400 Juniper Ln Muldrow, OK 74948

Estimated Value: $283,000 - $541,915

3

Beds

3

Baths

3,866

Sq Ft

$107/Sq Ft

Est. Value

About This Home

This home is located at 400 Juniper Ln, Muldrow, OK 74948 and is currently estimated at $412,458, approximately $106 per square foot. 400 Juniper Ln is a home with nearby schools including Muldrow Elementary School, Muldrow Middle School, and Muldrow High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 16, 2024

Sold by

Cash Alice M

Bought by

Cash Belinda A

Current Estimated Value

Purchase Details

Closed on

Nov 26, 2024

Sold by

Montgomery Schuyler and Montgomery Bobbie

Bought by

Rice Garrett and Rice Mallori

Purchase Details

Closed on

Oct 24, 2024

Sold by

Parkey Hubert J and Parkey Patricia

Bought by

Barnhill Darren and Barnhill Lisa

Purchase Details

Closed on

Sep 20, 2024

Sold by

Choate Vickie Starr and Finch Vickie Starr

Bought by

Starr Woodrow and Starr Cooper

Purchase Details

Closed on

May 31, 2024

Sold by

Barnes Heather Rae

Bought by

Barnes Heather Rae and Housing Authority Of The Cherokee Nation Of O

Purchase Details

Closed on

Oct 23, 2023

Sold by

Lookebill Gary and Lookebill Everlyn

Bought by

Lily Love Land Trust and Lookebill

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Cash Belinda A | -- | None Listed On Document | |

| Rice Garrett | $190,000 | Valley Land Title | |

| Rice Garrett | $190,000 | Valley Land Title | |

| Barnhill Darren | $15,000 | Valley Land Title | |

| Starr Woodrow | -- | None Listed On Document | |

| Barnes Heather Rae | -- | None Listed On Document | |

| Lily Love Land Trust | -- | None Listed On Document | |

| Lily Love Land Trust | -- | None Listed On Document |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,859 | $27,163 | $4,664 | $22,499 |

| 2024 | $1,859 | $26,371 | $4,528 | $21,843 |

| 2023 | $1,803 | $25,604 | $4,492 | $21,112 |

| 2022 | $1,695 | $24,858 | $4,444 | $20,414 |

| 2021 | $1,644 | $24,859 | $4,516 | $20,343 |

| 2020 | $1,594 | $23,431 | $4,270 | $19,161 |

| 2019 | $1,545 | $22,749 | $4,153 | $18,596 |

| 2018 | $1,498 | $22,086 | $3,984 | $18,102 |

| 2017 | $1,453 | $21,443 | $834 | $20,609 |

| 2016 | $1,408 | $20,818 | $789 | $20,029 |

| 2015 | $1,365 | $20,212 | $749 | $19,463 |

| 2014 | $1,323 | $19,623 | $710 | $18,913 |

Source: Public Records

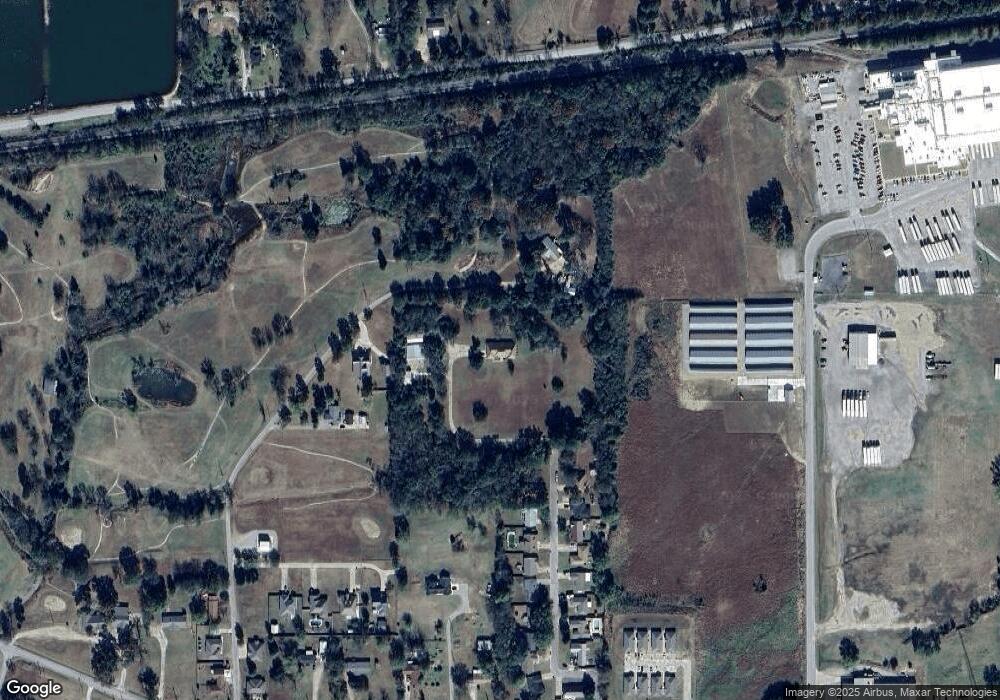

Map

Nearby Homes

- 505 Juniper Ln

- 503 S Dogwood St

- 904 Short St

- 1009 SE 10th St

- 450 Stockton Ln

- 302 E Shawntel Smith Blvd

- 107 7th St

- 103756 Oklahoma 64b

- 103 NE 1st St

- 802 S Main St

- 701 S Ada St

- 304 Oakdale Rd

- 1114 S Dogwood St

- 806 S Ada St

- 201 9th St

- 1104 Bran Britt Ln

- 203 Pendergrass St

- 110 Water Tower Rd

- 908 Cherry Loop

- 110662 S 4750 Rd