3966 Gardiner Run Copley, OH 44321

Estimated Value: $254,000 - $271,486

2

Beds

3

Baths

1,592

Sq Ft

$166/Sq Ft

Est. Value

About This Home

This home is located at 3966 Gardiner Run, Copley, OH 44321 and is currently estimated at $264,872, approximately $166 per square foot. 3966 Gardiner Run is a home located in Summit County with nearby schools including Fairlawn Lutheran School, Spring Garden Waldorf School, and St. Hilary Elementary School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 15, 2021

Sold by

Balzarini William

Bought by

Balzarini William and Simmons Michael J

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$144,750

Outstanding Balance

$128,894

Interest Rate

2.71%

Mortgage Type

New Conventional

Estimated Equity

$135,978

Purchase Details

Closed on

May 5, 2020

Sold by

Christopher Roman

Bought by

Balzarini William

Purchase Details

Closed on

Jun 5, 2009

Sold by

Pulte Homes Of Ohio Llc

Bought by

Thompson Kimberly A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$150,169

Interest Rate

5.27%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Balzarini William | -- | New Title Company Name | |

| Balzarini William | $135,000 | Insight Title | |

| Thompson Kimberly A | $152,940 | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Balzarini William | $144,750 | |

| Previous Owner | Thompson Kimberly A | $150,169 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,504 | $80,525 | $14,266 | $66,259 |

| 2024 | $4,504 | $80,525 | $14,266 | $66,259 |

| 2023 | $4,504 | $80,525 | $14,266 | $66,259 |

| 2022 | $4,239 | $61,943 | $10,976 | $50,967 |

| 2021 | $3,750 | $61,943 | $10,976 | $50,967 |

| 2020 | $3,969 | $61,950 | $10,980 | $50,970 |

| 2019 | $3,399 | $48,390 | $10,980 | $37,410 |

| 2018 | $3,150 | $48,390 | $10,980 | $37,410 |

| 2017 | $3,148 | $48,390 | $10,980 | $37,410 |

| 2016 | $3,144 | $48,390 | $10,980 | $37,410 |

| 2015 | $3,148 | $48,390 | $10,980 | $37,410 |

| 2014 | $3,127 | $48,390 | $10,980 | $37,410 |

| 2013 | $3,102 | $48,680 | $10,980 | $37,700 |

Source: Public Records

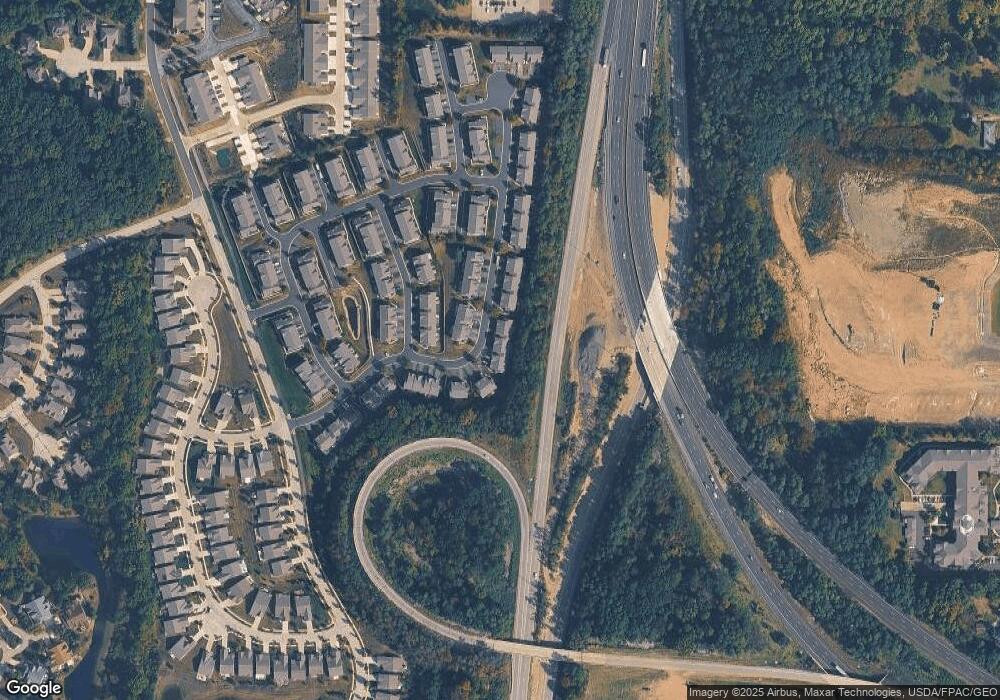

Map

Nearby Homes

- 3974 Gardiner Run

- 389 Caleb Dr

- 991 Croghan Way

- 4038 Gardiner Run

- 3888 Gardiner Run

- 522 Robinwood Ln Unit I

- 483 Rothrock Rd

- 3982 Palace Way

- 4180 Castle Ridge

- 4212 Castle Ridge

- 3800 Rosemont Blvd Unit 111B

- 3800 Rosemont Blvd Unit 116 D

- 3800 Rosemont Blvd Unit 105G

- 3800 Rosemont Blvd Unit 101G

- 3800 Rosemont Blvd Unit 116A

- 3800 Rosemont Blvd Unit 113D

- 3800 Rosemont Blvd Unit 113B

- 3820 Overlook Ct

- 3800 Rosemont 103 E Blvd

- 3831 Overlook Ct

- 3962 Gardiner Run

- 3970 Gardiner Run

- 3958 Gardiner Run

- 3978 Gardiner Run

- 3952 Gardiner Run

- 3982 Gardiner Run

- 3967 Gardiner Run

- 3963 Gardiner Run

- 3959 Gardiner Run

- 3948 Gardiner Run

- 3955 Gardiner Run

- 3986 Gardiner Run

- 3944 Gardiner Run

- 3949 Gardiner Run

- 3990 Gardiner Run

- 3940 Gardiner Run

- 3945 Gardiner Run

- 3994 Gardiner Run

- 473 Turner Dr

- 3936 Gardiner Run