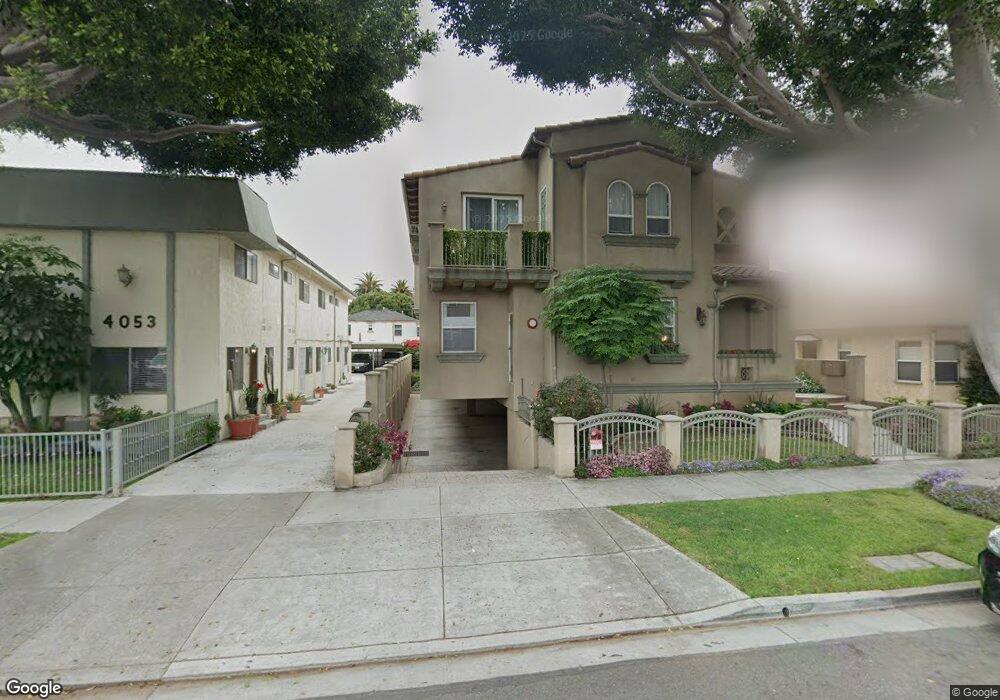

4045 Lincoln Ave Unit 1 Culver City, CA 90232

Estimated Value: $1,550,000 - $2,046,000

2

Beds

3

Baths

1,910

Sq Ft

$913/Sq Ft

Est. Value

About This Home

This home is located at 4045 Lincoln Ave Unit 1, Culver City, CA 90232 and is currently estimated at $1,744,096, approximately $913 per square foot. 4045 Lincoln Ave Unit 1 is a home located in Los Angeles County with nearby schools including Linwood E. Howe Elementary School, Culver City Middle School, and Culver City High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 6, 2015

Sold by

Daurio Damien E

Bought by

Farmer Richard Edward

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$500,000

Interest Rate

5.25%

Mortgage Type

Adjustable Rate Mortgage/ARM

Purchase Details

Closed on

Sep 15, 2005

Sold by

Daurio Damien and Birenbaum Anna

Bought by

Daurio Damien E

Purchase Details

Closed on

Jun 28, 2005

Sold by

Brubaker Ed and Ed Brubaker Trust

Bought by

Daurio Damien

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$674,100

Interest Rate

5.55%

Mortgage Type

Fannie Mae Freddie Mac

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Farmer Richard Edward | $1,080,000 | Lawyers Title | |

| Farmer Richard Edward | $1,080,000 | Lawyers Title | |

| Daurio Damien E | -- | -- | |

| Daurio Damien E | -- | -- | |

| Daurio Damien | $749,000 | First American Title Co | |

| Daurio Damien | $749,000 | First American Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Farmer Richard Edward | $500,000 | |

| Previous Owner | Daurio Damien | $674,100 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $20,463 | $1,769,032 | $707,824 | $1,061,208 |

| 2024 | $20,463 | $1,734,346 | $693,946 | $1,040,400 |

| 2023 | $19,540 | $1,700,340 | $680,340 | $1,020,000 |

| 2022 | $13,609 | $1,204,756 | $658,823 | $545,933 |

| 2021 | $13,588 | $1,181,134 | $645,905 | $535,229 |

| 2020 | $13,461 | $1,169,024 | $639,283 | $529,741 |

| 2019 | $13,070 | $1,146,103 | $626,749 | $519,354 |

| 2018 | $12,984 | $1,123,631 | $614,460 | $509,171 |

| 2016 | $10,163 | $881,936 | $528,691 | $353,245 |

| 2015 | $10,067 | $868,689 | $520,750 | $347,939 |

| 2014 | $9,006 | $760,000 | $456,000 | $304,000 |

Source: Public Records

Map

Nearby Homes

- 4048 Madison Ave

- 4113 Lincoln Ave

- 4036 La Salle Ave

- 1 Apn: 0489-051-65-0000

- 1

- 4155 Madison Ave

- 4140 Baldwin Ave Unit A

- 4076 Lafayette Place

- 4080 Lafayette Place

- 4224 Madison Ave

- 9627 Farragut Dr

- 4100 Le Bourget Ave

- 4309 Duquesne Ave

- 4279 Madison Ave

- 4160 Keystone Ave

- 3745 Jasmine Ave

- 3756 Bagley Ave Unit 102

- 4339 Motor Ave

- 9051 Lucerne Ave

- 3766 S Canfield Ave

- 4045 Lincoln Ave

- 4047 Lincoln Ave

- 4051 Lincoln Ave Unit 4

- 4049 Lincoln Ave

- 4039 Lincoln Ave

- 4053 Lincoln Ave Unit 1

- 4053 Lincoln Ave

- 4035 Lincoln Ave

- 4035 Lincoln Ave Unit A

- 4035 Lincoln Ave

- 4048 Madison Ave Unit 1

- 4048 Madison Ave Unit A

- 4055 Lincoln Ave

- 4044 Madison Ave

- 4057 Lincoln Ave

- 4058 Madison Ave Unit D

- 4058 Madison Ave Unit C

- 4058 Madison Ave Unit A

- 4058 Madison Ave Unit B

- 4058 Madison Ave