4022 Layang Layang Cir Unit B Carlsbad, CA 92008

North Beach NeighborhoodEstimated Value: $851,108 - $1,019,000

2

Beds

3

Baths

1,786

Sq Ft

$512/Sq Ft

Est. Value

About This Home

This home is located at 4022 Layang Layang Cir Unit B, Carlsbad, CA 92008 and is currently estimated at $914,277, approximately $511 per square foot. 4022 Layang Layang Cir Unit B is a home located in San Diego County with nearby schools including Carlsbad High School, Sage Creek High, and St. Patrick Catholic School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 20, 1998

Sold by

Karyn Mceachren and Karyn Alejandro Ortega

Bought by

Wager Arthur B

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$27,000

Outstanding Balance

$6,295

Interest Rate

6.82%

Mortgage Type

Credit Line Revolving

Estimated Equity

$907,982

Purchase Details

Closed on

May 19, 1995

Sold by

Va

Bought by

Mceachren Karyn and Ortega Alejandro

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$108,500

Interest Rate

8.32%

Mortgage Type

Seller Take Back

Purchase Details

Closed on

Jun 30, 1994

Sold by

Guild Administration Corp

Bought by

Guild Mtg Company

Purchase Details

Closed on

Sep 8, 1987

Purchase Details

Closed on

May 3, 1985

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Wager Arthur B | $135,000 | Southland Title | |

| Mceachren Karyn | $108,500 | First American Title Ins Co | |

| Guild Mtg Company | $107,665 | Northern Counties Title Ins | |

| -- | $100,000 | -- | |

| -- | $98,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Wager Arthur B | $27,000 | |

| Open | Wager Arthur B | $108,000 | |

| Previous Owner | Mceachren Karyn | $108,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,166 | $211,619 | $70,537 | $141,082 |

| 2024 | $2,166 | $207,470 | $69,154 | $138,316 |

| 2023 | $2,153 | $203,403 | $67,799 | $135,604 |

| 2022 | $2,118 | $199,416 | $66,470 | $132,946 |

| 2021 | $2,101 | $195,507 | $65,167 | $130,340 |

| 2020 | $2,086 | $193,503 | $64,499 | $129,004 |

| 2019 | $2,048 | $189,710 | $63,235 | $126,475 |

| 2018 | $1,960 | $185,992 | $61,996 | $123,996 |

| 2017 | $90 | $182,346 | $60,781 | $121,565 |

| 2016 | $1,847 | $178,772 | $59,590 | $119,182 |

| 2015 | $1,839 | $176,087 | $58,695 | $117,392 |

| 2014 | $1,807 | $172,639 | $57,546 | $115,093 |

Source: Public Records

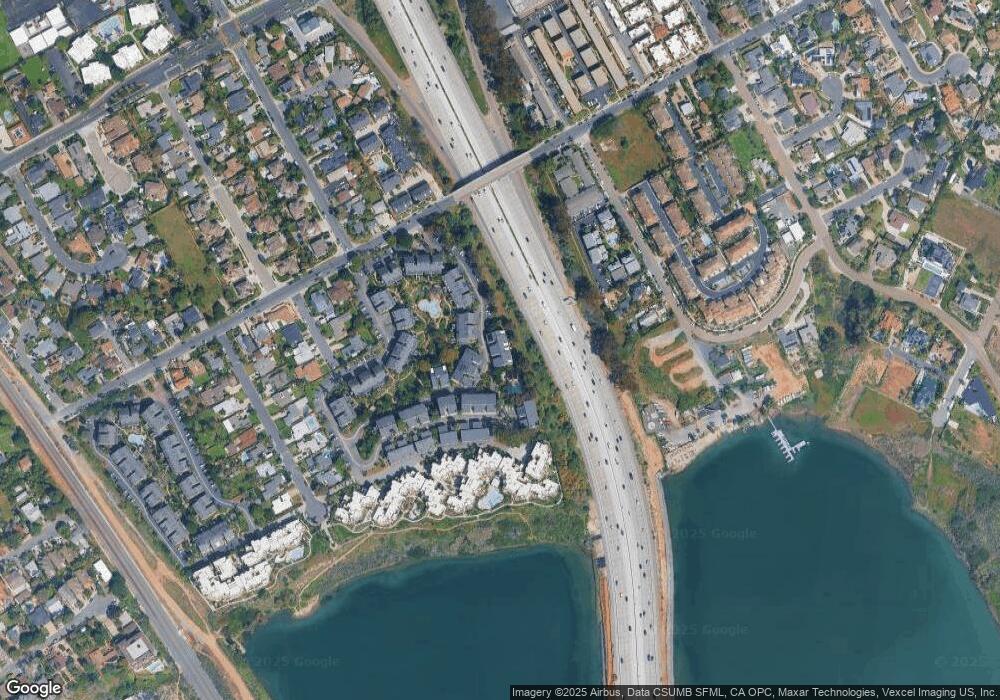

Map

Nearby Homes

- 801 Kalpati Cir Unit B

- 4031 Aidan Cir Unit 1205

- 4007 Canario St Unit E

- 1095 Hoover St

- 334 Date Ave

- 1170 Chinquapin Ave

- 0 Hoover St

- 324 Chinquapin Ave

- 320 Chinquapin Ave

- 310-326 Chinquapin Ave

- 314 Chinquapin Ave

- 1199 Tamarack Ave

- 370 Tamarack Ave

- 368 Hemlock Ave

- 0 Adams St Unit OC24201399

- 111 Sequoia Ave Unit C

- 3575 Madison St

- 4000 James Dr

- 160 Hemlock Ave

- 256 Juniper Ave Unit B6

- 4022 Layang Cir Unit A

- 4022 Layang Cir Unit E

- 4022 Layang Cir Unit H

- 4022 Layang Cir Unit G

- 4022 Layang Cir Unit C

- 4022 Layang Layang Cir Unit H

- 4022 Layang Layang Cir Unit G

- 4022 Layang Layang Cir Unit F

- 4022 Layang Layang Cir Unit E

- 4022 Layang Layang Cir Unit D

- 4022 Layang Layang Cir Unit C

- 4022 Layang Layang Cir Unit A

- 841 Kalpati Cir

- 4020 Layang Layang Cir Unit B

- 841 Kalpati Cir Unit F

- 841 Kalpati Cir Unit E

- 841 Kalpati Cir Unit D

- 841 Kalpati Cir Unit C

- 841 Kalpati Cir Unit B

- 841 Kalpati Cir Unit A