove St

- 3978 Dove St

- 3970 Dove St