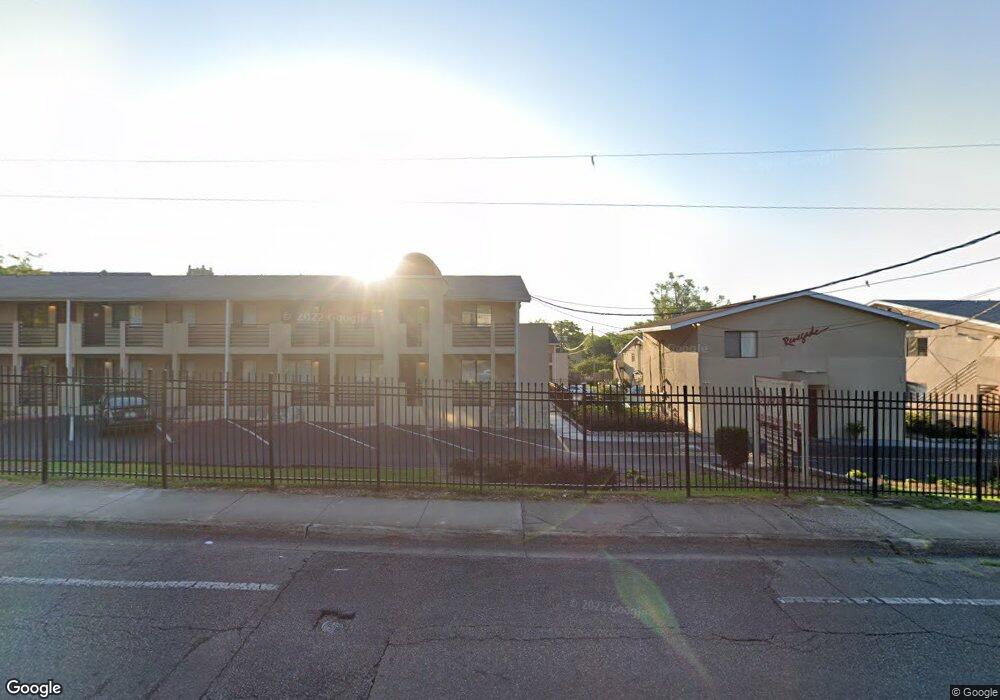

403 Hayden Rd Unit 248 Tallahassee, FL 32304

University NeighborhoodEstimated Value: $149,619 - $169,000

2

Beds

1

Bath

709

Sq Ft

$219/Sq Ft

Est. Value

About This Home

This home is located at 403 Hayden Rd Unit 248, Tallahassee, FL 32304 and is currently estimated at $155,155, approximately $218 per square foot. 403 Hayden Rd Unit 248 is a home located in Leon County with nearby schools including John G Riley Elementary School, R. Frank Nims Middle School, and Amos P. Godby High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 28, 2021

Sold by

Figari Gerard G and Figari James C

Bought by

English Megan and English Rocco

Current Estimated Value

Purchase Details

Closed on

Jul 19, 2010

Sold by

Wojtusik David J and Wojtusik Melody

Bought by

Figari Gerard G and Figari James C

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$68,970

Interest Rate

4.75%

Mortgage Type

FHA

Purchase Details

Closed on

Nov 20, 2007

Sold by

Brinson Tony A and Brinson Cheryl Mae

Bought by

Wojtusik David J and Wojtusik Melody

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$58,400

Interest Rate

6.06%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Aug 20, 1998

Sold by

Kutz Vincent G and Kutz Kristi

Bought by

Furman Howard M and Furman Susan T

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$31,050

Interest Rate

6.91%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| English Megan | $120,000 | Attorney | |

| Figari Gerard G | $69,900 | Attorney | |

| Wojtusik David J | $73,000 | Attorney | |

| Furman Howard M | $41,400 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Figari Gerard G | $68,970 | |

| Previous Owner | Wojtusik David J | $58,400 | |

| Previous Owner | Furman Howard M | $31,050 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $1,824 | $96,000 | -- | $96,000 |

| 2023 | $1,661 | $85,800 | $0 | $0 |

| 2022 | $1,465 | $78,000 | $0 | $78,000 |

| 2021 | $1,305 | $67,980 | $0 | $67,980 |

| 2020 | $1,224 | $64,740 | $0 | $64,740 |

| 2019 | $1,190 | $62,250 | $0 | $62,250 |

| 2018 | $1,133 | $58,750 | $0 | $58,750 |

| 2017 | $1,103 | $56,500 | $0 | $0 |

| 2016 | $1,079 | $54,500 | $0 | $0 |

| 2015 | $1,017 | $52,500 | $0 | $0 |

| 2014 | $1,017 | $51,000 | $0 | $0 |

Source: Public Records

Map

Nearby Homes

- 1605 Mayhew St

- 1649 Mayhew St

- 1824 Tyndall Dr

- 1737 Atkamire Dr

- 1337 Airport Dr Unit G5

- 1345 Airport Dr Unit 20

- 1642 Hernando Dr

- 1400 Hernando Dr

- 1751 Pepper Dr

- 924 S Lipona Rd

- 1233 Stuckey Ave

- 1304 McCaskill Ave

- 1300 McCaskill Ave

- 0 Eugenia St

- 2026 Desiree Ct

- 2029 & 2033 Desiree Ct

- 2006 Karen Ln

- 2046 and 2052 Bellevue Way

- 1631 McCaskill Ave

- 1207 McCaskill Ave

- 403 Hayden Rd Unit 231

- 403 Hayden Rd Unit 112

- 403 Hayden Rd Unit 101, 138, 238

- 403 Hayden Rd Unit 233

- 403 Hayden Rd Unit 144

- 403 Hayden Rd Unit 139

- 403 Hayden Rd Unit 102

- 403 Hayden Rd Unit 122

- 403 Hayden Rd Unit 120

- 403 Hayden Rd Unit 117

- 403 Hayden Rd Unit 247

- 403 Hayden Rd Unit 246

- 403 Hayden Rd Unit 245

- 403 Hayden Rd Unit 244

- 403 Hayden Rd Unit 243

- 403 Hayden Rd Unit 242

- 403 Hayden Rd Unit 241

- 403 Hayden Rd Unit 240

- 403 Hayden Rd Unit 239

- 403 Hayden Rd Unit 238