403 Hide a Way Ln E Hideaway, TX 75771

Estimated Value: $333,000 - $429,000

3

Beds

3

Baths

2,444

Sq Ft

$160/Sq Ft

Est. Value

About This Home

This home is located at 403 Hide a Way Ln E, Hideaway, TX 75771 and is currently estimated at $392,235, approximately $160 per square foot. 403 Hide a Way Ln E is a home located in Smith County with nearby schools including Early Childhood Center, College Street Elementary School, and Velma Penny Elementary School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 4, 2017

Sold by

Leneveu James C and Leneveu Rogene M

Bought by

Head David

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$113,850

Outstanding Balance

$56,580

Interest Rate

3.44%

Mortgage Type

New Conventional

Estimated Equity

$335,655

Purchase Details

Closed on

Oct 15, 2015

Sold by

Shelton William Kent and Shelton Vicki D

Bought by

Mize James Thomas and Mize Teresa L

Purchase Details

Closed on

Jun 6, 2013

Sold by

Thornton Warren Denise Elizabeth and Warren Thornton Denise Elizabeth

Bought by

Shelton William Kent and Shelton Vicki D

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$195,000

Interest Rate

2.64%

Mortgage Type

New Conventional

Purchase Details

Closed on

Mar 20, 2013

Sold by

Warren Rocky Ray

Bought by

Elizabeth Warren Denise and Thornton Warren

Purchase Details

Closed on

Jul 4, 2007

Sold by

Lamb Kelly E and Lamb Judy F

Bought by

Warren Rocky R

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Head David | -- | None Available | |

| Mize James Thomas | -- | None Available | |

| Shelton William Kent | -- | None Available | |

| Elizabeth Warren Denise | -- | None Available | |

| Warren Rocky R | -- | Fa | |

| Warren Rocky R | -- | Fa |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Head David | $113,850 | |

| Previous Owner | Shelton William Kent | $195,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,323 | $402,215 | $24,625 | $377,590 |

| 2024 | $4,323 | $406,430 | $35,000 | $451,889 |

| 2023 | $5,503 | $432,373 | $35,000 | $397,373 |

| 2022 | $5,669 | $376,034 | $24,000 | $352,034 |

| 2021 | $5,475 | $305,357 | $24,000 | $281,357 |

| 2020 | $5,627 | $295,397 | $24,000 | $271,397 |

| 2019 | $5,533 | $287,070 | $24,000 | $263,070 |

| 2018 | $5,036 | $262,308 | $24,000 | $238,308 |

| 2017 | $5,062 | $262,308 | $24,000 | $238,308 |

| 2016 | $5,082 | $263,333 | $20,000 | $243,333 |

| 2015 | $4,539 | $255,335 | $20,000 | $235,335 |

| 2014 | $4,539 | $241,965 | $20,000 | $221,965 |

Source: Public Records

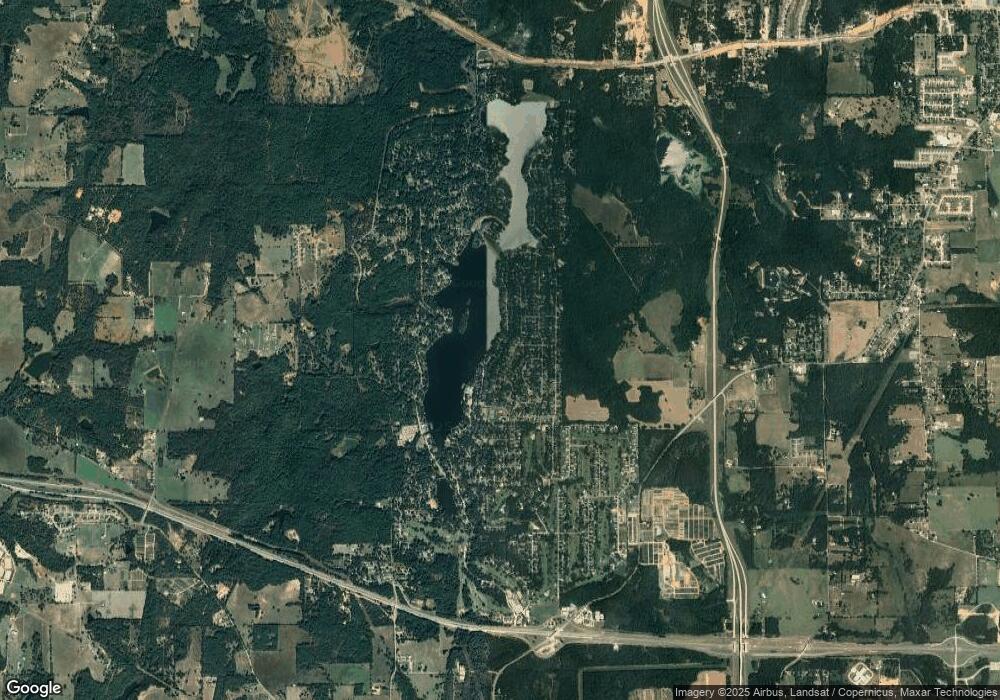

Map

Nearby Homes

- 401 Hideaway Ln E

- 318 Crestview Ln

- 329 Hideaway Ln E

- 332 Highlander Heights

- 307 Easy Dr

- 323 Rustic Rd

- 322 Lone Star Ln

- 321 Lakeview Dr

- 307 Lone Star Ln

- 439 Lone Star Ln

- 425 Hideaway Central

- 309 Harmony Ln

- 441 Hideaway Lane Central

- 251 Texas Dr

- 516 Hideaway Ln E

- 241 Hideaway Ln E

- 520 Hideaway Ln E

- 517 Dogwood Ln

- 1379 Hideaway Ln W

- 519 Hideaway Ln E

- 403 Hideaway Ln E

- 403 403 Hideaway Ln E

- 401 Hide a Way Ln E

- 404 Hide a Way Ln E

- 407 Hide a Way Ln E

- 407 Hideaway Ln E

- 402 Hideaway Ln E

- 402 402 Hideaway Ln E

- 339 Hideaway Ln E

- 402 Hide a Way Ln E

- 339 Hide a Way Ln E

- 406 Hide a Way Ln E

- 406 Hideaway Ln E

- 406 406 Hideaway Ln E

- 409 Hideaway

- 409 Hide a Way Ln E

- 409 Hideaway Ln E

- 409 409 Hideaway Ln E

- 409 409 E Hideaway Ln

- 408 Hide a Way Ln E